Canara Robeco AMC IPO lists at a 5.36% premium over issue price, defying muted GMP of 4.3% ahead of debut.

The shares of Canara Robeco Asset Management Company Ltd. are scheduled to list on the NSE and BSE at 10:00 a.m. today, Thursday, October 16. Strong interest in India’s expanding mutual fund sector is demonstrated by the ₹1,326.13-crore IPO, which was solely an Offer for Sale (OFS).

The grey market premium as of Wednesday was approximately ₹277.5, which represents a 4.3% premium over the upper price range of ₹266 per share. Analysts note that muted GMPs across financial sector IPOs reflect cautious investor sentiment amid market volatility, suggesting a muted but positive listing expectation.

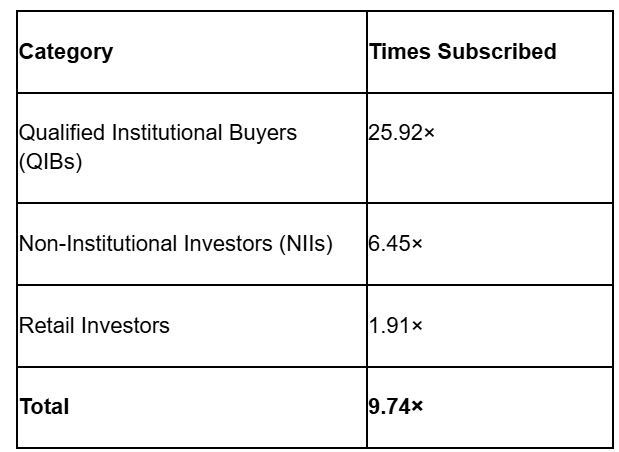

Subscription Snapshot

About the Company

Canara Bank, and ORIX Corporation Europe NV, a multinational financial services organization headquartered in the Netherlands, have partnered to form Canara Robeco Asset Management Company.

Canara Robeco was founded in 1993, and is one of the oldest in India and currently oversees a diverse product portfolio that includes various funds including equity, debt and hybrid funds. The AMC has established a solid reputation for reliable fund performance, and steady inflows from both retail customers and institutional.

The IPO was a pure Offer for Sale (OFS) of 4.98 crore shares and promoters Canara Bank Ltd and ORIX Corporation Europe NV collectively offloaded 2.59 crore and 2.39 crore shares, respectively.

The company said the listing would increase brand visibility and bring liquidity to current shareholders.

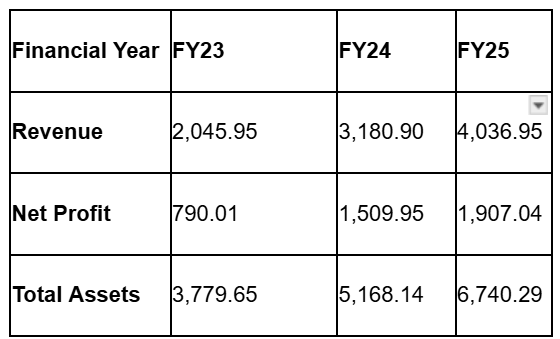

The firm has demonstrated robust and steady financial expansion, with net profit having increased by more than 2x between FY23 and FY25. The growth is driven by scalability and expanding brand name in retail SIP.

Financial Performance (₹ crore)

Competitor Analysis

Canara Robeco AMC is a competitor for other listed asset management companies including HDFC AMC, Nippon Life India AMC, and UTI AMC, all of which together control the domestic mutual fund space.

•HDFC AMC continues to be the biggest with more than 11% market share and consistent profitability.

•Nippon Life India AMC and UTI AMC have registered moderate profit growth in the face of changing regulatory environments and competition from new entry players.

•Canara Robeco AMC, although mid-scale in terms of AUM, has shown greater earnings efficiency and consistent fund performance in both equity and hybrid segments.

Experts observe that the post-listing trend of the stock will hinge on whether investors reward its stable profitability and brand confidence or remain choosy because of modest GMP and narrow sector valuations.

What to Watch on Listing Day

• Opening price action and initial trading volume vs 4–5% GMP expectations

• Institutional buying behavior and market breadth in BFSI sector stocks

• Sentiment tone of broader market, which may affect short-term sentiment

• Sustained emphasis on AUM expansion, fee margins, and cost control as drivers of valuations

Sahi Research View

Canara Robeco AMC’s IPO arrives when the Indian mutual fund sector is growing steadily, supported by increases in retail participation and historic SIP inflows. Its robust parentage, profitability, and operational controls make the company a legitimate long-term bet, even though listing day fireworks are subdued.