Options trading, especially in India, is often shrouded in a bit of mystery and a lot of misconceptions. New traders might hear conflicting statements: "Options are too risky!" vs "Selling options is free money!" – which can be confusing. Let's tackle some of the most common myths and set the record straight with a logical, conversational explanation. By debunking these myths, you'll gain a more solid, realistic understanding of how options really work.

Myth 1: “Options are only for experts or big institutions.”

Reality: Options certainly used to be the domain of institutional players, but not anymore. With so much educational material and user-friendly trading platforms, retail traders can and do trade options regularly. In fact, the surge in weekly options trading in NIFTY/BANKNIFTY is largely driven by retail participation. Yes, you do need to educate yourself (which you’re doing right now!), but you don’t need a PhD in finance to start trading options. Start small, learn the basics (like you're doing with this guide), and gradually you can gain proficiency. Options are a tool – like a car – powerful, but can be handled by anyone who learns to drive responsibly. As one source put it, options trading is accessible to everyone, thanks to educational resources and platforms; even beginners can explore options trading confidently with some effort.

Myth 2: “Options are extremely risky, it’s just gambling.”

Reality: Options can be risky if you use them recklessly (just like driving can be dangerous if you speed on wet roads). But they can also be used to reduce risk. For example, buying a put option is like buying insurance for your portfolio – that’s a risk-reducing move, not gambling. Selling covered calls on stocks you own can generate income and slightly reduce downside risk. It’s all about how you use them. If you take your entire capital and buy out-of-the-money weekly calls hoping to double money every time, yes that’s closer to gambling – not because options are inherently evil, but because the strategy is high risk. Many myths paint options as a casino, but in truth, options were originally created to hedge and manage risk. They only become a gamble if you treat them like a lottery ticket. So, with proper risk management (position sizing, not over-leveraging, using strategies with defined risk), options trading can be as prudent as stock trading, sometimes even less risky than owning stocks outright (consider a protective put giving a guaranteed floor to your losses)

Myth 3: “Buying options is always safer than selling options.”

Reality: This one is tricky. On the surface, buying options has limited risk (you can only lose the premium), whereas selling naked options can have large risks – so in that sense, yes buying is “safer” in terms of worst-case scenario. However, “safe” also depends on probability and consistency. Many new traders buy very cheap OTM options because “I can only lose ₹1000 but could make ₹10000!”. They then lose that ₹1000 premium 90% of the time as the option expires worthless. The occasional win might not cover the many small losses. On the other hand, an option seller might make ₹1000 90% of the time and once in a while lose ₹10000 on a big move – depending on how they manage, they could still come out ahead or blow up. The point is, neither is a sure path to riches or ruin. Option buying requires timing and significant movement in your favor; option selling requires careful risk control for the rare big moves. A balanced approach (sometimes being a buyer, sometimes seller, and often using spreads to cap risk) is best. So, don’t assume one side (buying or selling) is “easy money” – both have pros/cons

Myth 4: “Most options expire worthless, so you should only sell options.

Reality: It is often cited that “90% of options expire worthless.” This statistic can be misleading. Many options are closed or exercised before expiry, so saying 90% expire worthless doesn’t mean 90% of option trades were unprofitable for buyers. Also, even if many OTM options expire worthless, those that expire in the money might have made substantial money for the buyers. Option sellers might win more frequently (higher probability of small gains), but when they lose, they could lose big. If selling was a guaranteed edge, you’d only have sellers in the market and no buyers – clearly not the case. Option buyers exist and many make money by catching big moves or using options creatively. The reality is: options are a zero-sum game before costs – for every buyer profit, there’s a seller loss and vice versa (ignoring minor creation of value via dividends/interest differences). So you can’t have a situation where “all sellers always win” or “all buyers always win”. Each can have an edge in certain conditions. Being dogmatic (“I will only sell because of this stat”) can be dangerous. Better to evaluate trade by trade – what’s the risk/reward, what’s the volatility, etc. Many smart traders actually do both: they sell some options and hedge by buying others (creating spreads or combos)

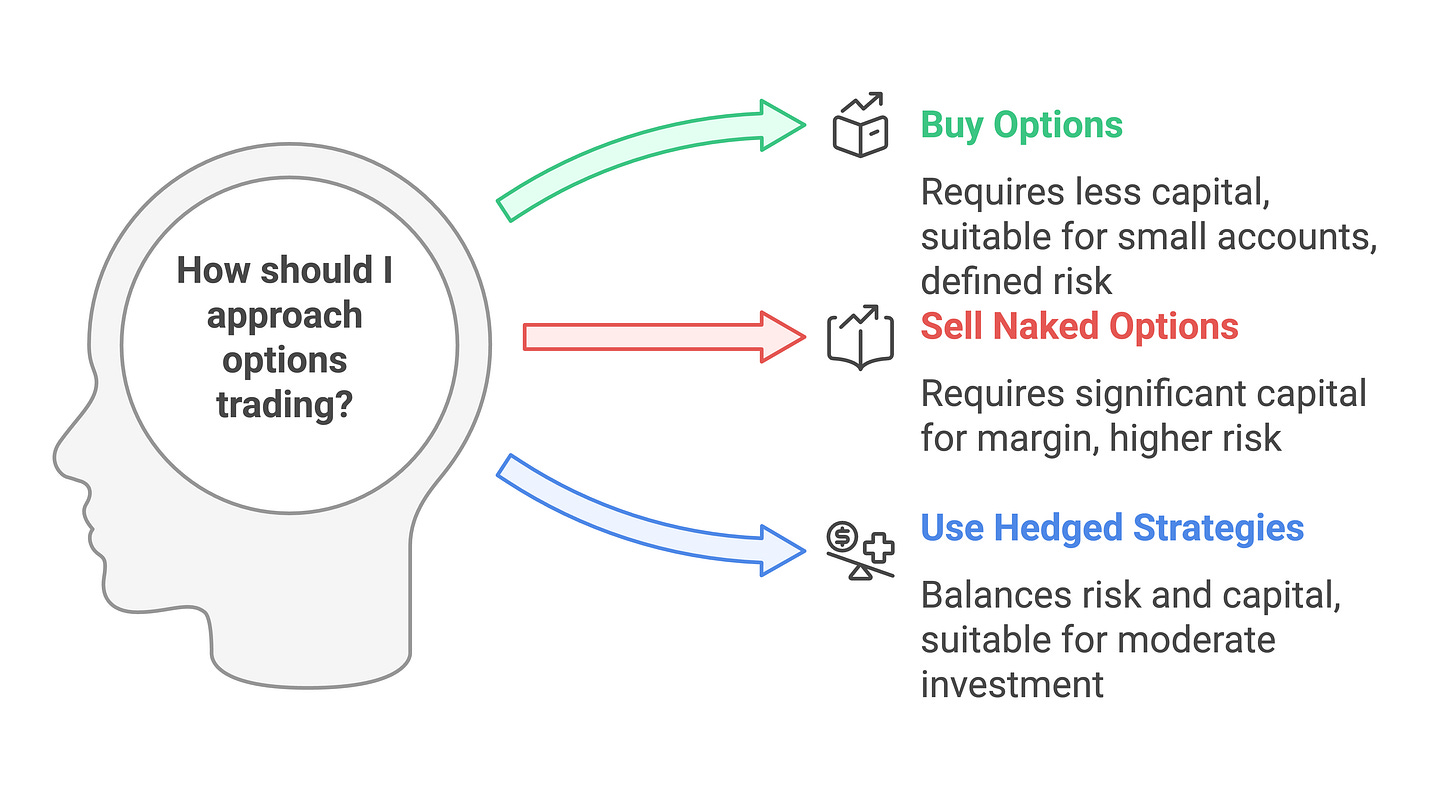

Myth 5: “You need a lot of capital to trade options, because of margins.”

Reality: It depends on what you do. If you want to sell naked options, yes you need significant capital for margin (as we discussed in the Margins section – to short 1 lot Nifty, you might need around ₹1+ lakh). But you can start by buying options with much smaller capital. With just ₹5,000-₹10,000, one can buy an option or two (like one lot BankNifty option might cost a few thousand rupees premium). Many brokers and platforms allow even intraday MIS trades on option buying with small amounts (though caution: small account can get wiped if you bet it all on one trade). Moreover, even on selling side, SEBI’s hedged margin benefit means if you have, say, ₹50k, you could deploy a couple of safe spread trades rather than one big naked position. So while having more capital gives flexibility, it’s a myth that options are only for the rich. In fact, trading a small account with options might sometimes be more sensible than trading stocks, because you can take defined risk bets. Just be mindful: don’t use all available leverage and blow up a small account quickly – start with fraction of your capital at risk.

Myth 6: “Options are too complicated – all those Greeks and formulas, it’s impossible for a regular person to understand.”

Reality: Yes, options have some complex underpinnings (Black-Scholes model, Greeks calculus, etc.), but you don’t need to be a mathematician to trade them profitably. Many successful option traders use intuitive understandings and rules of thumb. For example, you can grasp that “theta decay hurts buyers as expiry nears” without deriving any formula – and use that knowledge: e.g., avoid buying options expiring tomorrow unless you expect a big immediate move. Or knowing that “IV is high pre-event and falls after” can guide you not to overpay before an event. Over time, you pick up the Greeks and their implications (we’ve introduced them conversationally here). The basics – calls, puts, payoff diagrams – are straightforward enough. Think of it like chess: you can learn how the pieces move without immediately studying advanced strategies; those come later with practice. So, don’t be scared off by jargon. Start with the fundamentals (which you now have) and the rest will become clearer as you engage with the market

Myth 7: “Market makers or big operators always manipulate options; the retail guy has no chance.”

Reality: There is a popular notion in trading circles about “operators” moving markets to eat retailers’ premiums, especially around expiry ("they'll move Nifty to Max Pain level just to hurt the most people"). While it’s true that large players have more influence and information, the options market in India is too large and regulated to be easily manipulated at will. Market makers aim to keep things fair because they profit from volume and spreads, not from picking directional moves against you. Could a big entity try to push the market to make their massive short options expire safe? Possibly, but they’d need to burn a lot of capital and there are many competing forces. As a retail trader, if you stick to liquid contracts and use sensible strategies, you're basically riding the same wave as everyone else. In fact, retail traders often have the advantage of agility – you can get in and out quicker than someone dealing with thousands of contracts. So, while David vs Goliath stories abound, don’t start with a defeatist attitude. Focus on learning and strategy; the market is not rigged against the little guy in any structural way – retail participation is huge and growing, and regulators keep a close watch on manipulation.

Myth 8: “Options are best for short-term trading only, not for investment or long term.”

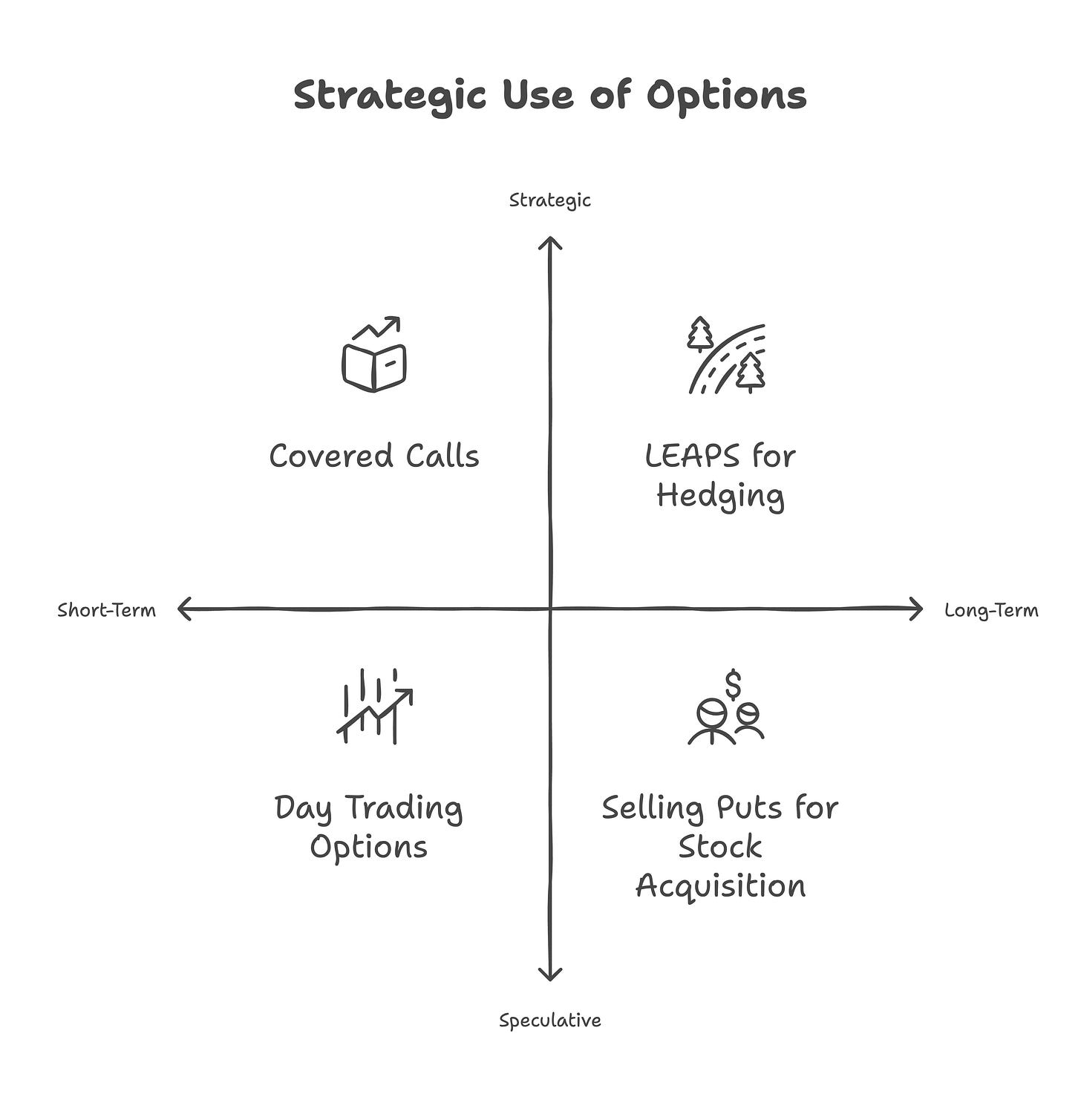

Reality: It’s true that a lot of options activity revolves around short-term moves (weeklies, day trading, etc.). But options can be part of a longer-term investment approach too. For example, an investor might use LEAPS (Long-term options, say 6-12 months out) to bet on a market rise with limited downside, or to hedge a portfolio for a year. Or use a covered call strategy continuously to enhance returns on stocks they hold. Options can generate income (selling premium) or provide insurance. Many long-term investors routinely sell puts to acquire stocks at lower effective prices (if the put is assigned, they buy the stock at strike minus premium; if not, they keep the premium). These are not get-rich-quick but can boost portfolio returns steadily. So, while the adrenaline of short-term trading is there, don't overlook the strategic use of options for long-term goals

.

We could list more, but these are some of the major myths. The overarching theme is: get educated (knowledge dispels most fears and myths), start small, and use options for their versatility. They are powerful tools – neither magical profit machines nor guaranteed loss-makers. Your success will depend on how well you understand their mechanics (which you’re well on your way to) and how disciplined you are in using them.

Conclusion and Next Steps:

Congratulations on making it through this extensive guide on Options 101 for Indian Markets! We covered a lot: from the basics of calls and puts to the nuances of Greeks and volatility, from reading option chains to understanding margins and busting myths. At this point, you should feel much more comfortable with the terminology and concepts of options.

Remember, reading about options is a great start – but the real learning happens when you start observing the market and maybe even doing a few paper trades or small real trades to see these concepts in action. A good next step is to track NIFTY and BANKNIFTY option chains daily for a while. See how premiums change with market moves, how time decay kicks in as expiry approaches, and how OI builds up at strikes. Maybe simulate a trade: "If I buy this call, what happens a day later?" to build intuition.

Also, always keep risk management at the forefront. Only trade with money you can afford to risk, especially as you are learning. Use stop-losses or predefined exit rules. And continue learning – perhaps the next module in your journey will be Options strategies (since we intentionally didn’t dive into specific strategies here). Strategies like spreads, straddles, strangles, etc., will build on this foundational knowledge and show you how to combine options for various market outlooks.

Options trading in India is an exciting space with lots of opportunities. With SEBI’s regulatory framework, a robust exchange (NSE), and active participation, it’s a fairly well-structured market. By understanding the theory and also the local market practices (like weekly expiries, margin rules, etc.), you are positioning yourself to trade smarter.

Use this guide as a reference anytime you need to recall a concept. The markets are a continuous learning process – even experienced traders learn new things as conditions change. Stay curious, stay disciplined, and enjoy the process of becoming an informed options trader!