Market Minute | November 11, 2025

🚀Markets rebound, Bajaj Finance crashes 7%: Here’s what drove Nifty to 25.7K today; October MF data insights & more inside!

Nifty 25,694.95 ▲ +0.47%

Sensex 83,871.32 ▲ +0.40%

Bank Nifty 58,138.15 ▲ +0.35%

Indices bounce back: Can the momentum sustain?

After a flat-to-positive start, the Markets found their ground again today. The Nifty50 opened near the 25,650 mark, the same resistance that capped gains in the previous session, and soon slipped towards 25,450. But the dip didn’t last long. A sharp V-shaped recovery through the day helped the index reclaim most of last week’s losses, closing strong near 25,700.

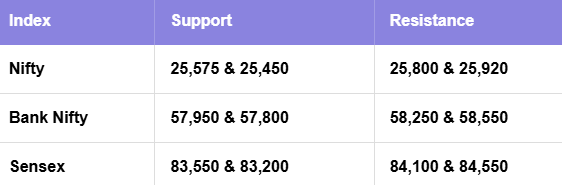

What’s next? If Nifty manages to push beyond the 25,700–25,835 zone, the door opens towards 26,100, potentially a new ATH. On the downside, 25,450 and 25,575 remain the key supports that need to hold for the ongoing recovery to sustain.

The broader markets moved largely in sync with the benchmarks, the Nifty Midcap index rose 0.5%, while Smallcap stocks stayed flat.

Bank Nifty & Sensex: Testing crucial levels!

The Bank Nifty climbed but still couldn’t clear the 58,250 hurdle, a zone that’s now acting as the decisive barrier. A breakout above this could spark a move towards 58,550 and lend further strength to the broader market.

Meanwhile, the Sensex closed above the previous day’s high. The index now faces a near-term resistance at 84,100; crossing it could trigger another leg higher.

What drove the Market today?

Out of the 50 Nifty stocks, 39 ended in the green, with strength seen across IT, Aviation, Auto, and Metals.

IndiGo led the rally, soaring over 3.47% after strong air traffic data.

M&M gained 2.33%, driven by healthy Auto sales numbers, while two-wheeler stocks inched higher following discussions on ABS norms.

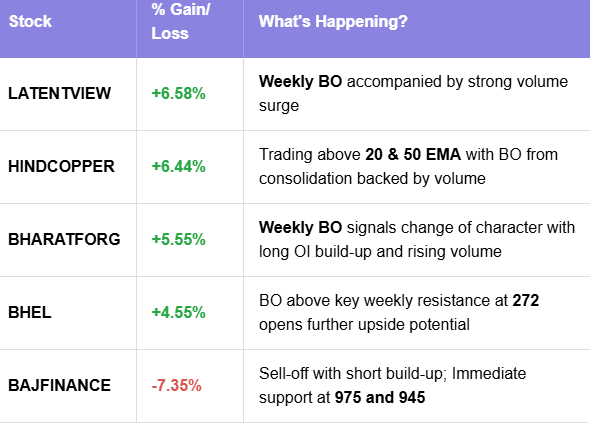

Bharat Forge, BHEL, and National Aluminium also extended gains on solid earnings and positive outlook commentary.

However, the day wasn’t all smooth, Bajaj Finance fell 7.35% after cutting its AUM growth guidance, dragging Bajaj Finserv down 6.09%. Bosch missed estimates in Q2, and Britannia ended lower despite recovering from early weakness after Varun Berry’s resignation.

NIFTY50: Top Gainers

IndiGo ▲ +3.47%

BEL ▲ +2.51%

M&M ▲ +2.33%

NIFTY50: Top Losers

Bajaj Finance ▼ -7.35%

Bajaj Finserv ▼ -6.09%

ONGC ▼ -0.78%

Key levels to watch for November 12, 2025

OI Insights

Heavy put writing at 25,600 (21.21L) and 25,500 (22.51L) suggests that traders are building a strong support base around these levels. Meanwhile, call additions were relatively modest at 25,800 (9.87L), indicating limited bearish positioning. The PCR-OI stands at 1.1.

What does this mean? This setup indicates that traders are confident about the index holding above 25,500–25,600. The sentiment is tilting towards the bullish side, and the market may attempt to move higher if these supports hold.

Today’s Buzzing stocks at a glance

News you can use

Mutual fund inflows slowed in October; net equity inflow at ₹24,671 crore vs ₹30,405 crore in September.

Mutual fund industry AUM rises to ₹79.87 lakh crore in October from ₹75.61 lakh crore a month ago.

Bajaj Finance cuts FY26 AUM growth guidance to 22–23%.

Bajaj Finserv Q2 net profit rises 7.5% YoY to ₹2,244 crore; revenue up 11%.

Hindustan Copper Q2 profit surges 82.3% YoY to ₹186 crore.

Bharat Electronics extends rally for third straight session after ₹792 crore order win.

Paras Defence secures ₹36 crore order from the Government of India for portable counter-drone systems.

Chart of the Day: LATENTVIEW

Spotted: Cup & handle

Structure: The “cup” forms after a rounded bottoming phase, followed by a smaller, downward-sloping consolidation known as the “handle.”

Validation: A BO above the handle’s resistance, ideally on strong volume, confirms the pattern.

Trading Insight: A transitioning pattern highlighting shift from a downward to an upward trajectory; Enter on a decisive BO with volume confirmation.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 12, 2025, with more sharp insights, fresh trends, and signals from the markets.