Market Minute | November 18, 2025

🚀Nifty50 snaps 6-Day winning streak: IT & Metals drag; PWL lists at 36% premium & full wrap inside!

Nifty 25,910.05 ▼ -0.40%

Sensex 84,673.02 ▼ -0.33%

Bank Nifty 58,899.25 ▼ -0.11%

Rally hits a speed-breaker as Markets catch their breath!

Markets finally took a pause today after a strong 6-day run. What began as a steady, flat open quickly turned into a day of selling, with Nifty50 tumbling beneath 26K while broader indices lagged even more sharply: Midcaps dropped 0.59% and Small caps slid 1.05%. Market breadth leaned heavily toward declines, and with India VIX rising 2.54%, you could sense that traders were suddenly a bit more cautious.

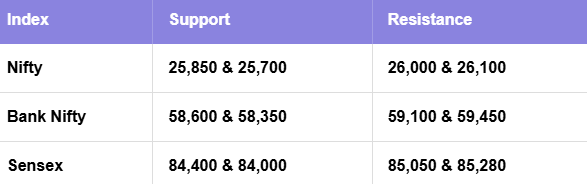

The day’s price action felt fairly straightforward: Nifty broke below 26,000 early, tried to crawl back, but the level refused to budge, acting as a resistance throughout the session. The index printed a low of 25,877 and stayed near those levels till the close, pulling the spotlight back on 25,850, a crucial support that now becomes the line to watch.

Bank Nifty wasn’t spared either; after spending most of the day in a tight range, it slipped late in the session, holding just above its breakout retest zone at 58,615. Meanwhile, Sensex still can’t get past the psychological 85,000 mark, making it the next hurdle for bulls to reclaim.

Sector heatmap turned red!

Every sector turned red, and the pressure was broad-based. Realty was hit the hardest with a 1.91% drop, followed closely by IT and Metals as Global cues and profit-taking weighed on sentiment. Autos, Energy, FMCG, and Pharma also drifted lower.

The stock-specific storylines were just as dramatic. Kaynes Technology slumped 5.58% as its shareholder lock-in expired, and Paytm continued to see volatility with a 2.81% slide after over 2% equity changed hands via Block deals. Mphasis also dipped 1.12% following a significant promoter stake sale.

Groww surged another 8.04% and is now close to doubling from its IPO price, while PhysicsWallah delivered a powerful debut closing 42.42% higher.

What lies ahead?

With Nifty50 repeatedly failing to hold above 26,000, this level has quickly shaped into a short-term supply zone that bulls will need to decisively conquer for the next leg higher. For now, 25,850 remains the key support where dip buyers might try their luck again. Bank Nifty’s structure still looks constructive as long as it defends 58,615, though the twin hurdles at 59,100 and 59,450 could slow down its upward momentum.

NIFTY50: Top Gainers

Bharti Airtel ▲ +1.75%

Axis Bank ▲ +1.26%

Asian Paints ▲ +0.63%

NIFTY50: Top Losers

IndiGo ▼ -2.27%

Tech Mahindra ▼ -2.12%

Tata Consumer ▼ -2.10%

Key levels to watch for November 19, 2025

OI Insights

Call writers are firmly crowding the 26,000CE (49.02L), making it clear that this level is being defended as a strong resistance zone. On the other hand, put writing remains muted, except for some activity at 25,700PE (14.56L), hinting that this area is slowly emerging as a short-term support. The PCR-OI stands at 0.9.

What does this mean? The setup suggests the index may struggle to move past 26,000 in the near term unless fresh long positions come in. Meanwhile, dips toward 25,700 could attract buyers.

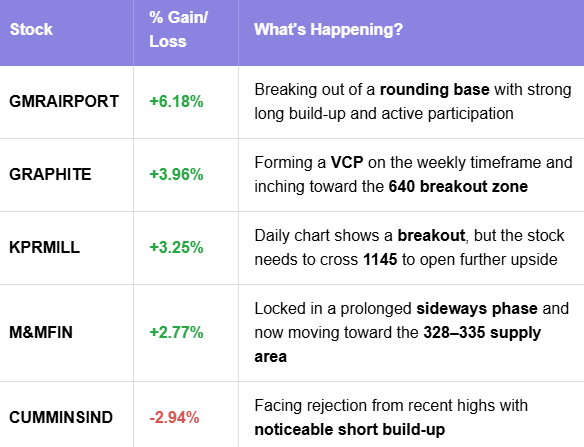

Today’s buzzing stocks at a glance

News you can use

Bombay Burmah terminates agreement with MSTC Ltd.

BLS International wins global contract from the Slovak Republic to operate visa centres in over 80 countries.

Solar Industries bags export orders worth ₹1,400 crore for defence product supplies over four years.

PhysicsWallah lists at ₹145 per share against the issue price of ₹109 on NSE.

Mphasis block deal: 1.8 crore shares: 9.5% equity change hands on BSE.

Paytm block deal: 1.32 crore shares: 2.07% equity worth ₹1,722 crore trade at ₹1,307 per share.

Chart of the day: IIFL

Spotted: Inverse H&S

Structure: An Inverse H&S forms after a downtrend, marked by 3 swing lows, a deeper central low (the head) between 2 higher lows (the shoulders), all aligned by a horizontal neckline.

Validation: A breakout above the neckline on strong volume confirms bullish reversal and signals that downward pressure has likely exhausted.

Trading Insight: A powerful trend-reversal pattern indicating a shift from selling to buying strength; traders look to enter on the neckline breakout for potential upside continuation.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 19, 2025, with more sharp insights, fresh trends, and signals from the markets.