Market Minute | October 23, 2025

🚨Nifty slips after a strong start: Pullback ahead? IT leads the charge, Laurus Labs Q2 profit surges 875% & full wrap inside!

Nifty 25,891.40 ▲ +0.09%

Sensex 84,556.40 ▲ +0.15%

Bank Nifty 58,078.05 ▲ +0.12%

Market Recap: From a strong start to a flat finish!

It was a day of two halves for the Markets. Nifty50 opened sharply higher and touched the 26,100 mark, while Sensex scaled above 85,200. But what started as a strong rally gave out by the end of the day, a reminder that rallies too need breathers.

By the closing bell, Nifty50 managed to hold onto a marginal gain of 23 points, while Sensex added 130 points. The Nifty Bank index, after a choppy ride, edged up 71 points. However, beneath the surface, volatility was visible, the Nifty slipped more than 200 points from the day’s high, signaling that traders preferred caution at elevated levels.

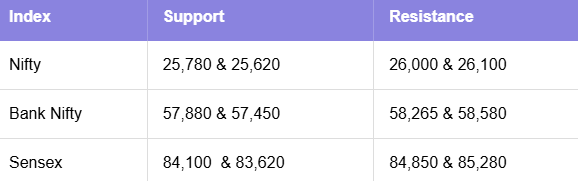

Technically, this looks like a healthy pullback. Nifty has now closed near its 20EMA on the hourly chart, with immediate support seen at 25,620. For Bank Nifty, support lies around 57,500, while the Sensex finds its cushion near 83,620. Holding these levels will be key for bulls.

Sectoral Snapshot: IT steals the show, Heavyweights weigh!

While frontline indices struggled to hold early gains, IT stocks came to the rescue. The Nifty IT index surged 2.21%, making it the day’s top-performing sector, tracking strength in global IT names and easing US bond yields.

But the cheer was partially offset by weakness in index heavyweights, particularly Reliance Industries, which slipped ~2.5% from intraday highs following reports of potential curbs on Russian oil imports. The decline in RIL, given its hefty index weight, capped broader market gains.

Among other movers, FMCG, Private Banks, and PSU Banks lent mild support, while sectors like Energy, Auto, Realty, and Pharma remained largely flat. Crude-sensitive stocks, including HPCL and IndiGo, fell as oil prices stayed volatile.

In the broader market, the mood was subdued, Nifty Midcap ended slightly lower by 38 points, and Smallcap indices too slipped marginally. The India VIX inched up 3.81%, reflecting a touch of nervousness ahead of key global and domestic cues.

Market Pulse: Stock highlights & more!

The day wasn’t short of stock-specific stories that captured attention. Vodafone Idea surged 5.78% ahead of the Supreme Court’s upcoming hearing on the AGR case, while Bharat Forge gained 4.56% after securing a carbine supply order from the Indian Army, a development that strengthened its defence credentials. IEX advanced 3.87% in anticipation of its October 30 market coupling hearing, while Laurus Labs posted a steady 1.14% rise following a Q2 earnings beat. The positive momentum extended to Info Edge, which rode the IT wave among midcap gainers.

On the flip side, Eternal Ltd. continued to slide, ending as the top Nifty loser with a 2.88% decline. Gold financiers such as Muthoot Finance also came under pressure as gold prices softened over the last 3 days. Interestingly, Textile stocks witnessed brisk buying, on reports of favorable trade negotiations that could lift export prospects.

As the day drew to a close, the Market Breadth turned slightly negative, with a 2:3 advance-decline ratio, suggesting traders are becoming selective after the recent rally. Yet, this consolidation appears healthy, the market seems to be digesting its sharp up-move rather than signaling exhaustion.

NIFTY50: Top Gainers

Infosys ▲ +3.81%

HCL Technologies ▲ +2.55%

TCS ▲ +2.21%

NIFTY50: Top Losers

Eternal ▼ -2.88%

IndiGo ▼ -2.10%

Eicher Motors ▼ -1.91%

Key levels to watch for October 24, 2025

OI insights

Nifty50 opened with a strong gap-up, reclaiming the 26,000 mark and holding firm for most of the session before witnessing a sharp sell-off in the final hour. On the derivatives front, there was mild put writing at 25,800PE with additions of 17.04L, indicating some support near that zone. Meanwhile, call writers were active at 26,100CE and 26,200CE, adding 52.79L and 54.89L, respectively, signalling resistance overhead.

Takeaway:

The late-session reversal highlights that bulls might be running out of steam near the strong wall of resistance. However, the consistent put writing at 25,800 suggests that buyers are still defending lower levels. In short, the battle line for the next move is drawn between 25,800 and 26,200, whichever side breaks first is likely to dictate Nifty’s next leg of direction.

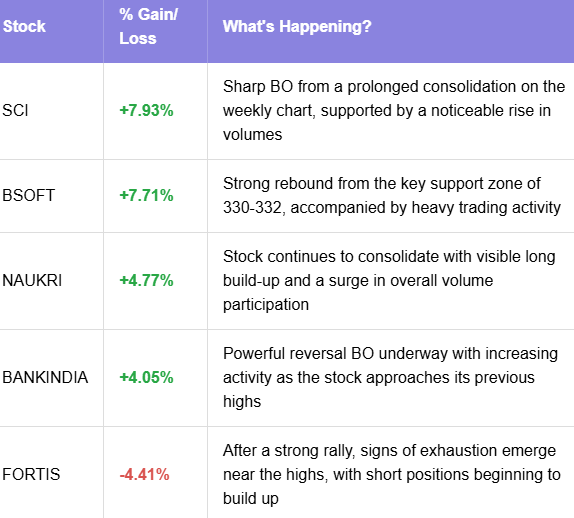

Today’s buzzing stocks at a glance

News you can use

Bharat Forge arm secures ₹4.25 lakh CQB carbine order from Indian Army.

Kalpataru Projects bags ₹2,332 crore order across key segments.

Bondada Engineering secures ₹1,050 crore order from Adani Group.

Intellect Design bags strategic deals from East African bank NCBA.

Laurus Labs Q2FY26 net profit soars 875% YoY to ₹195 crore; revenue up 35%.

HUL Q2FY26 net profit at ₹2,690 crore; revenue marginally up 0.5%.

Vardhman Textiles Q2FY26 net profit down 5% YoY to ₹187 crore.

Chart of the day: SCI

Spotted: Pennant pattern

Structure: A continuation pattern formed after a sharp, nearly vertical price move, followed by a brief, converging consolidation. It represents a pause before the prior trend resumes.

Validation: A BO from the pennant’s boundary in the direction of the preceding trend, ideally supported by a rise in volume.

Trading Insight: The Pennant pattern indicates a short consolidation after a strong directional move. Traders typically wait for a decisive BO with volume confirmation to enter trades.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 24, 2025, with more sharp insights, fresh trends, and signals from the markets.