Foreign Institutional Investors (FIIs) are the ultimate double-edged sword. When they buy, the market surges like there’s no tomorrow. When they sell, panic spreads faster than wildfire. Traders love them when they pump liquidity but hate them when they pull out billions overnight.

So, are FIIs the saviors of the market, or the silent assassins waiting for the right moment to strike? Let’s dive in. 👇

Why FIIs Are Critical for Market Growth💰

Liquidity Boosters – Their massive inflows create a smoother, more liquid market, making trading efficient.

📈 Bull Market Drivers – FII buying often kickstarts major uptrends, lifting stocks and indices higher.

🌎 Global Market Integration – Their participation makes India a key player in the global investment landscape.

Sounds great, right? But there’s a catch.

Why FIIs Can Be a Trader’s Worst Nightmare

❌ Unpredictable Exits – FIIs can pull out billions overnight, leaving markets in freefall.

❌ Rupee Depreciation – When FIIs exit, the rupee weakens, increasing inflation and economic stress.

❌ Over-Reliance Risk – A market overly dependent on FIIs lacks internal strength—making it fragile during global downturns.

So, what can you do to protect yourself?

How to Outsmart FII Movements

📍 Monitor FII Activity – Keep an eye on inflows and outflows; they often signal upcoming market trends.

📍 Trade with Data, Not Emotion – FIIs create sharp market swings; don’t get trapped in panic buying or selling.

📍 Focus on Domestic Strength – DIIs and retail investors are growing stronger—long-term opportunities exist beyond FII influence.

The Rise of Domestic Institutional Investors (DIIs): A Balancing Force?

While FIIs have dominated Indian markets for years, DIIs (Domestic Institutional Investors) have been stepping up in a big way:

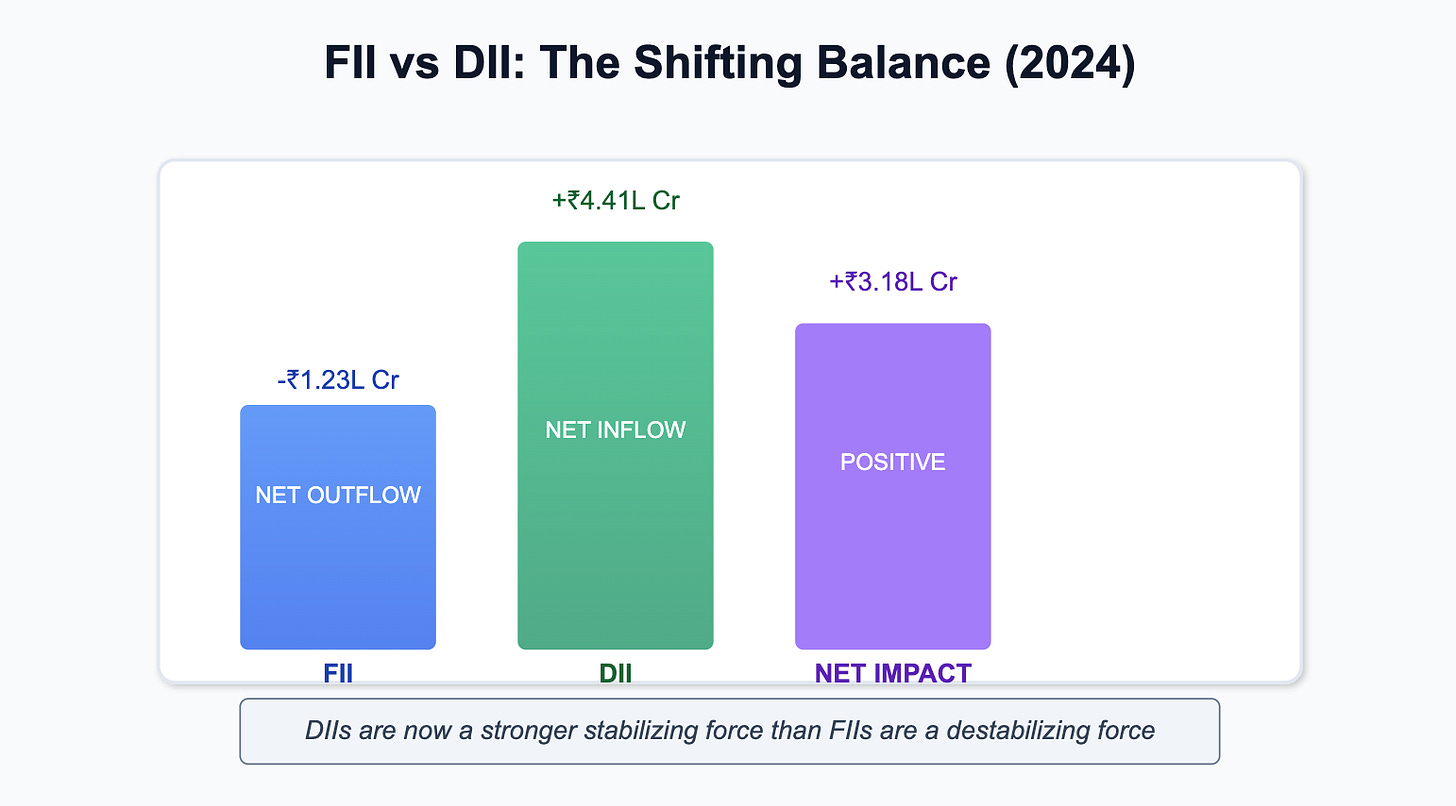

📊 DIIs have invested over ₹4.41 lakh crore in Indian equities in 2024, compared to FII net outflow of ₹1.23 lakh crore.

🏦 Mutual funds and insurance companies are absorbing FII shocks, ensuring market stability.

🔄 During FII sell-offs, DIIs have consistently provided a cushion, reducing extreme volatility.

💡 The shift is clear—India is no longer just an FII-driven market. DIIs are becoming a stabilizing force.

A Necessary Evil?

FIIs bring money, stability, and growth, but they also create volatility, fear, and dependence. The key isn’t to fear them—it’s to track their moves, understand their impact, and trade smarter.

What’s your take? Are FIIs the market’s biggest asset or its greatest risk? Let’s discuss below! 👇