Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) play a crucial role in India’s investment landscape.

Regularly tracking the FII and DII data helps investors understand how large institutions are influencing the market, which sectors are attracting investments, and the market sentiment in general.

In this article, we will explore who FIIs and DIIs are, the key differences between them, and how FII and DII data reflect the broader economy.

Who are FIIs?

FIIs stand for Foreign Institutional Investors. As the name suggests, these are institutions based outside India that invest in the Indian financial markets.

These investors are foreign institutions and not foreign individual investors. The latter come under the bracket of Foreign Portfolio Investors (FPIs).

Unlike individual investors who have limited capital, FIIs operate on a much larger scale by pooling funds and managing them on behalf of institutions, governments, or groups of investors. Considering the large amount of funds involved, their influence on the market is high and is visible in daily FII and DII data.

When FIIs invest aggressively, demand for stocks and indices like NIFTY and BANKNIFTY shoots up, pushing prices higher. On the flip side, heavy selling increases supply, dragging prices down sharply. This is why FII activity tends to create short-term volatility and sudden intraday swings that traders must closely watch.

FIIs are highly sensitive to global trends, international interest rates, and currency fluctuations, which often influence their investment decisions. They typically focus on high-growth sectors or established blue-chip companies, aiming to maximise returns through investments in the global financial market.

Here is a simple example for you to understand FIIs better:

The Government Pension Fund Global, owned by the Norway Government, has significant investments across Indian sectors. Its investments include major companies such as Infosys, HDFC Ltd, Axis Bank, Cipla, Divi’s Laboratories and more.

This pattern shows how FIIs prefer established companies and sectors with steady growth, global competitiveness and long-term stability.

For India, this investment brings in extra capital, boosts confidence in the market, and has a positive effect on the economy.

Who are DIIs?

Domestic Institutional Investors, or DIIs, are investment entities based in India that invest in the Indian financial markets. Unlike FIIs, which bring in foreign capital, DIIs mobilise funds from within the country, including investments from Indian individuals, companies, and government institutions.

DIIs play a balancing role during market volatility, helping manage sudden fluctuations. When FIIs sell heavily, markets often face downward pressure. DIIs then step in with inflows, protecting the fall and creating support zones that traders rely on during corrections. So, analysing FII and DII data together helps traders gauge the balance between foreign sentiments and domestic resilience.

DII investments are usually aligned with domestic growth sectors such as infrastructure and manufacturing, supporting long-term economic development while maintaining market stability.

Here is an example of DIIs

SBI Mutual Fund, one of India’s largest Domestic Institutional Investors, has consistently invested in top Indian companies like Reliance Industries, HDFC Bank, and Infosys. A significant portion of its allocations go into banking, IT, energy and similar industries, supporting long-term growth in such core sectors and providing stability during FII outflows.

Major categories of FIIs and DIIs

Both FIIs and DIIs can be categorised into pension funds, mutual funds, insurance companies, banks and financial institutions, hedge funds and Sovereign wealth funds & Government agencies (FIIs only).

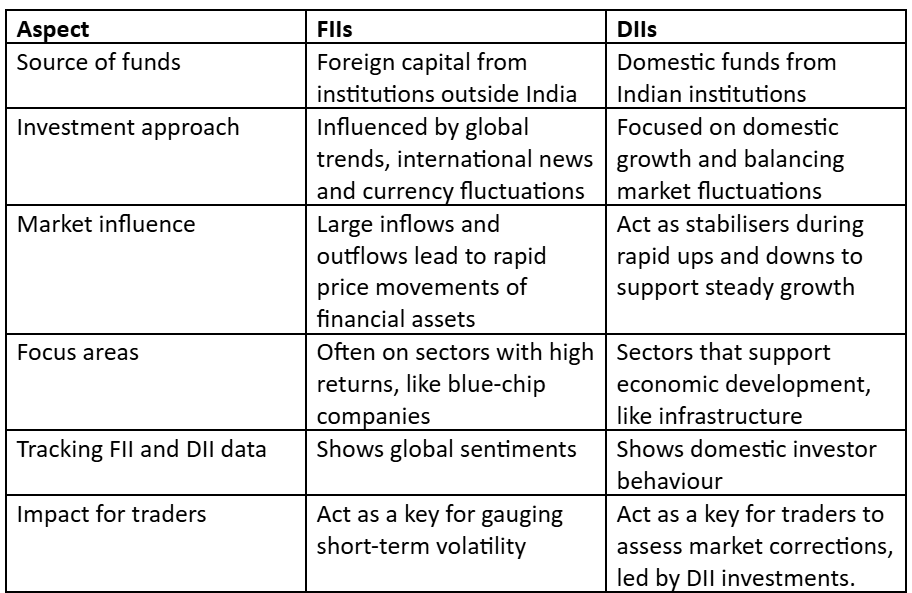

Key differences between FIIs and DIIs

FIIs and DIIs both play important roles in the market, but they operate differently. Here are some major differences:

How FII and DII data reflect the economy

FII and DII data show the movement of domestic and foreign funds in India, giving clues about investor perspectives, the economy’s health, and the market, in general.

FII data: Large foreign inflows suggest global confidence in India, while outflows can indicate caution.

DII data: DII data helps investors track which sectors are stable and how the market is likely to be supported during fluctuations.

Stock exchange websites and various financial news portals publish the FII and DII data, making this information easily accessible for investors.

Recent trends in FII and DII net flows:

Since July 2025, FIIs have sold over ₹1 lakh crores from Indian stocks, due to global uncertainties and high valuations.

At the same time, DIIs have invested around ₹94,829 crores in August alone, supporting the market and limiting sharp declines.

Sectoral impact:

Large-cap stocks: Nifty 50 stayed relatively stable due to strong DII support.

Mid and small-cap stocks: Mid and small-cap indices are trading at P/E ratios of 26.1× and 24.9×, which is higher than usual. This means they are costlier than large-cap stocks and more volatile.

Sectors: FIIs focused on IT, pharma, and telecom, while DIIs supported broader sectors like banking, FMCG, and chemicals.

What traders should watch:

Daily FII/DII data help predict short-term market moves.

Sectors with strong DII support are usually more stable and safer for trades.

To know more about the inflow and outflow of FII and DII funds, and how this helps stock market investors, click here (Interlink the article on What causes the inflow and outflow from FIIs and DIIs here after it is published)

Conclusion

While FIIs bring foreign capital and react to global trends, DIIs provide stability and support domestic growth. Observing their investment patterns gives a clear picture of market sentiment, sector performance, and the overall health of the economy, which is essential knowledge for any investor, beginner or experienced.