Market Minute | November 06, 2025

🚨Volatile session: Nifty50 ends at day’s low, SBI’s Market Cap hits $100 billion; Redington gains ~15% & full wrap inside!

Nifty 25,509.70 ▼ -0.34%

Sensex 83,311.01 ▼ -0.18%

Bank Nifty 57,554.25 ▼ -0.47%

Markets struggle for support as volatility persists!

It was yet another day of turbulence for Indian Markets, as the Benchmark indices slipped for the 2nd consecutive session, weighed down by sustained foreign fund outflows and selling in heavyweight names like ICICI Bank. The Sensex ended 148 points lower at 83,311, after swinging nearly 600 points intraday between 83,846 and 83,237. Similarly, the Nifty50 dropped 88 points to close near the day’s low at 25,510, unable to hold above the crucial 25,600 mark.

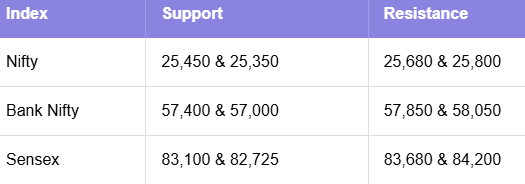

From a technical perspective, the index is now inching closer to the breakout zone around 25,450–25,500, which will act as immediate support. A slip below this band could invite deeper cuts toward 25,350–25,150, while on the upside, resistance remains firm at 25,600–25,800. The sentiment, for now, remains cautious with traders preferring to sell on rallies.

Bank Nifty tests crucial support; caution builds up!

The Bank Nifty mirrored the broader trend, slipping 273 points to settle at 57,554 amid choppy trade. The index is now hovering dangerously close to the support zone at 57,480, and a sustained move below could drag it toward 57,000.

On the flip side, the recovery zone lies between 57,850–58,000, which will need to be taken out decisively for any meaningful reversal to unfold. The financial space also saw pressure from PSU banks and Private lenders alike, with selling intensifying in select names post earnings. Traders are closely watching if buyers step in around these supports to arrest further downside.

Broader markets & stock action: Sellers stay in charge

It wasn’t just the benchmarks, the pain was widespread. The Broader Markets underperformed, with the Nifty Midcap 100 falling 0.95% and the Nifty Smallcap 100 slipping 1.39%. Among the sectoral indices, losses were broad-based, barring Nifty IT and Nifty Auto, which managed to stay marginally in the green. The Nifty Media index was the biggest laggard, tumbling 2.54%, followed by Nifty Metal (-2.07%), Realty, Energy, and Financial Services.

In the stock action, Power Grid extended its losing streak, sliding another 3.17%, while Grasim and Hindalco topped the Nifty losers among the Aditya Birla Group pack. Blue Star fell 6.89% after lowering its revenue and margin guidance, dragging peers Havells and Voltas down. Delhivery, ABFRL, and NCC also dropped post-weak results.

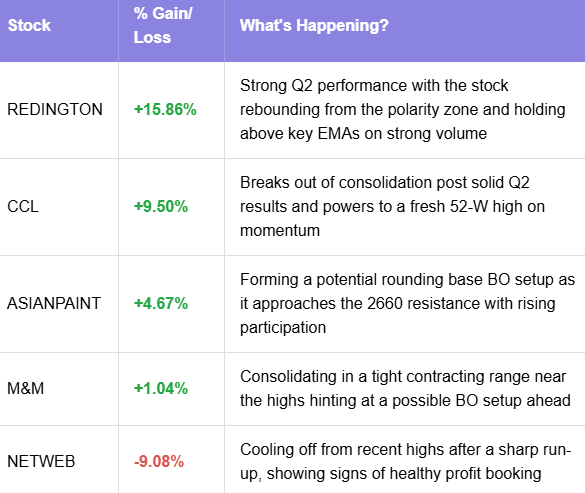

On the brighter side, Astral, Britannia, and Nuvama ended higher after healthy Q2 prints, while Redington jumped 15.86% on strong earnings. Paytm gained 4.15% after being added to the MSCI Index.

NIFTY50: Top Gainers

Asian Paints ▲ +4.67%

Reliance Industries ▲ +1.56%

Mahindra & Mahindra ▲ +1.04%

NIFTY50: Top Losers

Grasim Industries ▼ -6.31%

Hindalco Industries ▼ -5.17%

Adani Enterprises ▼ -4.36%

Key levels to watch for November 07, 2025

OI Insights

Yet another session of weakness as Nifty50 slipped steadily and wrapped up at the day’s low, with the derivatives data mirroring this cautious mood. Strong call writing at 25,600CE (68.42L), 25,700CE (63.61L), and 25,800CE (50.71L) clearly marks a ceiling for the index, indicating traders’ reluctance to bet on a sharp rebound. Meanwhile, modest put additions at 25,400PE (35.81L) suggest that confidence in building a solid base is still missing.

Takeaway: Bears continue to hold the upper hand, with resistance firming up at higher levels, a decisive bounce will need strong follow-through buying to shift sentiment.

Today’s buzzing stocks at a glance

News you can use

State Bank of India joins the $100 billion market-cap club, becoming the sixth Indian company to achieve the milestone.

Ola Electric Q2 results: Net loss narrows to ₹418 crore as revenue slumps 43% YoY.

Bajaj Housing Finance Q2 results: Net profit up 18% YoY; AUM grows 24%.

Delhivery Q2 results: Reports a loss of ₹50.49 crore versus a profit of ₹10.20 crore last year; total income rises 14.8% to ₹2,651.53 crore.

India’s October Services PMI slips to 58.9 from 60.9 in September; Composite PMI eases slightly to 60.4 from 61.

Orkla India lists at ₹750.1 per share versus issue price of ₹730 on NSE.

Ather Energy block deal: 1.4 crore shares (3.66% equity) worth ₹856.2 crore change hands at ₹630 per share.

RBL Bank block deal: 2.11 crore shares (3.45% equity) worth ₹678 crore traded at ₹321 per share.

Chart of the Day: ASTRAL

Spotted: Symmetrical Triangle

Structure: Forms when price consolidates after a prior move, creating a series of higher lows and lower highs that converge into a symmetrical triangle. This reflects steady accumulation as buyers quietly absorb supply.

Validation: A breakout above the triangle’s upper trendline, supported by strong volume, confirms the accumulation phase is ending and a new leg up is underway.

Trading Insight: Suggests buyers regaining control after a period of balance. Enter on a convincing breakout candle with volume; keep stops just below the lower trendline or recent swing low.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 07, 2025, with more sharp insights, fresh trends, and signals from the markets.