IndiGo Q1 FY25 Results: Profit Slips Despite Passenger Growth, Global Peers Show Mixed Signals

InterGlobe Aviation (IndiGo) remained India's largest airline in Q1 FY25 by market share and passenger volume, but rising costs and external disruptions weighed heavily on its profitability. While revenue and yields edged higher, profit declined both sequentially and year-on-year.

Profit Misses Despite Top-Line Growth

IndiGo reported a net profit of ₹2,161 crore, down 21% YoY and 29% QoQ.

Revenue from operations stood at ₹20,496 crore, up 5% from the same period last year.

Expenses surged to ₹19,232 crore, up 10% YoY outpacing revenue growth.

The pressure came from higher fuel prices and rerouting costs caused by the Pakistani airspace closure.

Load factor declined by 1.9 points, despite a modest 1% YoY capacity increase.

Yield improved 3% YoY to ₹5.24, but wasn’t strong enough to offset the cost base.

These results came in slightly below analyst estimates, particularly on the profit front, given the sharp rise in operating expenses and external headwinds.

IndiGo vs. Etihad & Global Benchmarks

While IndiGo posted solid passenger growth and held a 64.4% domestic market share, international peers like Etihad Airways reported stronger profitability and revenue momentum in the same quarter.

Etihad reported a 30% YoY jump in net profit (AED 685 million) with a 15% rise in revenue.

The airline carried 5 million passengers with a load factor of 87%, up 1 percentage point YoY.

Global airline traffic grew 4.7% YoY, with capacity growth broadly in line.

Industry-wide load factors remained between 81–87%, with mixed yield performance depending on the region.

Compared to peers, IndiGo continues to outperform in market share and passenger growth, but lags in margin stability and load efficiency, likely due to geopolitical exposure and cost dynamics in the Indian market.

Industry-Wide Signals

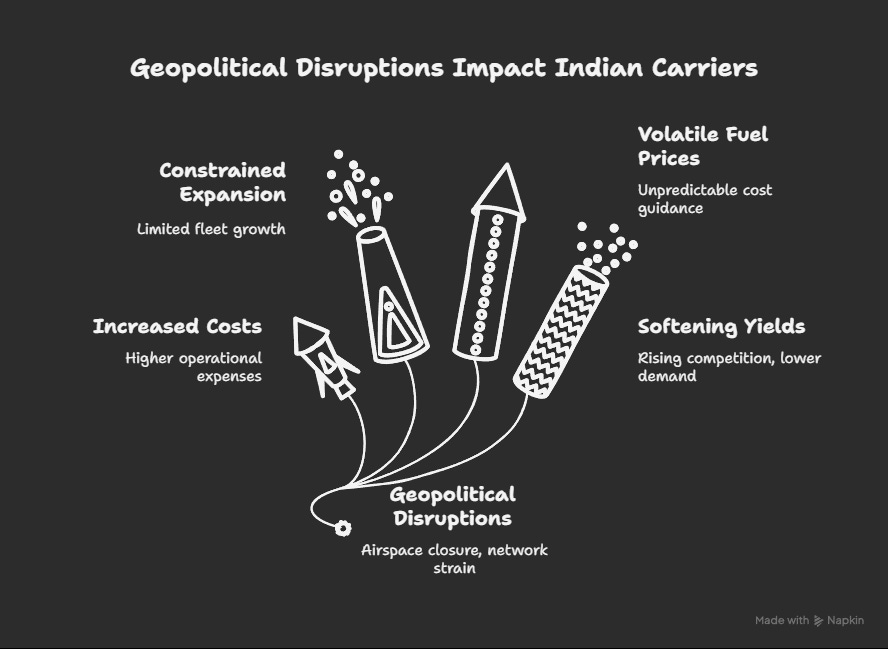

Geopolitical disruptions (e.g., Pakistan airspace closure) are adding costs and stretching operational networks for Indian carriers.

Aircraft supply remains tight, constraining expansion and putting a floor under aircraft values.

Jet fuel prices, while lower YoY, remain volatile impacting forward cost guidance.

Yield trends globally are softening in some markets due to rising competition and slower-than-expected premium travel demand.

Stock Reaction

IndiGo announced its Q1 FY2025 results after market hours on July 30. The stock closed at ₹5,740 on the day, with no immediate reaction priced in. Market response will be seen in the July 31 trading session, where investors are expected to weigh the decline in profit and management’s cautious outlook on costs against IndiGo’s strong market position and steady passenger growth.

Sahi’s Take

IndiGo’s Q1 FY25 results show a carrier still leading India’s skies in scale and traffic, but one navigating headwinds on the profitability front. Its domestic dominance (64.4% market share) and growing passenger base (up 10.15% YoY) provide strong fundamentals, but rising costs and operational disruptions suggest near-term margin compression.

As international peers like Etihad maintain high load factors and profitability, IndiGo’s challenge lies in balancing growth with efficiency, especially as fuel volatility and route disruptions persist