If there’s one thing Adani Green Energy Ltd (AGEL) made clear this quarter, it’s this: Scale is the new strategy. And they’re executing it with precision.

In Q1 FY26, AGEL delivered one of its strongest performances yet not just financially, but operationally and strategically. Profits rose, projects expanded, and the company edged closer to its ambitious 2030 target of 50 GW renewable capacity.

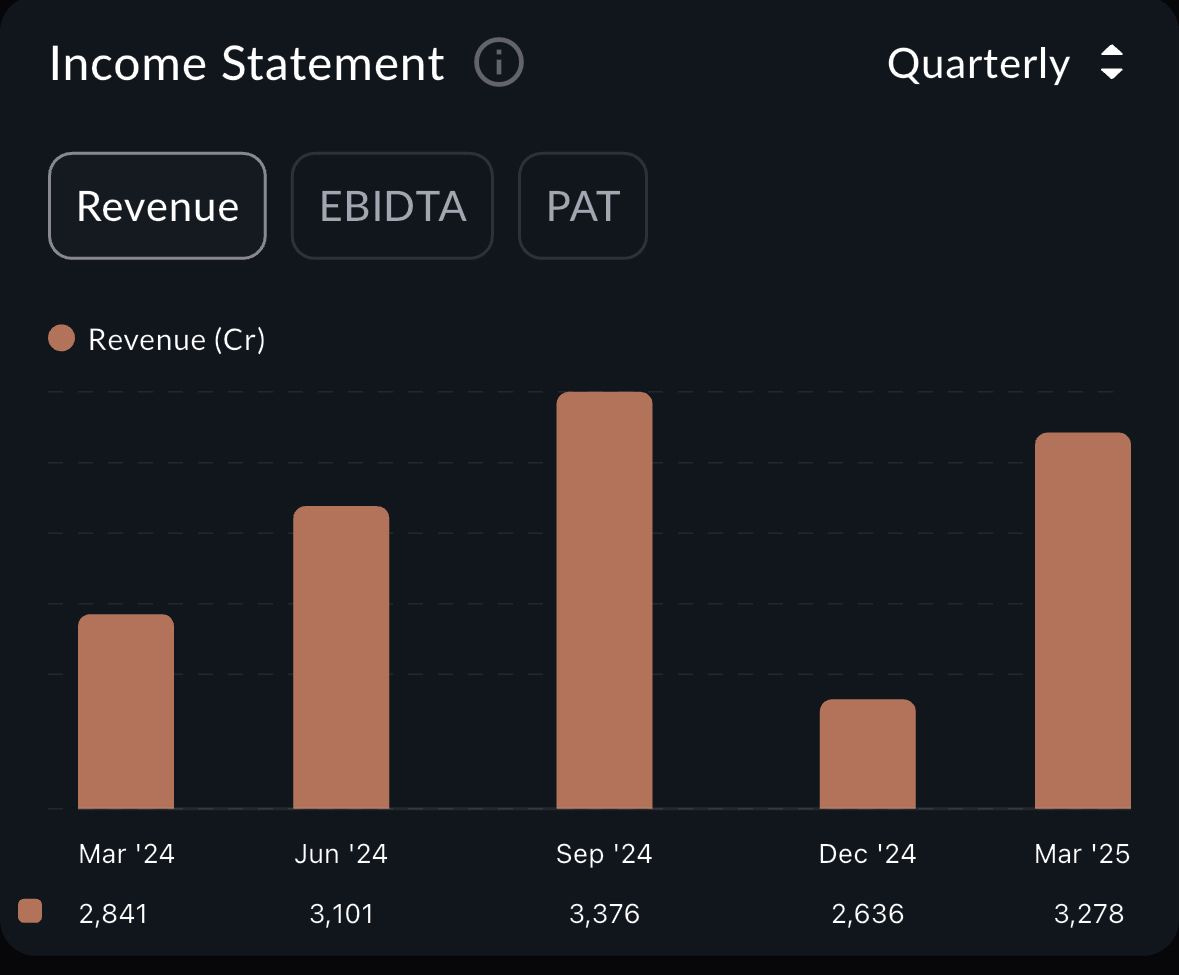

The Financial Pulse

The numbers are strong but more importantly, they’re consistent.

Net profit surged to ₹713 crore, a 60% jump YoY.

Revenue from operations grew 29% to ₹4,006 crore.

Revenue from power supply rose 31% to ₹3,312 crore tracking capacity additions.

Energy sales hit 10,479 million units, growing 42% YoY.

EBITDA for the quarter: ₹3,108 crore.

Cash profit stood at ₹1,744 crore, up 25%.

This isn’t just quarter-on-quarter momentum it’s a multi-quarter trend now. AGEL’s financial engine is starting to resemble the scale of its ambition.

Building India’s Largest Green Power Base

Where these numbers truly shine is in what’s powering them: capacity addition.

AGEL added 1.6 GW of greenfield capacity in a single quarter the largest quarterly build-out in India’s renewable history.

Total operational capacity is now 15.8 GW, up 45% YoY.

New plants went live in resource-rich zones like Khavda (Gujarat) and Rajasthan, where performance and yields are naturally higher.

Over the past 12 months, AGEL has commissioned 4.9 GW of new capacity no small feat in a sector where even 1 GW per year used to be considered solid execution.

This level of rollout, quarter after quarter, signals a company not just participating in India’s energy transition but shaping it.

2030: A Target That No Longer Feels Distant

When AGEL announced its 50 GW renewable capacity target by 2030, it sounded like a moonshot.Today, it sounds like a roadmap , with 15.8 GW already operational and a proven 1.5+ GW per quarter commissioning pace, the numbers work. Even without acceleration, AGEL could cross the 50 GW mark within 6–7 years. The company also reaffirmed its commitment to develop at least 5 GW in battery and pumped hydro storage, setting itself up for future grid resilience and round-the-clock green power.

ESG That Shows Up in Awards and in Margins

AGEL isn’t just growing fast it’s also being recognized for how it’s doing it.

Top-ranked in FTSE Russell ESG scores among peers.

Honored at the Reuters Global Energy Transition Awards 2025.

Public commitments to zero-waste operations and sustainable project sites.

This matters not just for reputation, but for access to low-cost green financing. In a capital-intensive sector, better ESG ratings often translate to better borrowing terms, and that gives AGEL a structural edge.

Market Confidence

The markets responded positively to the results:

Stock price rose over 3% intraday, closing at ₹1,003.90.

Market cap stood at ₹1.59 lakh crore as of July 28, 2025.

The reaction reflects not just short-term performance, but confidence in AGEL’s execution credibility and long-term vision.

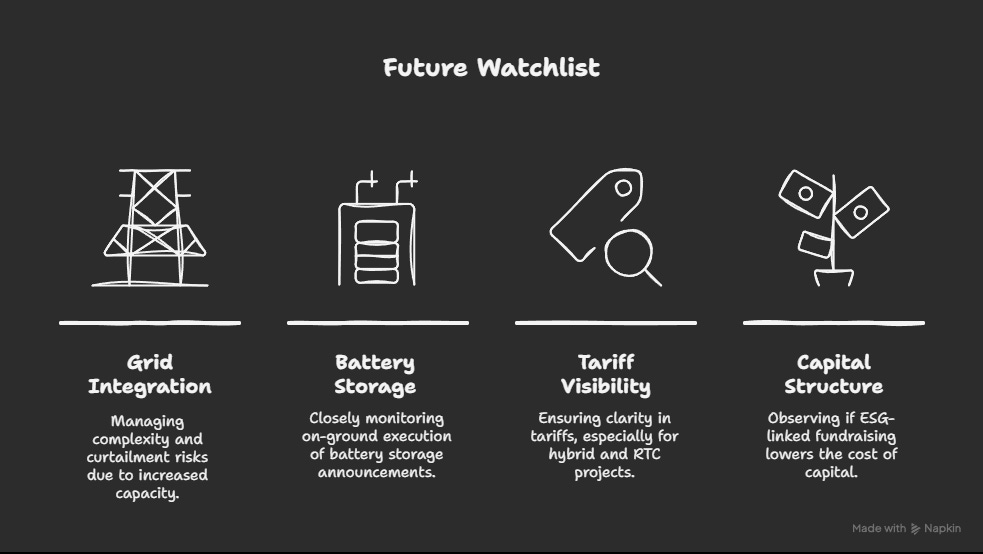

What’s Next?

Here’s what to watch in the coming quarters:

Grid integration: More capacity means more complexity. Curtailment risks, if any, will need active management.

Battery storage timelines: Announcements are one thing on-ground execution will be closely watched.

Tariff visibility: Especially for newer hybrid and RTC (round-the-clock) projects.

Capital structure: Will ESG-linked fundraising continue to lower the company’s cost of capital?

Sahi’s Take

Adani Green’s Q1 FY26 isn’t just another good quarter it’s a marker of maturity. A signal that India’s largest private green energy player is no longer chasing scale it’s operating at it.

In a space where ambition often outpaces execution, AGEL is proving that both can coexist and deliver results.