Market Minute | October 13, 2025

🚀Nifty recovers from 25,150, Inflation at 1.54%; CAMS 1:5 stock split & full wrap inside!

Nifty 25,227.35 ▼ -0.23%

Sensex 82,327.05 ▼-0.21%

Bank Nifty 56,625.00 ▲ +0.03%

Markets hold ground after early volatility!

The Markets began the week on a cautious note, weighed down initially by IT stocks and weak cues from Asia after the U.S. issued fresh Tariff threats against China. However, as global sentiment improved, Indian equities staged a commendable recovery from early losses. The Nifty50 slipped 58 points to close at 25,227, while the Sensex ended 174 points lower at 82,327 after a volatile session. Notably, the Nifty Bank index showed resilience, rebounding smartly from its intraday lows to end 15 points higher at 56,625.

The Mid and Smallcap segments continued to see selective buying: with the Nifty Midcap100 closing 0.11% higher and the Smallcap100 easing 0.17%. Market breadth, however, leaned slightly towards declines, with the advance-decline ratio at 1:2, suggesting profit booking in certain pockets after last week’s sharp upmove. Meanwhile, volatility inched up as the India VIX surged 8.91%, indicating a touch of nervousness ahead of the upcoming earnings-heavy week.

Sectoral Pulse: Mixed bag with Defensive drag!

It was a mixed day across sectors, reflecting a tug-of-war between profit booking and rotational buying. On the upside, Nifty PSU Banks led the charge with a 0.24% gain, supported by optimism around governance reforms and improving credit metrics. Financial services and power stocks also stayed in the green, with Torrent Power rising 3.57% after the Power Ministry floated a new draft electricity bill.

However, defensives like FMCG (-0.9%), IT (-0.78%), and Metals (-0.43%) weighed on the indices. Pharma, Realty, and Auto ended largely flat, though select Auto names like Bajaj Auto bucked the trend, benefiting from healthy registration data.

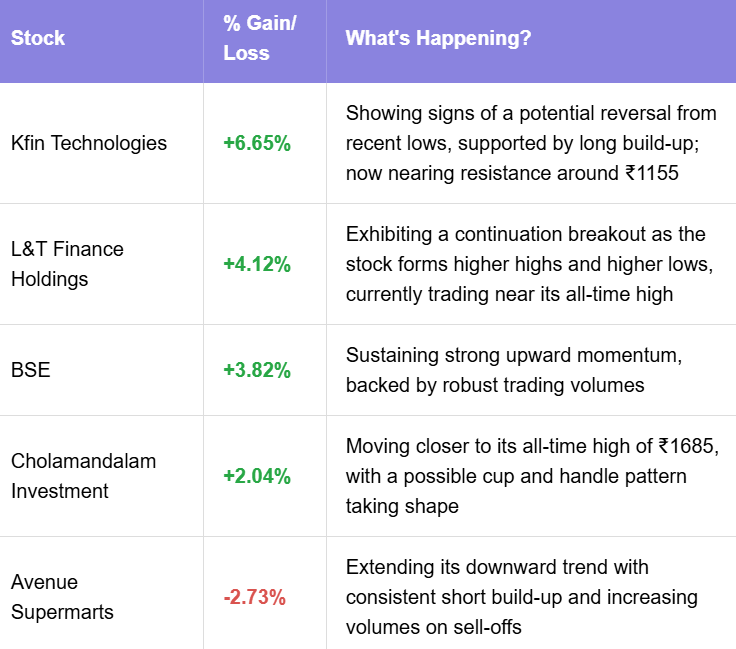

Stock Watch: Exchanges, Insurance, and Midcaps shine!

On the stock-specific front, Adani Ports continued to dominate the leaderboard as the top Nifty gainer, supported by steady buying interest. The exchange stocks were on fire: BSE and MCX rallied around 3.82% and 2.87%, respectively, extending their recent momentum. Insurance stocks too rebounded, led by Max Financial, while HDFC AMC climbed 2.70% ahead of its board meeting to consider a potential bonus issue.

In the Midcap space, KFin Technologies stole the show with a 6.65% surge after a positive brokerage report, followed by strength in Fortis Healthcare, taking its October gains to nearly 12.93%. On the flip side, Vodafone Idea slipped 3.32% after the Supreme Court deferred its AGR hearing, and Avenue Supermarts declined 2.73% post a muted Q2 performance.

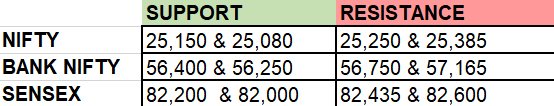

Key levels to watch for October 14, 2025

OI Insights

Let’s also look at the Open Interest insights

After a weak start, Nifty managed to stabilize around the 25,150 zone and traded within a ~100-point band for most of the session, eventually closing near the day’s high, a sign of buying support at lower levels. Derivatives data reflected this cautious optimism, with put writing at 25,200PE (39.66L) suggesting traders are defending that level. On the flip side, significant call additions at 25,250CE (85.38L), 25,300CE (83.54L), and 25,400CE (42.84L) highlight resistance zones overhead.

Takeaway:

The market remains range-bound, with 25,080 acting as a crucial support to maintain the bullish bias. A decisive breakout on either side of this range could set the tone for the next directional move.

Today’s Buzzing stocks at a glance

News you can use

India’s retail inflation eases to 1.54% in September 2025, down from 2.07% in August.

Hero MotoCorp enters Italy through a distribution partnership with Pelpi International; launches Euro 5+ models.

Supreme Court rejects Asian Paints’ plea against CCI probe following Grasim Industries’ complaint.

Tata Capital’s debuts 1.23% above issue price; closes 1.38% higher.

Canara Robeco AMC IPO fully subscribed on Day 3.

Supreme Court defers Vodafone Idea AGR case hearing to after Diwali.

L&T secures grid infrastructure order worth ₹2,500–5,000 crore in West Asia.

CAMS: Board approves 1:5 stock split.

Chart of the day: SBIN

Spotted: Pennant

Structure: Forms after a sharp, nearly vertical move, followed by a brief consolidation phase resembling a small symmetrical triangle. This consolidation represents a pause before the prevailing trend resumes.

Validation: A breakout in the direction of the prior trend, ideally supported by higher volumes confirms the continuation pattern.

Trading Insight: The pennant indicates a temporary equilibrium between buyers and sellers before the dominant side regains control, often leading to a strong follow-through move.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 14, 2025, with more sharp insights, fresh trends, and signals from the markets.