Canara Robeco Asset Management Company Ltd (AMC) closed its ₹1,326.13 crore IPO subscription window on October 13, 2025. The public issue comprised a pure Offer for Sale (OFS) of 4.99 crore shares, with a price band of ₹253–₹266 per share and a lot size of 56 shares (minimum investment ₹14,896).

The IPO will list on both NSE and BSE, with the allotment expected on October 14, refunds and credit to Demat accounts on October 15, and the listing scheduled for October 16, 2025.

Canara Robeco AMC is India’s second-oldest mutual fund house, jointly owned by Canara Bank (51%) and ORIX Corporation Europe (49%). Established in 1987, it has grown into one of India’s most trusted retail-focused fund managers.

How to Check Canara Robeco AMC IPO Allotment Status Online

Option 1 – BSE Website

Visit https://www.bseindia.com/investors/appli_check.aspx

Select “Equity” under Issue Type

Choose “Canara Robeco AMC Ltd” under Issue Name

Enter your Application Number or PAN

Click “Submit” to view status

Option 2 – NSE Website

Visit https://www.nseindia.com/invest/check-ipo-allotment-status

Select “Equity” and choose Canara Robeco AMC Ltd

Enter your PAN or Application Number

Click “Submit”

Option 3 – Registrar (MUFG Intime India Pvt. Ltd.)

Visit https://in.mpms.mufg.com/Initial_Offer/public-issues.html

Select “Canara Robeco AMC IPO” under Select Company

Enter any of the following: PAN, Application No., or DP/Client ID

Click “Submit” to check allotment

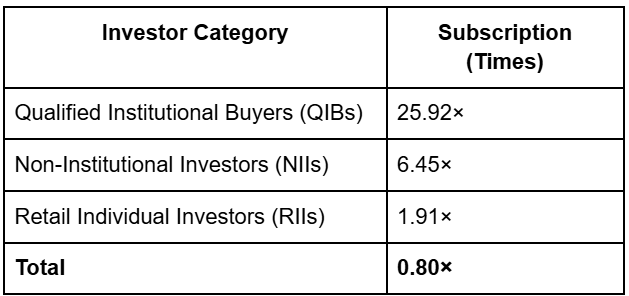

Canara Robeco AMC IPO Subscription Status (Final Day – Oct 13, 2025)

Company Overview & Financials

Canara Robeco AMC is a joint venture between Canara Bank and ORIX Europe, managing mutual fund schemes across equity, debt, and hybrid categories. With over 64 lakh investors and a strong retail customer base, it is among India’s fastest-growing asset managers.

For FY25 Q1, the AMC reported:

Average AUM: ₹1.03 lakh crore

PAT Margin: ~ 50.37%

ROE : 36.3%

Despite a modest grey market premium of ₹10 per share (≈4% listing gain potential), the issue garnered strong QIB participation, reflecting long-term confidence in the AMC’s steady profitability and brand trust.