Anantam Highways Lists at Rs 103 per share, a 3% premium over its issue price

Anantam Highways Shares List at a Premium.

Anantam Highways InvIT will listed at Rs 103 per share - a 3% premium over its issue price of Rs 100 per share. Its listed on NSE and BSE on Oct 17.

The IPO closed on October 9, 2025. It is a mainboard issue to raise ₹400 crore, and the Anantam Highways shares will be listed on NSE & BSE. The listing follows finalisation of allotment and refund timelines.

Grey market action for this InvIT is subdued. As per the latest media reports, no active GMP has been reported. That indicates that the market is holding out for fundamentals instead of hype and shows conservative investor sentiment before listing.

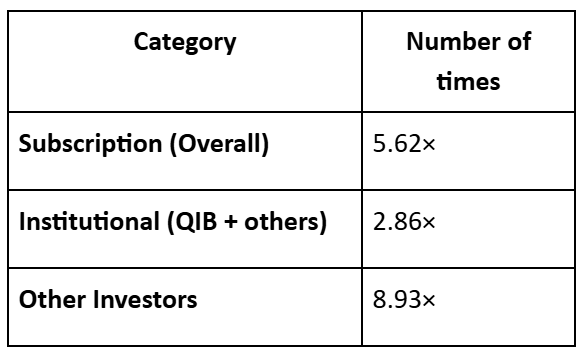

Anantam Highways InvIT IPO Subscription Snapshot

Retailers dictated demand, and the overall subscription issue concluded with a total subscription of ~5.62×.

About the company

Anantam Highways InvIT is advised by Alpha Alternatives Fund Advisors LLP, which is the sponsor. The trust was set up on July 24, 2024, and registered with SEBI as an InvIT on August 19, 2024. Its highway portfolio consists of projects such as Dhrol Bhadra, Dodaballapur Hoskote, Repallewada, Viluppuram, Narenpur Purnea, Bangalore Malur, and Malur Bangarpet — spread over various states.

The business model is infrastructure leasing: the InvIT will derive cash flows in the form of tolling/availability payments, subject to the contractual terms of the road assets.

Competitor Context

In the InvIT / infrastructure trust segment, similar vehicles are IRB InvIT, India Grid Trust, and PowerGrid InvIT, but these are on roads, power transmission, or pipelines.

Anantam’s highway-only strategy gives a niche benefit but also poses concentration risk. Investors will benchmark yield hopes and risk profiles versus these benchmarked InvITs.

What to Watch on Anantam Highways Listing Day

Whether the listing opens near ₹98–₹100 (issue band) since no visible GMP

Early trading volume and comparison with other infrastructure trusts

Investor appetite for InvIT yields vs equities on listing day

How the listing performance creates yield benchmarks for subsequent road InvITs

Sahi Review

Anantam Highways InvIT enters with a robust highway portfolio and institutional positioning. But with subdued GMP and emphasis on infrastructure yields, its listing may be steadier than spectacular. Whether it maintains yield expectations and fulfils cash flow promises after listing will be crucial to investor confidence.