Canara HSBC Life Insurance Shares List Flat on NSE,BSE

Canara HSBC Life Insurance IPO faces muted response on listing.

Canara HSBC Life Insurance shares listed at Rs 106 per share on October 17, 2025, on the NSE & BSE. This was a flat listing over its issue price. The price band of the IPO is fixed at ₹100 – ₹106 per equity share with a lot size of 140 shares.

The IPO, which is fully designed as an Offer for Sale (OFS) of 23.75 crore shares, has attracted good investor support, especially from institutions.

The grey market premium (GMP) had cooled to flat / ₹0 over issue price as of 1:30 pm on Oct 16 according to a few media sources. This indicates a conservative listing despite good subscription.

In an offer for sale, the promoters of the company sell their shares and the money raised goes back to those promoters. The company will not be getting any capital from this IPO.

The OFS has been conceptualised in a way that existing promoters can offer shares, and the company will not be getting any capital raise from this IPO.

Previously, the company also mobilized ₹750 crore from 33 anchor investors with substantial allocations to domestic mutual funds.

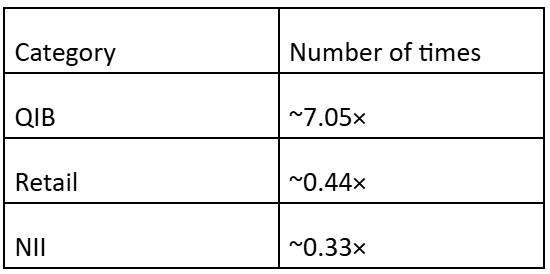

Canara HSBC Life IPO Subscription Snapshot

Institutional investors emphatically dominated demand, as retail subscription remained dull. The issue wrapped up with a total subscription of ~2.29×.

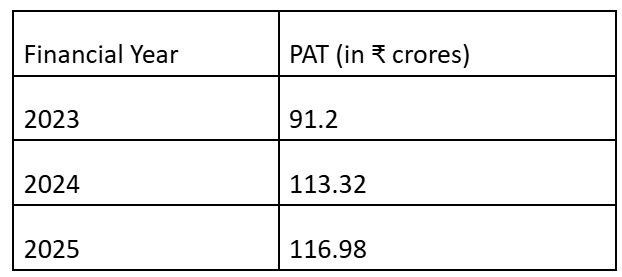

About the Company

Canara HSBC Life Insurance is a joint venture promoted by Canara Bank, HSBC Insurance (Asia-Pacific), and Punjab National Bank.

Over the years, the organization has developed a diversified product portfolio, keeping protection and non-participating businesses in focus while expanding the customer base through retail. Canara HSBC Life has also made investments in digital distribution and automation for improved operational efficiency and customer interaction. The insurer’s profitability and strong solvency ratio over the years indicate prudent underwriting and disciplined capital management, making it a well-placed company in India’s growing life insurance market.

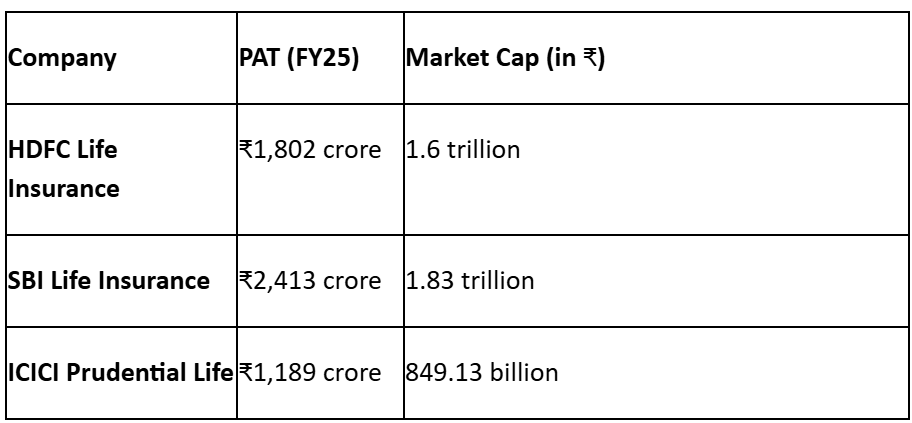

Competitor Context

Canara HSBC Life Insurance operates in the life insurance space with listed incumbents such as HDFC Life, SBI Life, and ICICI Prudential Life. These incumbent players have deeper scale, wider distribution, and high valuation multiples.

Canara HSBC’s listing and valuation will now be compared to these peers, particularly regarding growth, underwriting performance, and margin durability.

Key Things to Watch on Canara HSBC Life Listing Day

• Whether the stock opens around or higher than the issue price, considering subdued GMP

• Intensity of institutional participation in opening trades

• Comparison with listings of other financial and insurance names on the same day

• Post-listing action whether gains will sustain or booking pressures surface

Sahi Review

Canara HSBC Life’s IPO closes at a 2.29× subscription, overwhelmingly institutional-driven, while retail participation remained soft. With GMP almost flat, the listing will be cautious and not celebratory. Its long-term tale will depend on how competitively it manages against big, listed life insurers and whether it can put up consistent underwriting and growth.