Market Minute | October 17, 2025

🚀Nifty touches 1-year high, Bank Nifty hits record peak; FMCG stocks lead the charge & full weekly wrap inside!

Nifty 25,709.85 ▲ +0.49%

Sensex 83,952.19 ▲ +0.58%

Bank Nifty 57,713.35 ▲ +0.51%

Bulls back in control: Nifty reclaims 1-year high, Sensex nears 84,000!

The Markets wrapped up the week on a strong note, as the Nifty50 surged past the 25,700 mark, its highest level in a year. After a soft start in the red, the index gathered steam through the day, climbing over 124 points to close near 25,710. The Sensex, too, mirrored the upbeat sentiment, rising nearly 485 points to settle just shy of the 84,000 mark, which it briefly crossed for the first time in 4 months during intraday trade.

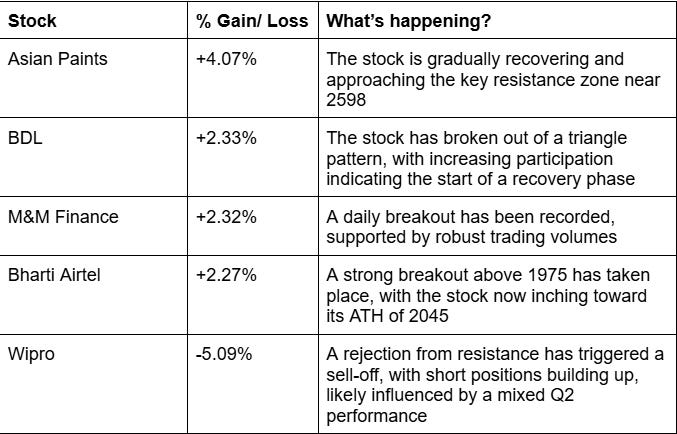

The buying interest was broad-based across blue-chip counters, but FMCG stocks led the rally, with names like Asian Paints, HUL, ITC, and Nestlé topping the gainers list. M&M continued its upward momentum, ending 2.43% higher, while Max Healthcare gained 2.33% after an upgrade from UBS. On the other hand, IT heavyweights like Wipro and Infosys came under pressure, reacting negatively to their Q2 results with declines of 5.09% and 2.07% respectively.

Broader markets, however, told a different story. The Nifty Midcap 100 slipped 0.57%, while the Smallcap 100 remained largely flat, hinting at selective participation.

Banking takes the lead: Nifty Bank hits record high!

If there was one sector that truly powered the market today, it was Banking. The Nifty Bank index soared to a fresh record high, crossing 57,800 intraday. Both HDFC Bank and ICICI Bank contributed to the strength. Reliance Industries, too, lent crucial support, ending higher and holding above the ₹1,400 mark ahead of its much-anticipated results later in the day.

However, the market breadth tilted slightly in favour of declines, with an advance-decline ratio of 1:2, suggesting that gains were largely concentrated in large-cap names.

The week that was: Bulls rule for the 3rd straight week!

This marks the 3rd consecutive week of gains for the Markets, with both the Sensex and Nifty rising 1.68% and 1.76%, respectively, the biggest weekly gain in 4 months.

Among the sectoral performers, FMCG and Realty emerged as the top gainers, thanks to strong consumption trends and healthy earnings updates. Pharma and Auto indices also posted modest gains, up 0.68% and 0.66% respectively. On the losing side, IT stocks dragged sentiment, with the Nifty IT index falling 1.63%, followed by Media (-1.56%) and Metals (-0.85%).

NIFTY50: Top Gainers

Asian Paints ▲ +4.07%

Mahindra & Mahindra ▲ +2.43%

Max Healthcare ▲ +2.33%

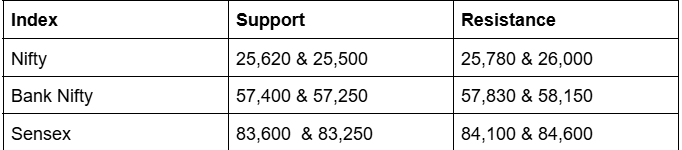

Key levels to watch for October 20, 2025

OI Insights

As Nifty gained momentum from the opening bell and touched a 1-year high, the derivatives data highlighted the market’s undertone. Put writers were active at key zones, with 25,700PE seeing additions of 65.66L and 25,500PE adding 25.79L. On the call side, writing picked up at 25,800CE and 26,000CE with additions of 38.75L and 55.65L respectively.

Takeaway: With Nifty approaching its all-time high, immediate resistance lies at 25,800 and 26,000. On the downside, key supports remain strong, suggesting that the current bullish momentum is likely to sustain in the near term.

Today’s Buzzing stocks at a glance

News you can use

M&M: Mahindra Group and Embraer forge a strategic alliance to introduce the C-390 Millennium aircraft to India.

KPI Green: Secures an order worth ₹696.5 crore from SJVN for a 200 MW solar power project in Khavda, Gujarat.

ACME Solar signs PPA with Tata Power-D for 50 MW FDRE project.

Q2 updates

UCO Bank: Q2 net profit up 2.8% at ₹620 crore vs ₹603 crore YoY.

PVR Inox: Posts net profit of ₹106 crore vs loss of ₹11.8 crore YoY. Revenue up 12.4% to ₹1,823 crore; EBITDA rises 27.7% to ₹611.7 crore.

Polycab India: Net profit jumps 55.7% to ₹693 crore vs ₹445 crore YoY. Revenue nearly flat at ₹6,477 crore; EBITDA surges 61.5% to ₹1,020.7 crore.

JSW Steel Q2 results: Net profit surges 270% YoY to ₹1,623 crore.

Hindustan Zinc Q2 results: PAT rises 14% YoY to ₹2,649 crore.

Chart of the day: NIFTY50

Spotted: Symmetrical Triangle

Structure: A consolidation pattern marked by converging trendlines forming a symmetrical triangle. It reflects indecision and contracting volatility as buyers and sellers battle for control.

Validation: A breakout beyond either the upper or lower trendline, supported by strong volume, confirms the next directional move.

Trading Insight: The symmetrical triangle signals pause before continuation. Traders usually wait for a clear BO with volume confirmation to avoid false signals within the pattern.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 20, 2025, with more sharp insights, fresh trends, and signals from the markets. Until then, have a great weekend!