Market Minute | November 20, 2025

🚀Nifty50 scales to 26.2K, Bank Nifty at 59.4K: Is 60K coming? M&MFIN breaks out; INFY begins ₹18,000-crore Buyback & full wrap inside!

Nifty 26,192.15 ▲ +0.54%

Sensex 85,632.68 ▲ +0.52%

Bank Nifty 59,347.70 ▲ +0.22%

Bulls hold ground as Markets hover near Record Highs!

The Market opened with confidence today, and that tone stayed intact through the session. Nifty50 inched its way above 26,200 and Sensex followed a similar path, just a handful of points shy of its own lifetime high. Market breadth, though, told a softer story, with Broader indices like the Midcap 100 and Smallcap 100 ending flat.

Bank Nifty, meanwhile, continued its streak of record-breaking highs before cooling off a bit and ending with minor gains. The zone near 59,700 remains the key weekly support, and as long as it holds, the index still seems to be eyeing that psychological 60,000 mark. If Nifty continues to hold above the day’s low, the upward momentum looks set to extend into the next session.

Sector & Stock-specific Highlights!

Sectoral action had its own story to tell: Financial Services led the charge, supported by strong moves in Reliance and HDFC Bank, both of which were among the biggest contributors to Nifty’s gains. Defence and Auto stocks also had a distinctly positive day, while Media slipped 1.54%.

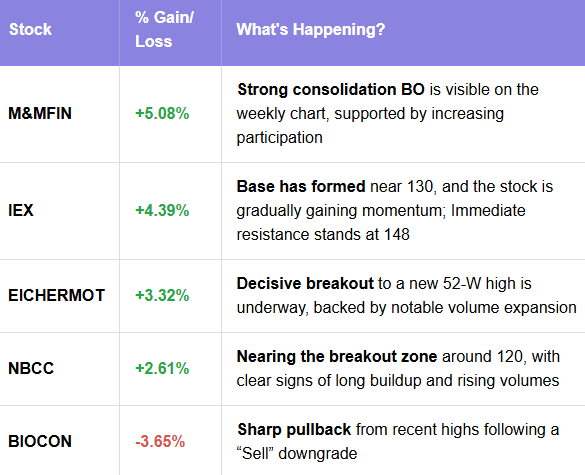

Across individual stocks, it was a lively mix of breakouts, rebounds, and sharp moves. Hero Moto hit a fresh 52-week high after a second upgrade in 2 days, while PhysicsWallah staged a 21.68% bounce from the lows.

On the flip side, Biocon extended its slump with a 3.65% drop after a double-downgrade from Citi, and Vodafone Idea saw profit-booking push it down 4.86%. Among Midcaps, IEX, Hitachi, and Glenmark Pharma showed strength.

What today’s close signals for tomorrow’s session?

What stood out through the day was how the indices respected their key levels. Nifty climbed to 26,246, just 30 points short of its all-time high. Sensex too pushed past important resistance zones at 85,280 and 85,500 before settling below its record peak of 85,978.

Heading into tomorrow, the focus will be on whether Nifty50 can make a clean move beyond its previous highs and whether Bank Nifty can keep its momentum intact despite minor intraday pullbacks.

As long as the major indices continue to defend their near-term supports, the market looks poised for another attempt at fresh lifetime highs, and possibly a broader participation if Midcaps stabilize.

NIFTY50: Top Gainers

Eicher Motors ▲ +3.32%

Bajaj Finance ▲ +2.29%

Bajaj Finserv ▲ +2.21%

NIFTY50: Top Losers

Asian Paints ▼ -1.17%

HCL Technologies ▼ -1.03%

Titan Company ▼ -0.78%

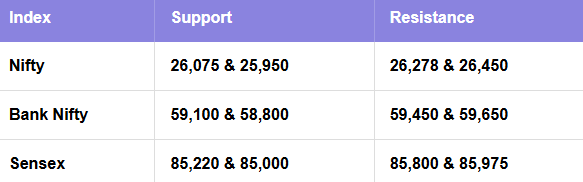

Key levels to watch for November 21, 2025

OI Insights

Put writers are still loading up heavily at 26,100 PE (58.06L) and 26,000 PE (30.89L), a strong hint that traders see this entire belt as solid support. On the other hand, call writing is fairly muted, with only mild additions at 26,500 CE (13L). The PCR-OI is at 1.5.

What does this mean? The market is showing confidence in holding above 26,000, and unless call writers step in aggressively, the bias remains tilted toward further upside.

Today’s Buzzing stocks at a glance

News you can use

Infosys begins ₹18,000-crore share buyback at ₹1,800 per share.

Max Financial in focus as IRDAI withdraws Supreme Court appeal on Shriram GI merger.

Transrail secures ₹548-crore orders and adds a new country in the MENA region.

Baroda BNP Paribas AMC launches GIFT US Small Cap Fund, India’s first direct route to US small caps under IFSCA.

Lloyds Engineering signs two contract agreements worth $1,63,900 and €3,10,000 with Kliver Polska.

Adani Enterprises rises after receiving LoI for Jaiprakash Associates following CoC approval.

Chart of the day: EICHERMOT

Spotted: Broadening wedge

Structure: A Broadening Wedge forms when price swings widen over time. This reflects increasing volatility and indecision between buyers and sellers.

Validation: A BO above the upper trendline typically signals bullish continuation.

Trading Insight: Highlights a market in conflict; Wide swings, rising volatility, and no clear control. Once a decisive BO occurs, it often leads to a strong move as price escapes the expanding structure.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 21, 2025, with more sharp insights, fresh trends, and signals from the markets.