IPO Summary

Lenskart Solutions Ltd closed its ₹7,278.02-crore IPO subscription window on November 4, 2025.The issue comprised a fresh issue of ₹2,150 crore (5.34 crore shares) and an offer for sale (OFS) of ₹5,128 crore (12.75 crore shares).

The IPO was priced in the range of ₹382–₹402 per share with a face value of ₹2 per share, and investors could bid for a minimum of 37 shares per lot.

The allotment process is expected to be finalized on November 6, 2025, while listing is likely on November 10, 2025, on both NSE and BSE.

The IPO’s registrar is MUFG Securities India Pvt Ltd.

Grey Market Premium (GMP)

The latest grey market premium for Lenskart stood at ₹59–₹60 per share as of November 4, 2025, implying an expected listing gain of around +14–15% over the upper price band of ₹402.

This translates to an estimated listing price of ₹461–₹462 per share.

However, the GMP has slightly decreased in recent sessions, indicating that traders have turned a bit cautious ahead of the listing.

How to Check IPO Allotment Status

Option 1: On the BSE Website

Visit BSE IPO Allotment Page

Select ‘Equity’ under Issue Type

Choose ‘Lenskart Solutions Ltd’ under Issue Name

Enter your Application Number or PAN

Click ‘Submit’ to view your allotment status

Option 2: On the NSE Website

Visit NSE IPO Allotment Page

Select ‘Equity’ and choose ‘Lenskart Solutions Ltd’

Enter your PAN or Application Number

Click ‘Submit’

Option 3: On the Registrar’s Website (MUFG Securities)

Visit MUFG Securities India IPO Allotment Portal

Select ‘Lenskart Solutions Ltd’ from the dropdown

Enter one of the following:

PAN

Application Number

DP/Client ID

Click ‘Submit’ to check your allotment status

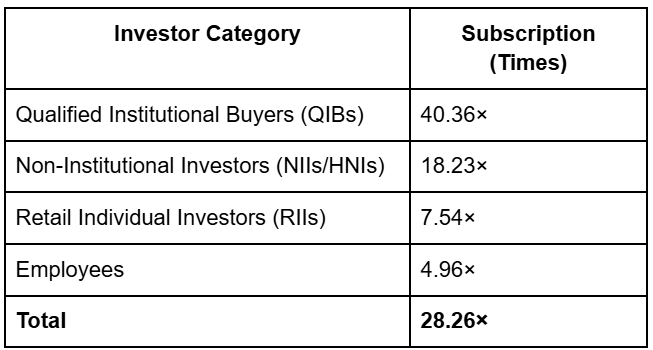

IPO Subscription Status (as on November 4, 2025)

Company Overview

Lenskart Solutions Ltd is India’s largest tech-enabled omnichannel eyewear retailer, offering prescription glasses, sunglasses, and contact lenses. Founded in 2008 by Peyush Bansal, the company combines a strong online platform with over 2,700 stores across 14 countries.

Operating through a vertically integrated D2C model, Lenskart manages manufacturing, design, branding, and retail under one umbrella, ensuring cost efficiency and faster turnaround times.

For FY25, the company reported revenues of around ₹6,652 crore, an EBITDA margin of 14.6%, and a net profit of ₹297 crore, marking its first full year of profitability.

Proceeds from the fresh issue will be utilized for store expansion, technology upgrades, marketing, and international growth.

Prominent investors include SoftBank, Temasek, Kedaara Capital, and Alpha Wave.

What’s Next

Lenskart’s IPO received strong demand across all investor categories, led by institutional investors subscribing over 40 times. While the grey market premium continues to indicate a positive sentiment, its recent moderation reflects a wait-and-watch approach ahead of the November 10 listing.

Tags:

#LenskartIPO #IPOAllotment #IPOListing #SahiResearch #StockMarketIndia #LenskartListing #IPOUpdates