Listing Overview

Groww made a strong market debut on November 12, 2025, listing at ₹114 a 14% premium over its issue price of ₹100 per share. The much-anticipated fintech IPO marked a major milestone for the company, which delivered a remarkable turnaround — swinging from a ₹805 crore loss in FY24 to a ₹1,824 crore profit in FY25.

The solid listing reflects investor confidence in Groww’s strong growth trajectory and expanding retail investor base, even as valuations remain on the higher side for the sector.

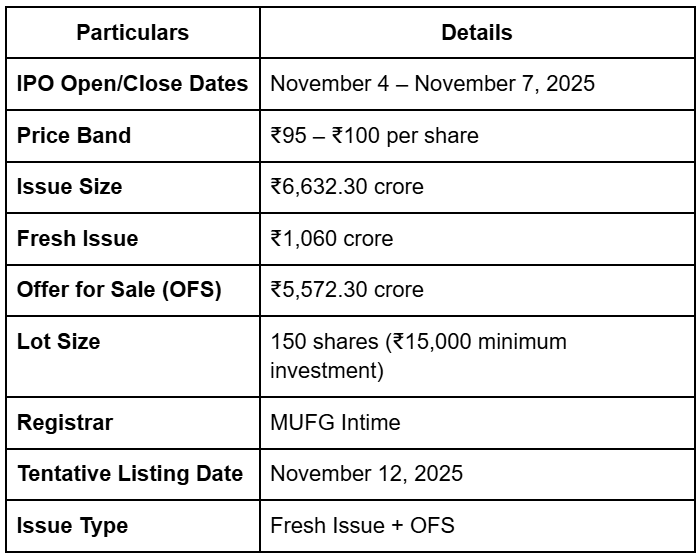

Groww IPO Summary

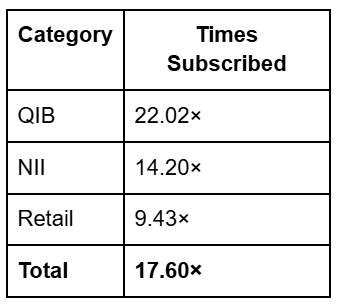

Groww IPO Subscription

Groww IPO Anchor Investors

Groww raised ₹2,984.54 crore from 102 anchor investors at ₹100 per share.

Prominent participants included SBI Mutual Fund, Sequoia Capital, ADIA, Dragoneer, Coatue Management, Kotak Flexicap, Nippon India, Axis Midcap, Motilal Oswal, Government of Singapore, Norway’s Pension Fund Global, Goldman Sachs, Amundi, MIT Endowment, and Wellington.

About Groww

Founded in 2016 by Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal,, Groww has evolved from a mutual fund app into a full-stack financial platform, offering equities, F&O, mutual funds, IPOs, US stocks, digital gold, and loans against securities.

It now commands a 26.3% share of the retail broking market, with 12.6 million active clients (June 2025), making it India’s largest retail broker.

Groww’s focus on simplicity and mobile-first design has helped it to capture a strong Gen-Z and millennial investor base, over 83% of its users are acquired organically.

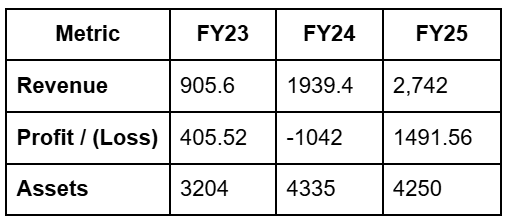

Financial Highlights (₹ crore)

Highlight:

Groww’s financial turnaround underscores its scalable model cost efficiencies and monetization in core segments boosted profitability in FY25.

Valuation and Listing Outlook

At the upper price band of ₹100, Groww’s implied valuation stands near ₹61,735 crore, translating to a P/E of ~33.8× FY25 earnings notably higher than peers like Angel One (~20×) and Motilal Oswal (~25×).

The cooling GMP of 4% suggests the market is pricing in the strong growth story but remains cautious about sustainability amid a cyclical trading environment.

A flat-to-moderate premium listing near ₹104–₹105 appears likely, with post-listing performance hinging on sustained profitability and user monetization.

Key Risks to Watch

Revenue Dependence: ~84% of revenue still comes from brokerage; market slowdowns can directly impact topline.

Regulatory Exposure: SEBI’s potential curbs on F&O volumes or margin trading could pressure revenues.

High Competition: Zerodha, Upstox, Angel One, and new fintech entrants (including Jio) may erode market share or margins.

Cyclicality: Performance is tightly linked to trading sentiment and retail investor participation.

Tech & Data Risks: As a fully digital platform, reliability, uptime, and cybersecurity are key dependencies.

Month-on-Month Decline in Active Clients: Groww has seen periodic MoM drops in active users during 2025, though it continues to lead the industry in total client base.