Market Minute | October 24, 2025

🚨Nifty slips below 25.8K as Banks drag the Market, Metals just hit ATH; ITC Hotel’s profit surged 74% & full wrap inside!

Nifty 25,795.15 ▼ -0.37%

Sensex 84,211.88 ▼ -0.41%

Bank Nifty 57,699.60 ▼ -0.65%

Markets lose steam after a muted start!

After opening on a steady note, Markets struggled to hold early gains on Friday as weakness in Banking and Consumer names weighed on sentiment. The Nifty50 touched a high of 25,945 before slipping nearly 250 points intraday to test the 25,700 zone, finally closing at 25,795, down 96 points. The Sensex followed suit, shedding 345 points to settle at 84,212, while Bank Nifty underperformed with a 379-point dip to 57,700. The tone of the day was cautious, with traders reacting to uncertainty around the India–US trade deal and profit booking across Frontline names.

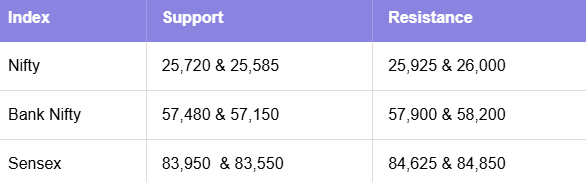

Technically, for Nifty, the 25,700-25,585 band now serves as crucial support, and a breach below it could open the door for a deeper pullback. Meanwhile, Bank Nifty and Sensex also remain anchored near their respective supports at 57,400-57,150 and 83,950-83,550.

4th straight weekly gain, but momentum cools!

Despite the weak close, the week marked a milestone, both Nifty and Sensex clocked their 4th consecutive weekly gain, the first such streak of 2025. However, the upside momentum clearly slowed, with Nifty adding just 0.33% for the week. In the session, Nifty Midcap 100 slipped 0.25%, while the Smallcap 100 edged down 0.21%, reflecting consolidation.

This week, among Nifty’s 50 constituents, the breadth remained evenly split, 25 advancing and 25 declining, indicating a balanced yet fatigued Market setup. Hindalco, Shriram Finance, Infosys, and Bajaj Finserv topped the gainer’s list, while UltraTech Cement, ICICI Bank, Adani Ports, and Eternal led the losers.

Today, Aluminium stocks surged on rising global prices, lifting Hindalco to the top spot, whereas FMCG giant HUL fell 3.27% as brokerages stayed cautious post muted results.

Sectoral snapshot: Metals shine, Banks under pressure!

Sectorally, the session belonged to Nifty Metals, which scaled to a fresh ATH before paring gains to still end up 1.03%. Defence and Oil & Gas stocks also added to the green, while Private Banks, PSUs, FMCG, Financials, Pharma, and Auto bore the brunt of the selling.

With the markets consolidating near record highs, the coming week will likely be all about whether Nifty can defend its key support zones and carry forward this 4-week winning streak into uncharted territory.

NIFTY50: Top Gainers

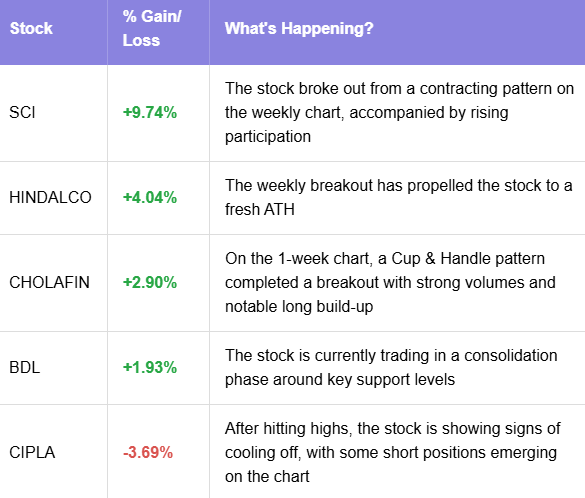

Hindalco ▲ +4.04%

Bharti Airtel ▲ +1.07%

ONGC ▲ +1.05%

NIFTY50: Top Losers

Cipla ▼ -3.69%

HUL ▼ -3.27%

Max Healthcare ▼-2.22%

Key levels to watch for October 27, 2025

OI Insights

Nifty50 opened on a flat note and gradually drifted lower after hitting an early high near 25,945. Such mild pullbacks are common and healthy after an extended rally, as long as the index respects its key support zones.

On the derivatives front, fresh put writing at 25,700PE (33.06L added) suggests traders are defending that level as short-term support. Meanwhile, heavy call writing at 25,900CE (73.29L added) and 26,000CE (76.16L added) indicates visible resistance overhead.

Takeaway:

The setup points to a range-bound tone for now, with 25,700 acting as support and 26,000 as the ceiling. A decisive break on either side will likely set the next directional move for the index.

Today’s buzzing stocks at a glance

News you can use

Bajaj Auto gets approval from the Austrian Takeover Commission for its bid to acquire PIERER Mobility AG.

Refex Industries secures an order worth ₹300 crore from a mining entity in Jharkhand.

Thyrocare promoter sells a 10% stake via market trades at ₹1,252.03 per share.

Crompton Greaves bags an order worth ₹445 crore from the Andhra Pradesh government.

Larsen & Toubro (L&T) wins orders in the range of ₹2,500-₹5,000 crore for its Minerals & Metals business from Hindalco and Tata Steel.

Midwest Ltd lists at ₹1,165 per share, compared to its issue price of ₹1,065.

ITC Hotels Q2 net profit surges 74% YoY to ₹133 crore; revenue up 7%.

NACL Industries Q2 net profit declines 82.7% YoY to ₹3 crore from ₹15 crore; revenue rises 4% to ₹457 crore from ₹440.3 crore.

Chart of the day: CHOLAFIN

Spotted: Cup & handle pattern

Structure: The “cup” represents a rounded consolidation phase, showing gradual profit-taking and accumulation, while the “handle” forms as a short pullback before the next leg up.

Validation: A BO above the handle’s resistance confirms the pattern, ideally accompanied by an increase in trading volume.

Trading Insight: Suggests a gradual shift from profit-taking to renewed buying interest and continuation of the prior uptrend after a healthy consolidation.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 27, 2025, with more sharp insights, fresh trends, and signals from the markets. Until then, have a great weekend!