Market Minute | October 27, 2025

🚀Nifty conquers 26K, BNF forms Inverse H&S, PSU Banks soar; RIL’s $100Mn Meta JV grabs attention & more inside!

Nifty 25,966.05 ▲ +0.66%

Sensex 84,778.84 ▲ +0.67%

Bank Nifty 58,114.25 ▲ +0.72%

Bulls re-gain control as Nifty edges closer to 26K!

After a volatile end to last week, the Markets made a strong comeback on Monday with the Nifty reclaiming lost ground and rising nearly 170 points to close just shy of the 26,000 mark. The Sensex too followed suit, adding over 560 points to settle near 84,800. From the opening bell, the Nifty50 carried bullish momentum, breaking above 25,935 and testing the 26K level intraday, before consolidating near the highs.

Technically, the index looks well-poised, with trailing supports intact at the hourly 20EMA and 50EMA. The near-term outlook remains constructive as the index continues to show resilience after a bout of exhaustion seen last week. This rebound was largely fuelled by strong earnings reactions across frontline stocks, breathing fresh optimism into the broader market sentiment.

Banking index Re-bounds: Inverse H&S takes shape!

The Bank Nifty finally caught a bid after a few subdued sessions, gaining 415 points to close at 58,114. The index not only moved back above key averages but also confirmed the formation of an Inverse Head & Shoulders pattern on the hourly chart, with the neckline placed near 58,200. A breakout above this level could pave the way for the index to retest recent highs in the coming sessions.

SBI emerged as one of the top performers within the pack, rising 2.02%, helped by reports suggesting a possible increase in the FDI limit for PSU banks. Federal Bank also gained 2.92% after brokerages raised their target price. However, Kotak Bank stood out as a laggard, slipping 1.76% after reporting in-line Q2 results.

Sectoral Pulse

Across the broader market, the tone remained upbeat with the Nifty Midcap 100 advancing 0.93% and the Nifty Smallcap 100 gaining 0.82%. The rally was well-distributed, though PSU banks led from the front, surging 2.22% on the back of renewed FDI optimism. Realty and Metal stocks also participated in the up-move, while FMCG and Auto lent support.

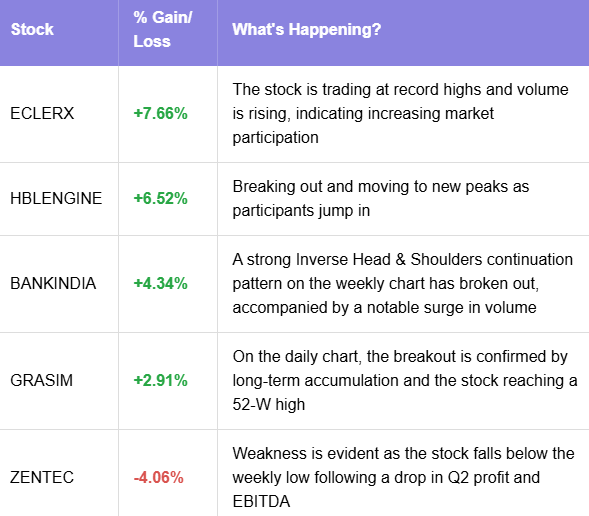

Among the star performers, SBI Life rallied 3.44% post a strong Q2 showing, Grasim gained 2.91%, while Reliance advanced 2.24% after announcing a JV with Meta for AI products. On the Midcap front, Coforge surged over 4.01% after beating earnings estimates, while Vodafone Idea soared 3.75% following a favourable Supreme Court verdict in the AGR case. Meanwhile, HUL and SBI Cards witnessed mild profit booking, ending the day lower.

The only weak spots were Pharma and Media stocks, which lagged behind amid sector-specific pressures.

NIFTY50: Top Gainers

SBI Life ▲ +3.44%

Grasim Industries ▲ +2.91%

Bharti Airtel ▲ +2.50%

NIFTY50: Top Losers

Kotak Mahindra Bank ▼ -1.76%

BEL ▼ -1.63%

Infosys ▼ -1.37%

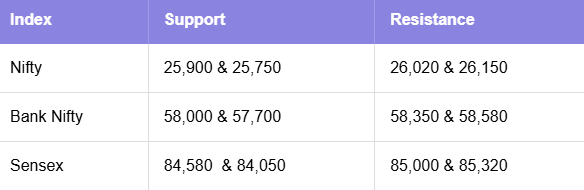

Key levels to watch for October 28, 2025

OI insights

Nifty50 started the session on a positive note and extended gains during the early hours, before moving into a consolidation phase towards the close. In the derivatives segment, notable put writing was seen at 25,900PE (1.14 Crore) and 25,800PE (50.95 L), indicating that traders are actively defending these zones as immediate support levels. On the other hand, call unwinding at 26,000CE (43.89 L) with no fresh additions suggests limited bearish positioning at higher levels.

Takeaway:

Strong base building seen around 25,800-25,900; resistance lightens near 26,000, bias remains positive as long as these supports hold.

Today’s buzzing stocks at a glance

News you can use

LTIMindtree secures $100 million multi-year deal with a leading global chemicals and polymers manufacturer.

Reliance Industries announces a $100 million AI-focused JV with Meta Platforms.

Chennai Petro swung to profit with ₹719 crore in Q2 versus a loss of ₹40 crore QoQ; revenue up 10.2%.

Sona BLW reports 24% YoY rise in revenue to ₹1,144 crore; net profit up 20% at ₹173 crore.

Tata Investment Q2 profit rises 16.5%, revenue up 8.5%.

Sumitomo Chemicals Q2 profit declines 7.5% YoY to ₹178 crore; revenue down 5.9% to ₹930 crore.

Chart of the day: GRASIM

Spotted: Ascending Triangle

Structure: The ascending triangle is formed when the price repeatedly tests a horizontal resistance while making HL’s on the downside. This reflects consistent buying pressure and shrinking supply near the resistance zone.

Validation: A BO above the resistance, supported by a surge in trading volume, confirms the pattern and signals bullish continuation.

Trading Insight: The pattern highlights accumulation and growing confidence among buyers. As sellers weaken near the resistance, a BO often leads to a strong upward move in line with the prevailing trend.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 28, 2025, with more sharp insights, fresh trends, and signals from the markets.