Listing Overview

Lenskart Solutions IPO listed on the NSE and BSE on November 10, 2025, after concluding one of the most anticipated consumer-tech IPOs of the year. Priced at the upper band of ₹402 per share, the stock made a soft debut at ₹395 ,down 1.74% from the issue price. The grey market premium (GMP) had cooled to around ₹10–₹12 (≈3%) ahead of listing, a sharp drop from the ₹80 levels seen during the pre-subscription phase, reflecting tempered post-listing sentiment.

Despite the moderation in grey market sentiment, analysts remain positive on the company’s long-term growth potential driven by its omnichannel presence, strong brand equity, and profitability turnaround.

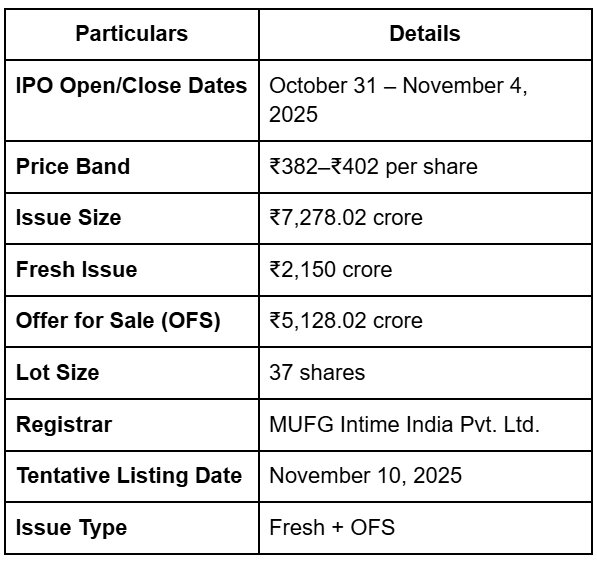

Lenskart IPO Summary

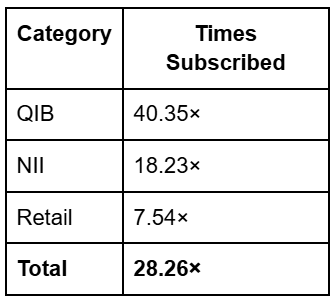

Lenskart IPO Subscription

Anchor Investors

Lenskart raised ₹3,268 crore from 147 anchor investors, including Goldman Sachs, JP Morgan, BlackRock, SBI, Temasek, Government of Singapore, and Steadview Capital, at ₹402 per share.

About Lenskart IPO

Founded in 2008, Lenskart is India’s largest omnichannel eyewear retailer, offering prescription glasses, sunglasses, and contact lenses through a hybrid online-offline model. With 2,723 stores across 14 countries (2,067 in India) and over 100 million app downloads, it operates a vertically integrated D2C business, controlling design, manufacturing, and distribution

Key acquisitions such as Owndays (2022) and Dealskart (2024) have helped accelerate international expansion and retail consolidation.

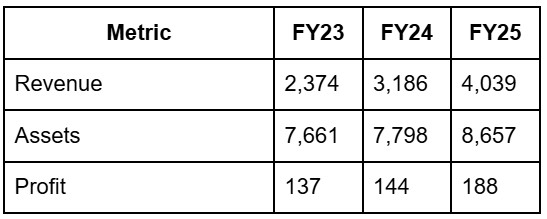

In FY25, Lenskart generated ₹4,039Cr in revenue and ₹188Cr in profit, with EBITDA margins expanding to 14.7% a clear shift toward operational maturity

Financial Highlights (₹ Cr)

Revenue Mix FY25: 60% India, 40% International.

Customer Base: 9.9M transacting customers, 6.8M Gold members.

Valuation and Listing Outlook

At the upper price band, Lenskart commands a valuation of ₹70,000–₹72,700 crore, translating to roughly 235× FY25 P/E and 10.5× P/S a premium multiple relative to global peer EssilorLuxottica (~50× P/E).

Analysts suggest that the rich valuation leaves little margin for error, making short-term listing gains unlikely. The falling GMP and cautious sentiment indicate that the stock could list flat to marginally positive, in the ₹412–₹415 range.

However, long-term investors see Lenskart as a high-growth play in an underpenetrated eyewear market, expected to expand at 10–15% CAGR through FY30, driven by digital adoption and rising refractive errors

Risks to Watch

Supply Chain Exposure: 40% raw material dependency on China.

Financial Leverage: Lease liabilities (~₹26,929M) and debt (~₹3,459M).

Regulatory Risks: Tax/GST disputes and data privacy compliance.

Competition: 70% market still unorganized; integration risk from acquisitions.

Sahi’s Research Review

Avoid for Listing Gains | Subscribe for Long Term

Lenskart’s fundamentals and brand moat make it a solid structural story in India’s eyewear market, but valuation remains elevated. The muted GMP reflects the market’s “wait-and-watch” stance ahead of listing.

Investors with a long-term horizon and appetite for high-growth consumer-tech plays may consider exposure, while short-term traders should monitor early price action before entry.