Market Minute | November 03, 2025

🚀Nifty50 recovers from lows, Banks lead, PMI at 59.2, ShriramFin’s strong BO; Airtel’s profit up 89% & more inside!

Nifty 25,763.35 ▲ +0.16%

Sensex 83,978.49 ▲ +0.05%

Bank Nifty 58,101.45 ▲ +0.56%

Benchmark indices grind higher!

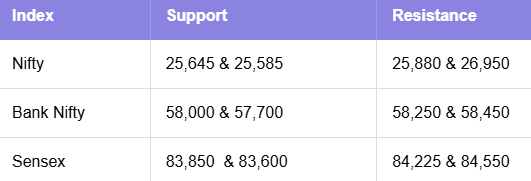

The Market wrapped Monday on a positive note, though the mood was far from euphoric. The broader sentiment was driven more by Mid-cap strength than Large-cap conviction. Interestingly, the day started with a soft tone, Nifty slipped at open, tested support around the 25,645 mark, and then clawed its way back. But the index continued to face a wall of supply near the 25,800–25,825 zone, followed by another barrier at 25,925. This range now becomes pivotal, a break above could unlock a fresh leg higher, while 25,645 remains the key downside support for the coming sessions.

Sensex mirrored that hesitation, repeatedly struggling near 84,225, with 83,775–83,600 acting as a buffer on declines. Meanwhile, Bank Nifty again respected resistance at 58,200–58,250; reclaiming and sustaining above this band may ignite a move toward recent highs.

The Broader Market continues to outperform as Midcaps hit fresh highs!

To begin with, the Nifty Midcap 100 touched a fresh 52-week high of 60,400, ultimately closing at 60,287, that’s its highest level since October 2024, highlighting how investors are increasingly backing growth-oriented Mid-tier names post strong Q2 prints. The Nifty Smallcap 100 wasn’t left behind either, gaining 0.72%.

Sectorally, the rally was broad, Realty led with a 2.23% jump, followed by PSU Banks (+1.92%) and Pharma (+1.20%). Financials, too, quietly strengthened in the background. On the flip side, IT and FMCG saw mild cooling, not a sell-off, just routine consolidation after recent runs.

The India VIX climbed 4.2%, reflecting sentiment beneath the surface despite the positive market breadth. Think of it as the Market saying, “I’m bullish, but I’m watching every move.”

Key movers and Earnings-driven action power stock-specific moves!

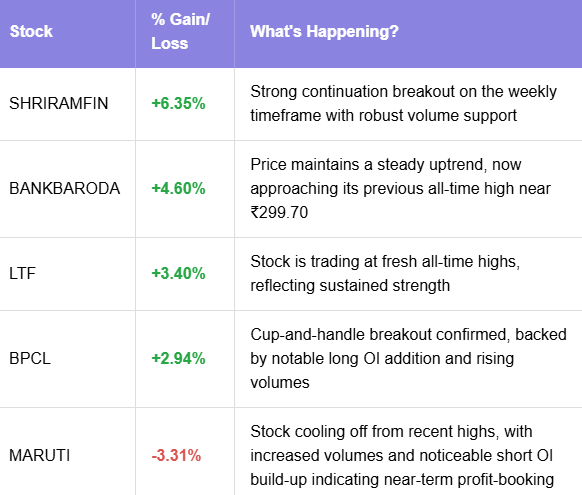

Earnings and news flow continued to shape the leaderboard. Vodafone Idea jumped 10.32%, supported by clarity from the Supreme Court on AGR dues, removing a big overhang for investors. Indus Towers followed with a 5.27% rally.

Capital-market plays stayed in demand, with BSE, Angel One, and MCX gaining. Phoenix Mills and Vedanta rallied, the former riding strong Real-estate sales momentum while the latter benefited from healthy operational metrics. Aditya Birla Capital extended its post-earnings rally for the second session, adding another 3.10%, scaling to a fresh record-high.

Earnings excitement was also seen in names like Shriram Finance and Bank of Baroda, Godrej Consumer after delivering steady performance in a tough environment. On the downside, Maruti Suzuki saw profit-booking after an in-line quarter, becoming one of the top Nifty drags, and Tata Chemicals slipped 1.72% after results.

NIFTY50: Top Gainers

Shriram Finance ▲ +6.35%

Tata Consumer ▲ +2.79%

Apollo Hospitals ▲ +1.87%

NIFTY50: Top Losers

Maruti Suzuki ▼ -3.31%

ITC ▼ -1.52%

TCS ▼ -1.35%

Key levels to watch for November 04, 2025

OI Insights

Nifty50 began the session with a mild dip but held its opening lows, gradually recovering through the day to finish near the highs. The derivatives setup aligned with this constructive tone, significant put writing at 25,700PE (73.26L), 25,650PE (67.84L), and 26,600PE (51.57L) suggests a strong support base forming beneath current levels. Meanwhile, call writing remained relatively subdued, with 25,800CE (34.63L) seeing the highest addition, indicating that bears are still cautious and not aggressively capping the upside.

Takeaway:

Market participants appear to be building a floor, signalling a potential upward bias, but a decisive move above 25,800 could be key for momentum to expand.

Today’s buzzing stocks at a glance

News you can use

Bharti Airtel Q2 profit jumps 89% YoY to ₹6,792 crore.

Ambuja Cements Q2 profit surges 177% YoY to ₹1,387.55 crore; revenue up 26.2% to ₹5,139.48 crore.

Tata Consumer Products beats estimates with ₹397 crore Q2 profit; revenue rises 18% YoY to ₹4,966 crore.

HSBC/S&P Global India Manufacturing PMI climbs to 59.2 in October vs 58.4 in September.

The Supreme Court allows the government to consider relief on additional and reassessed AGR dues for Indus Towers.

Zen Technologies secures ₹289 crore order for anti-drone system.

L&T signed a MoU with Holtec to enhance heat-transfer solutions for the nuclear power sector.

Chart of the day: SHRIRAMFIN

Spotted: Cup & Handle

Structure: Forms after an uptrend when price pulls back gradually, shaping a ‘rounded cup’, followed by a small consolidation dip called ‘the handle’. This shows healthy profit-booking while stronger hands accumulate.

Validation: A BO above the handle’s resistance on strong volume confirms continuation. A clean close above the cup’s high helps avoid false BOs.

Trading Insight: Signals a pause before the next leg up. As price tightens in the handle, buying pressure builds. Enter on a volume-backed breakout candle; keep stops below the handle low.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 04, 2025, with more sharp insights, fresh trends, and signals from the markets.