Market Minute | October 15, 2025

🚀Nifty breaks 25,300: At 1-month high- What’s next? HDFC AMC’s 1:1 Bonus issue, ICICIGI surges 8.92% & full wrap inside!

Nifty 25,323.55 ▲ +0.71%

Sensex 82,605.43 ▲ +0.70%

Bank Nifty 56,799.90 ▲ +0.54%

Bulls take charge: Nifty ends at a 1-month high!

The Markets extended their winning streak on Wednesday, with the Nifty 50 closing at its highest level in a month, a sign that bulls are gradually regaining firm control. After opening with a strong gap-up, the index barely looked back, steadily climbing past the 25,250 mark and decisively crossing 25,300 to end at 25,324, up 178 points. 38 Nifty constituents ended in the green.

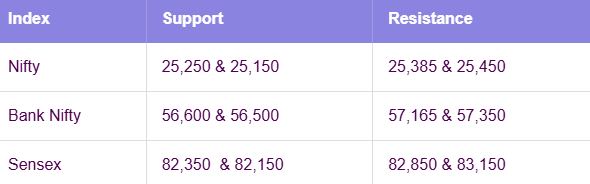

This rally wasn’t just about momentum; it was about breadth. Buying was broad-based across sectors, reflecting renewed risk appetite and confidence in the market’s near-term outlook. From Financials to FMCG and Realty, most indices participated in the up-move. For the week so far, the Nifty has shown remarkable resilience, comfortably holding above key support levels and now eyeing resistance zones at 25,385 and 25,500, which could define the next leg of the rally.

The Nifty Midcap 100 and Smallcap 100 mirrored the frontline action, rising 1.11% and 0.82% respectively, while the India VIX cooled off by 5.65%, reflecting fading volatility.

Banking on strength: Bank Nifty holds key levels!

The Bank Nifty joined the uptrend, rising 303 points to close at 56,800, finally managing to sustain above its crucial 56,750 resistance zone. This breakout holds technical importance, maintaining this level could pave the way for a test of the 57,000 mark, which would reaffirm the ongoing momentum in the banking space.

Among sectoral movers, NBFCs stole the spotlight, with Bajaj Finance and Cholamandalam Investment 4% and 3.20%, respectively after strong buying interest. PSU banks also added to the optimism, climbing nearly 1.67% on reports of consolidation among state-run lenders. Meanwhile, Insurance stocks traded mixed: ICICI Prudential slipped post-results, while HDFC Life edged higher ahead of its own earnings announcement.

Sensex scales higher as Broader Markets join the rally!

Over on Dalal Street, the Sensex gained 575 points to close at 82,605, sitting right at its immediate resistance of 82,615. The next hurdle lies at 82,800, if crossed, could signal another leg higher for the benchmark index. The tone across the market was distinctly positive, with the NSE’s advance-decline ratio at 2:1, underscoring a strong breadth of participation.

On the other hand, Auto stocks like Maruti and Bajaj Auto couldn’t hold early gains, while Infosys slipped ahead of results. Still, Tech Mahindra, Persistent Systems, and ICICI Lombard delivered sharp post-result rebounds. Elsewhere, Vodafone Idea recovered 4.67%, Paytm gained 2.61%, and Urban Company surged 8.99% ahead of its shareholder lock-in expiry. HDFC AMC continued to shine on strong earnings and its 1:1 bonus issue. Altogether, the mood remained constructive.

Key levels to watch for October 16, 2025

OI Insights

As Nifty gained momentum right from the opening bell, the derivatives setup echoed the bullish sentiment. Put writers were highly active at key levels: 25,300PE saw additions of 85.71L contracts, followed by 62.01L at 25,200PE, signaling strong support zones forming beneath the current price. In contrast, call writers remained relatively cautious, with modest additions of 15.65L at 25,400CE and 19.34L at 25,500CE, suggesting an open territory.

Takeaway:

The derivatives data indicates a bullish undertone, with put writers confidently defending lower levels while call writers stay restrained, hinting that the bias remains upward unless fresh call writing emerges at higher strikes.

Today’s buzzing stocks at a glance

News you can use

Adani Green operationalises a 50 MW solar power project at Khavda, Gujarat; total renewable capacity reaches 16,730 MW.

HEG receives ₹1,230 crore loan sanction from SBI for graphite anode production unit at Dewas, Madhya Pradesh.

Waaree Renewable Energy secures order for 150 MWac (217.5 MWp) solar power project.

Welspun Enterprises board approves issuance of convertible warrants worth ₹1,000 crore at ₹525 per warrant.

China files a WTO complaint against India over EV and battery subsidy policies.

Q2 updates

HDFC AMC Q2: Net profit jumps 25% YoY to ₹718 crore; board approves 1:1 bonus issue.

Axis Bank Q2: Net profit drops 26% YoY to ₹5,090 crore; NII rises marginally by 2%.

HDFC Life Q2: Net profit rises 3% to ₹447 crore; net premium income up 13% YoY.

IRFC Q2: Net profit up 10.2% to ₹1,777 crore; revenue down 7.6% YoY to ₹6,372 crore; NIM improves to 1.55%.

Tata Communications Q2: Net profit declines 3.7% QoQ to ₹183 crore; revenue up 2.3% to ₹6,100 crore.

HDB Financial Services Q2: Net profit slips nearly 2% YoY to ₹581 crore; announces ₹2 dividend.

Chart of the day: SBIN

Spotted: Rectangle pattern

Structure: Forms during a period of consolidation where price moves between parallel support and resistance levels, creating a rectangular range.

Validation: A breakout above resistance or breakdown below support, backed by volume, confirms the next directional move.

Trading Insight: The rectangle pattern reflects market indecision; traders watch for a breakout to signal trend continuation or reversal.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 16, 2025, with more sharp insights, fresh trends, and signals from the markets.