Market Minute | November 04, 2025

🚨Nifty50 slips below 25.6K, Banks & Metals take a hit, Tata Steel’s acquisition; Groww IPO opens & more inside!

Nifty 25,597.65 ▼ -0.64%

Sensex 83,459.15 ▼ -0.62%

Bank Nifty 57,827.05 ▼ -0.47%

Note: The Markets will remain closed on Wednesday, 5 November 2025, on account of Guru Purab. Trading will resume on Thursday, 6 November 2025.

Markets lose steam, End at day’s low!

The Markets had a rough day, with the benchmark indices giving up early ground and sliding steadily through the session. Nifty50 slipped below the 25,600 mark and closed near the day’s low, ending down ~166 points. Sensex followed suit, mirroring Nifty’s intraday trajectory, an early resistance test near 25,800 and then a grind lower through the afternoon.

Bank Nifty, which had been showing relative resilience in recent sessions, also couldn’t dodge the broader weakness, stuck inside a contracting range. The structure suggests a clear pressure zone overhead near 58,000–58,200, while immediate supports sit around 57,650 and further lower at 57,480, a region that bulls would want to defend to avoid deeper selling.

Broader Market and Sector pulse!

If large caps struggled, the Broader Market didn’t find shelter either. Midcaps lost ~0.42% while Smallcaps fell ~0.82%, showing the selling was fairly broad-based. Market breadth stayed negative, 42/50 Nifty stocks finished in the red.

Sectorally, it was almost a sea of red. Metals led the decline with ~1.44% cuts, followed by IT (~1.06%) and weakness across Autos, Realty, Private Banks, FMCG, Media, and Energy. One space that bucked the trend? Consumer durables, up ~0.39%, showing pockets of defensive buying even on a weak day.

IPO corner stayed active, Lenskart entered its final bidding day, while Groww’s much-anticipated issue opened.

Earnings-driven moves & What to expect?

Stock action remained earnings-driven: Power Grid dropped 3.11% after a Q2 miss, while Titan and Bharti Airtel climbed 2.39% and 1.89%, respectively, each on strong quarterly prints. Hero MotoCorp fell 4.15% following soft monthly sales, and SBI and M&M staged brief intraday rebounds post results. Weakness was also seen across names like Gland Pharma, JK Paper, and Arvind SmartSpaces, whereas Indus Towers gained after Bharti Airtel approved plans to lift its stake. Adani Enterprises slid 1.91% after announcing a ₹2,500-crore rights issue.

For Nifty50, The next immediate support lies at 25,580, followed by 25,450, while 25,720 and 25,800 remain overhead resistance zones where supply continues to emerge. For Bank Nifty, the 57,650–57,480 pocket will be crucial, a breakdown could invite further downside. Any recovery attempt needs a clean move above 58,000–58,200 to gain momentum. Meanwhile, Sensex holds support near 83,120, with 83,880 acting as the initial resistance on pullbacks.

NIFTY50: Top Gainers

Titan Company ▲ +2.39%

Bharti Airtel ▲ +1.89%

Bajaj Finance ▲ +1.33%

NIFTY50: Top Losers

Power Grid ▼ -3.11%

Coal India ▼ -2.83%

Zomato ▼ -2.82%

Key levels to watch for November 06, 2025

OI Insights

As Nifty50 drifted lower through the session and closed at the day’s low, the derivatives setup echoed the nervous undertone. Heavy call writing at 25,700CE (36.62L) and 25,800CE (32.19L) signals firm supply zones overhead, suggesting traders are capping upside expectations for now. On the other hand, put additions were modest, with 25,500PE (12.21L) and 25,300PE (20.27L), reflecting hesitation to confidently build support levels just yet.

Takeaway:

Bears held the upper hand today. With calls stacking up near immediate resistance zones and limited put buildup, bulls will need fresh triggers and volume to reclaim momentum.

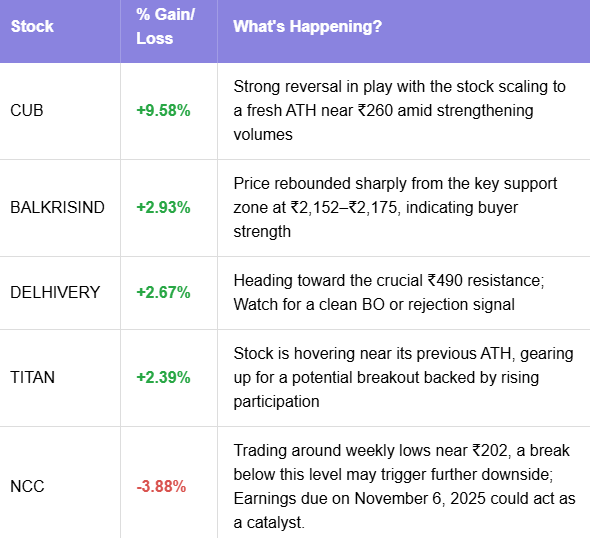

Today’s buzzing stocks at a glance

News you can use

SBI Q2 results: Profit rises 6.4% YoY to ₹21,504.49 crore.

M&M Q2 results: PAT surges 28% YoY to ₹3,673 crore; revenue jumps 22%.

Adani Ports Q2 results: Net profit grows 27.2% to ₹3,109 crore; revenue up 29.7% to ₹9,167.5 crore.

Adani Enterprises board approves raising ₹25,000 crore via rights issue.

BlackRock increased its stake in Sammaan Capital to 5.33% after acquiring 38.75 lakh shares on October 31.

Indian Metals & Ferro Alloys approves asset transfer agreement with Tata Steel for ferro alloys plant acquisition; declares interim dividend of ₹5 per share.

Chart of the day: ICICIGI

Spotted: Pennant

Structure: Appears after a sharp up-move where price pauses and contracts into a tight, symmetrical triangle, a brief consolidation on strong momentum.

Validation: Breakout above the pennant’s upper trendline on strong volume confirms continuation and helps avoid false moves.

Trading Insight: Indicates momentum cooling before the next push higher. Enter on a volume-backed breakout; place stops below the lower trendline or recent swing low.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 06, 2025, with more sharp insights, fresh trends, and signals from the markets.

Airtel lifting its stake in Indus Towers is a stretagic play that seems underappreciated. This vertical integration will improve margins over time and give them more control over infrastructure costs. With their Q2 beat and ARPU growth, the fundamentals are clearly heading in the right direction.