IPO Summary

Billionbrains Garage Ventures Ltd (Groww) closed its IPO subscription window on November 7, 2025.

The ₹6,632.3 crore public issue comprised a fresh issue of ₹1,060 crore and an offer for sale (OFS) of ₹5,572.3 crore, with a price band of ₹95–₹100 per share.

The allotment process is expected to be finalized on November 10, 2025, while the listing is tentatively scheduled for November 12, 2025, on the NSE and BSE.

Groww is one of India’s largest fintech and retail investment platforms, offering investing in equities, mutual funds, UPI, and credit products.

Founded in 2016, Groww serves over 12.6 million active clients and commands a 26% market share in retail broking as of June 2025.

How to Check IPO Allotment Status

Option 1: On BSE Website

Visit the BSE IPO Application Status Page

Select ‘Equity’ under Issue Type

Choose “Groww Ltd (Billionbrains Garage Ventures Ltd)” under Issue Name

Enter your Application Number or PAN

Click ‘Submit’ to view your allotment status

Option 2: On NSE Website

Visit the NSE IPO Allotment Page

Select ‘Equity’ and choose Groww Ltd(Billionbrains Garage Ventures Ltd) under Issue Name

Enter your PAN or Application Number

Click ‘Submit’

Option 3: On Registrar’s Website (MUFG Intime India)

Visit the MUFG Intime India IPO portal

Select ‘Groww Ltd’(Billionbrains Garage Ventures Ltd) from the dropdown

Enter any of the following:

PAN

Application Number

DP/Client ID

Click ‘Submit’ to check your allotment

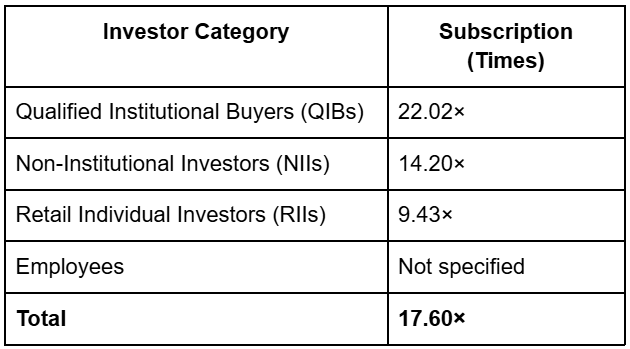

IPO Subscription Status (As on Last Day)

Grey Market Premium (GMP)

As of November 7, 2025, the Groww IPO Grey Market Premium (GMP) stands at ₹5 per share, indicating a 5% premium over the upper price band of ₹100.

The GMP has declined in recent sessions, suggesting a more measured sentiment and flat-to-mild positive listing expectation around ₹105 per share.

Company Overview

Groww (Billionbrains Garage Ventures Ltd) is a Bengaluru-based digital investment and financial services platform that allows retail users to invest in stocks, mutual funds, and ETFs. The company has diversified into UPI payments and credit services, creating an integrated fintech ecosystem.

In FY25, Groww turned profitable, marking a major milestone in its evolution from a startup to a full-scale financial intermediary. With 12.6 million active clients and a 26% market share, Groww remains one of the fastest-growing players in India’s fintech landscape.