Canara HSBC Life Insurance Company Ltd closed its ₹2,517.5 crore initial public offering on October 14, 2025. The IPO was a 100% Offer for Sale (OFS) by existing shareholders Canara Bank, HSBC Insurance (APAC) and Punjab National Bank with no fresh capital raised. The price band was ₹100–₹106 per share, and each lot comprised 140 shares (minimum investment ₹14,840).

Shares will list on both NSE and BSE, with the allotment finalisation on October 15, refunds and Demat credit on October 16, and the listing scheduled for October 17, 2025.

How to Check Canara HSBC Life Insurance IPO Allotment Status Online

Option 1 – BSE Website

Visit https://www.bseindia.com/investors/appli_check.aspx

Select “Equity” under Issue Type

Choose “Canara HSBC Life Insurance Ltd” under Issue Name

Enter your Application Number or PAN

Click “Submit” to view your status

Option 2 – NSE Website

Go to https://www.nseindia.com/invest/check-ipo-allotment-status

Select “Equity” and choose Canara HSBC Life Insurance Ltd

Enter your PAN or Application Number

Click “Submit”

Option 3 – Registrar (KFin Technologies Ltd)

Visit https://ipostatus.kfintech.com/

Select “Canara HSBC Life Insurance IPO” under Select Company

Enter your PAN, Application Number, or DP/Client ID

Click “Submit” to check allotment status

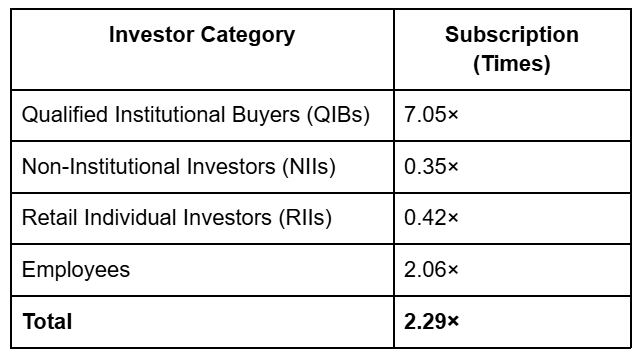

Canara HSBC Life Insurance IPO Subscription Status (as of Oct 13, 2025)

The issue saw muted interest across segments, with QIB category leading participation but retail and employee categories remaining subdued.

Current GMP stands at ₹0 per share, suggesting a flat or negative listing.

Company Overview & Financials

Founded in 2007, Canara HSBC Life Insurance is a joint venture between Canara Bank (51%), HSBC Insurance (APAC) Holdings (26%), and Punjab National Bank.

The company offers a broad range of life insurance solutions protection, savings, health, annuity, and group plans and leverages one of India’s largest bancassurance networks with over 15,700 bank branches including regional rural banks.

Financial Snapshot (FY25):

Revenue: ₹8,027.46 crore crore (annualised)

Profit : ₹116.98 crore

Lives Covered: 10.5 million as of June 2025

The company raised ₹750 crore from anchor investors including Allianz Global, Amundi Funds, Marshall Wace, Societe Generale, and WhiteOak, underscoring its institutional credibility despite the tepid retail response.