Market Minute | October 06, 2025

🚀Nifty reclaims 25,000, What’s next? Financial & IT stocks lead; Max Healthcare surges 6.5% & more inside!

Nifty 25,077.65 ▲ +0.74%

Sensex 81,790.12 ▲ +0.72%

Bank Nifty 56,104.85 ▲ +0.93%

Nifty hits 25,000; Financials & IT lead the charge!

The markets extended their rally for a third straight session, with Nifty rising 183 points to close at 25,078 and Sensex jumping 583 points to 81,790. The lift was broad-based, driven by strong performance in Financials, IT, and a heavyweight boost from Reliance Industries.

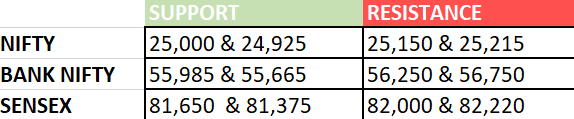

After a positive start, Nifty cleared its daily 20EMA at 24,915, reclaimed 25,000, and held above 25,020, setting up 25,150 as a plausible next stop. Supports now shift lower to 25,000 and 24,925. Meanwhile, Sensex eyes 81,650-82,000 on the upside, and Bank Nifty held up well: Up 516 points to 56,105, solidifying its strength.

Broader Markets mix it up, Breadth remains cautious!

On the surface the market looked bullish, but internals were mixed:The advance/decline picture showed more stocks lagging even as the headline indices rose. Midcaps were the better performers today: the Nifty Midcap 100 gained roughly 0.89% to close near 58,015, while the Nifty Smallcap 100 posted only a marginal uptick of 0.28%; That tells you the rally was led by a mix of index heavyweights and selective midcap buying, not a broad-based buying.

Sectorally, Nifty IT was the top mover gaining 2.28% and Banks/Financials also powered gains, a classic earnings-season lead-in where Large-Cap, high-quality names catch bids ahead of results. Meanwhile, Hospital names spiked after the government revised CGHS procedure rates. The takeaway: Headline strength plus selective internal rotation, good for trend followers, cautious for breadth-sensitive traders.

Stock-specific movers!

As markets gear up for the Q2 earnings season, stock-specific action is heating up. Financial heavyweights like Bajaj Finance and Kotak Bank lent solid support to today’s rally, reflecting early optimism from their quarterly business updates. In contrast, consumer-facing names told a mixed story: Avenue Supermarts (DMart) slipped after a weaker-than-expected sales update dampened festive sentiment.

On the event front, Vodafone Idea came under pressure, falling 3.97% after the Supreme Court deferred the AGR case hearing to October 13, a headline that keeps regulatory risk alive for the telecom pack. Meanwhile, festive and policy-driven momentum played out in select pockets: Nykaa and Delhivery surged 6.48% and 5.79%, respectively on healthy operational updates ahead of the festive rush, while hospital stocks like Max Healthcare and Fortis rallied sharply after the government revised CGHS package rates.

Put simply, while the indices are holding their bullish tone, the real story now lies beneath the surface, in the stock-specific catalysts and headlines that could quickly redraw the market’s map in the days ahead.

Key levels to watch (October 07, 2025)

OI Insights

As Nifty50 reclaimed and closed above the 25,000 mark, the derivatives setup lent strong confirmation to the move. On the put side, heavy writing at the 25,000PE (1.53 Crore) signaled that traders are confidently positioning this level as a solid support zone. Meanwhile, call writers remained relatively cautious, with open interest additions of 47.9L at the 25,150CE and 55.9L at the 25,200CE, hinting at a near-term resistance band between 25,150 and 25,200.

Takeaway:

The data reflects a market tilted in favor of the bulls, with traders defending 25,000 as a base. However, a sustained move above 25,200 will be key to confirming follow-through momentum in the upcoming session.

News you can use

HSBC/S&P Global September composite PMI eases to 61 from 63.2 in August.

Supreme Court defers Vodafone Idea AGR case hearing to October 13.

Bharti Airtel secures multi-year contract from Indian Railway Security Operations Centre (IRSOC).

Tata Capital IPO subscribed 0.28x on Day 1; QIBs 0.32x, NIIs 0.20x, retail 0.28x, employee 0.90x.

WeWork IPO subscribed 0.12x on Day 2; retail leads with 0.33x while QIBs at 0.09x.

JLR September auto sales dropped 40% YoY to 6,419 units versus 10,807 units last year.

Jammu & Kashmir Bank’s total business rose 9.89% YoY to ₹2.57 lakh crore in Q2 FY25-26 (provisional).

KEC International wins new orders worth ₹1,102 crore.

Chart of the day: SBICARD

Spotted: Flag & pole pattern

Structure: Begins with a sharp, almost vertical price move: the pole, followed by a brief, downward or sideways consolidation that forms the flag.

Validation: A breakout from the flag in the direction of the prior move, ideally supported by strong volumes, confirms the pattern.

Trading insight: Typically viewed as a continuation pattern, the flag & pole suggests that after the short consolidation, the market is preparing for another strong leg in the direction of the initial move.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 07, 2025, with more sharp insights, fresh trends, and signals from the markets.