An Initial Public Offering (IPO) is a way for companies to raise capital by offering shares to the public. After investors apply, there is a short waiting period before the shares are listed and start trading. During this time, an unofficial market known as the grey market becomes active. The Grey Market Premium (GMP) in IPOs reflects sentiment around the shares before they get listed.

In this article, we will cover what the grey market and GMP mean, how they operate, what the listing price is, the differences between GMP and listing price, and what investors should learn from them.

What is a grey market?

A grey market is an unofficial and unregulated market where traders buy and sell shares before they are listed.

When a company launches an IPO, shares are made available to investors at a fixed price or a price range known as the price band. However, the actual listing price on the market can be different, based on factors like demand. This difference in price creates an opportunity for grey market trades.

Transactions in the grey market are contracts based on expected listing prices. Settlement happens only after the shares are officially listed, based on which traders make profits or losses.

Since the grey market is unregulated, there is a higher risk of manipulation or fraud.

What is GMP in an IPO?

Grey Market Premium (GMP) is the extra amount traders are willing to pay to buy or sell shares before they are officially listed. It is over and above the IPO issue price.

Traders pay the premium because they expect the listing price to be higher than the issue price, creating an opportunity for profit.

Example:

Company ABC issues shares at a price band of ₹220–₹240. In the grey market, traders pay ₹265, expecting a higher listing.

If the stock lists at ₹280 → traders earn ₹15 per share.

If it lists at ₹250 → traders lose ₹15 per share

What does the GMP of IPO indicate?

The Grey Market Premium (GMP) is often seen as an early signal indicating how a stock might perform once it is listed on the exchange.

High premiums indicate strong demand and a possible price rise while listing.

Low premiums indicate weak demand and possible lower listing.

Near-zero GMP indicates uncertainty or neutral sentiment.

While GMP is a useful indicator, it should not be the only factor to judge a stock’s future performance, considering the risk of manipulation in the unregulated grey market. Moreover, the listing price depends on several other factors, such as the company’s fundamentals, overall market conditions, and economic cycles, in addition to the GMP of the IPO.

How can traders monitor GMP pricing?

Since the grey market is unregulated, the details of premiums are not published through any official exchange. Instead, GMP values are often shared through news channels, newspaper articles, social media forums, or directly via brokers who are active in the grey market.

To trade in the grey market, traders must enter into contracts with their brokers and negotiate prices privately. The contract is then settled based on the actual listing price only after the shares are officially allotted and listed on the stock exchange.

Who should consider trading based on GMP in IPOs?

Besides the risk of fraudulent activities due to the lack of regulations, there is also the risk of speculation failing. Therefore, grey market trading is mostly suitable for highly experienced traders who understand the downsides and have a high-risk appetite. For investors who prefer calculated risks, the grey market may not be the best place to trade.

Understanding the listing price in IPOs

The listing price is the price at which a company’s shares officially start trading on the stock exchange after the IPO process is complete. It is the first day when shares become available for public trading.

Listing price depends on:

Demand for shares during subscription

Company fundamentals and growth prospects

IPO issue price

Peer company valuations

Market sentiment and economic conditions

Once listed, the price moves dynamically based on demand and supply.

The listing price plays a crucial role for investors as it determines the initial profit or loss for those who were allotted shares during the IPO subscription.

Initial profit/loss = Listing price - IPO issue price

Example:

Company ABC issues shares at ₹200. Based on demand, it lists at ₹250. Investors who have received allotment during the IPO at ₹200, gain ₹50 per share.

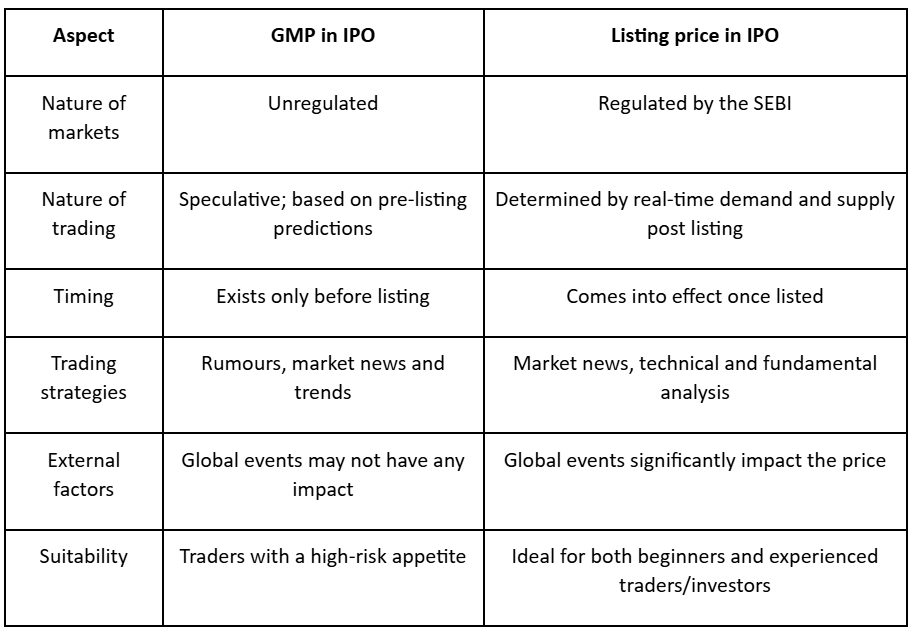

GMP vs listing price: Key differences

Though listing price and GMP are both related to a stock’s IPO, they rarely match. The two prices significantly differ due to their different nature. Here are some key differences:

Why do GMP and listing price differ?

The two figures are usually different because:

GMP is speculative, listing price is market-driven.

Events after GMP calculation (global or domestic) can affect actual listing.

Investor sentiment or subscription strength can shift between subscription and listing.

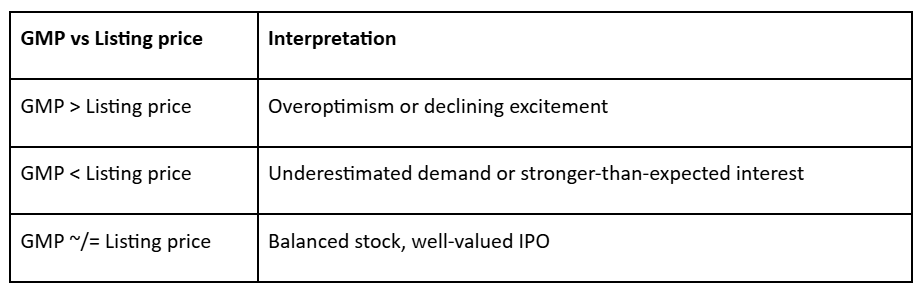

What does the gap between GMP and listing price tell traders?

Understanding the gap between the Grey Market Premium (GMP) and the listing price, and the significance of each of them, is crucial for investors looking to invest in IPOs.

A big gap between GMP and listing price shows shifting market expectations. While GMP reflects early predictions, the listing price reveals actual market value and investor sentiments.

Conclusion

The Grey Market Premium provides a useful insight into market enthusiasm. However, it is not the most reliable indicator due to the high fluctuations in the grey market.

For both new and experienced investors, it is best to treat GMP as a reference rather than a definitive predictor. Instead of viewing GMP in isolation, combining it with fundamental and technical analysis can help navigate the market more effectively and make better-informed decisions.