Access to timely capital is essential for any business to grow, but not every company can directly approach the main stock market due to SEBI’s regulations around IPO and listing. To address this, SEBI offers two IPO routes: Main board IPOs for large companies and SME IPOs for smaller businesses.

In this article, we will explore the two modes and understand how they work, their eligibility criteria, differences, benefits, limitations, and which option traders and investors may consider.

What is a main board IPO?

A main board IPO is the traditional route through which large and established companies raise funds from the public by offering their shares in the primary market. These shares are then listed and traded on the main platforms of stock exchanges such as the NSE (National Stock Exchange) or BSE (Bombay Stock Exchange).

To qualify for a main board IPO, SEBI and the exchanges have laid down the below eligibility requirements:

Net tangible assets: At least ₹3 crore in each of the last three years, with no more than 50% held in cash or cash equivalents.

Operating profit: An average of at least ₹15 crore over the last three years, with profits in each year.

Net worth: Minimum ₹1 crore in each of the last three years

Name change condition: If the company has changed its name within the past year, at least 50% of its revenue in that year must come from the new line of business indicated by the new name.

Post-issue capital: Minimum post-issue paid-up capital of ₹10 crore.

Listing on the main board helps companies gain access to a wider pool of investors, including large institutions such as mutual funds, insurance companies, and foreign institutional investors. It also enhances their visibility and credibility in the market, while offering higher liquidity due to strong trading volumes on NSE and BSE.

Main board IPO Example – Ganesh Consumer Products:

Ganesh Consumer Products, a major FMCG player, has launched its main board IPO with a total issue size of about ₹408.80 crore, comprising a fresh issue of ₹130 crore and an offer for sale of about ₹278.80 crore. The price band is ₹306-322 per share, with the IPO opening on 22 September 2025 and closing on 24 September 2025. Shares are expected to list on NSE and BSE on 29 September 2025.

What is an SME IPO?

Small and Medium Enterprises (SMEs) are businesses with lower revenues, smaller capital base, and limited resources compared to large corporates, but they play a vital role in the economy by driving employment, innovation, and exports.

Companies falling under the SME category often face difficulties raising capital through traditional means. To support them, SEBI and stock exchanges have introduced dedicated SME IPO platforms with relaxed norms that allow SME businesses to list and issue their shares to the public:

NSE Emerge

BSE SME

Eligibility requirements for SME IPO:

Post-issue capital: Must be between ₹1 crore and ₹25 crore.

Underwriting: 100% of the issue must be underwritten, with the merchant banker compulsorily underwriting at least 15%.

Market making: A market maker must be appointed for at least 3 years to provide continuous liquidity in the stock.

The company must have a track record of at least 3 years of operations.

Operating profit of INR 1 crore from operations for any 2 out of 3 previous financial years.

Must have positive Free Cash Flow to Equity (FCFE) for at least 2 out of 3 previous financial years. (NSE Emerge)

Net worth of at least ₹ 1 crore for the 2 preceding full financial years. (BSE SME)

Net tangible assets of ₹ 3 crores in the last preceding (full) financial year. (BSE SME)

SME-listed companies can migrate to the main platform once they meet SEBI’s main board eligibility criteria, such as higher paid-up capital, net worth, and profitability requirements. This allows them to access a larger investor base, better liquidity, and greater visibility as they grow.

SME IPO Example – Prime Cable Industries:

Prime Cable Industries, a wires and cables manufacturer, recently launched its IPO on the NSE SME platform with an issue size of about ₹40 crore. The price band was set at ₹78–83 per share with a minimum investment size of ~₹1.3 lakh for retail investors. The IPO opened on 22nd September 2025 and is scheduled to list on 29th September 2025.

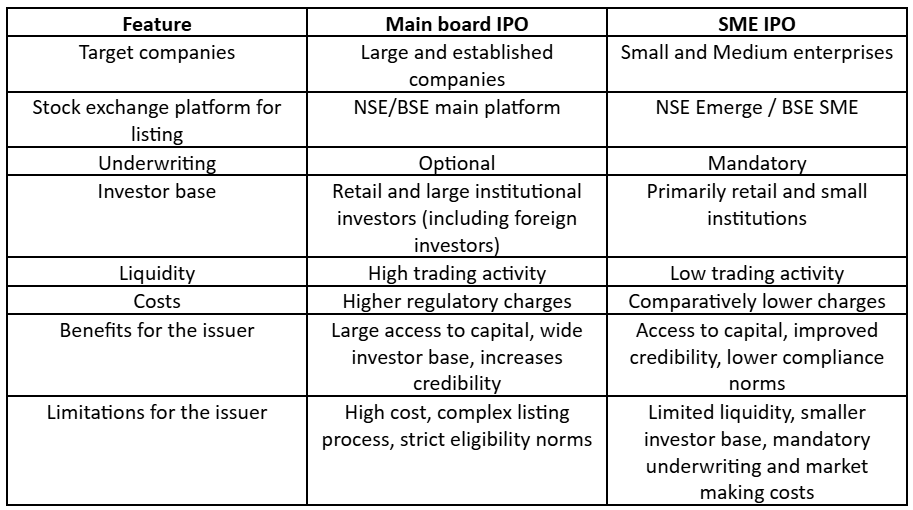

Main board IPO vs SME IPO: Key differences

Besides their eligibility criteria, capital, profit and other things, here are some key differences in the nature of the two IPOs:

Which IPO should a trader choose?

For traders and investors, the choice between main board and SME IPOs largely depends on risk appetite, investment objectives, and liquidity preferences.

Choose main board IPOs if you prefer:

Stable and established companies.

Higher liquidity and easier trading on NSE/BSE.

Exposure to institutional investors and wider market participation.

Lower risk compared to smaller companies.

Choose SME IPOs if you are open to:

Higher risk for potentially higher returns.

Lower liquidity and higher volatility.

Support the growth of small or growing companies.

Research and monitor the company closely over the long term.

Conclusion

In conclusion, main board IPOs cater to large, established companies seeking substantial funds and liquidity, while SME IPOs offer smaller businesses an accessible route to raise capital. For traders, main board IPOs provide stability, whereas SME IPOs present higher risk-reward opportunities, helping investors decide based on their investment goals and risk tolerance.