Market Minute | October 28, 2025

🚀NF snaps back from lows, PSU Banks gain, Laurus Labs breaks out; CarTrade’s 109% profit & full wrap inside!

Nifty 25,936.20 ▼ -0.11%

Sensex 84,628.16 ▼ -0.18%

Bank Nifty 58,214.10 ▲ +0.17%

Nifty stages a sharp comeback on Expiry day, Ends flat above 25,900!

The monthly expiry session turned out to be a tale of 2 halves for the markets. After the opening bell, Nifty50 attempted to reclaim the 26,000 mark early in trade and what followed after was a rejection at that level. A swift drop towards the 25,800 zone, only for the index to stage an impressive 140-point recovery from the day’s lows and end largely unchanged. The takeaway? Nifty has now carved out a well-defined range between 25,800-26,040, and a breakout on either side could dictate the next directional move.

This rebound was led primarily by Metal stocks, with Tata Steel and JSW Steel shining bright after fresh brokerage upgrades. On the flip side, IT and FMCG names weighed on the index, while the Realty pack slipped 1.05%.

Banks take the lead: Recovery led by BNF, PSU pack extends gains!

The Banking space provided much of the muscle behind Nifty’s late-hour comeback. Bank Nifty mirrored the benchmark’s early hesitation but rebounded sharply from intraday lows to close near the day’s high at 58,214, up nearly 100 points.

The 58,320 level is emerging as a key short-term resistance; a breakout above this could open room for fresh upside in the coming sessions.

The PSU banking index once again stole the limelight, marking another strong day, with Indian Bank gaining 3.28%. The ongoing rally in PSU banks continues to be fueled by robust Q2 earnings momentum and strong loan growth visibility.

Among individual movers, SBI Life extended its 2-day rally, up 5.27% this week on the back of healthy Q2 results. ICICI Bank, Bajaj Finance, and Bajaj Finserv, however, were among the major drags, limiting index gains.

Sensex slips, Broader Markets stay range-bound; Earnings in focus!

Despite the strong intraday recovery, the Sensex closed 151 points lower at 84,628, while Nifty50 ended 30 points down. The weakness was more sentiment-driven than structural, with profit booking seen in key heavyweights like Titan, Nestlé, and Bajaj twins. The broader markets too remained subdued as Nifty Midcap 100 ended flat at -0.02% while Nifty Smallcap 100 barely managed to stay green at +0.02%.

In stock-specific action, CarTrade surged 17.63% after posting strong Q2 numbers and guiding for healthy margins. Newgen Software rose 11.19% on robust earnings.

Supreme Industries slipped 4.67% as it cut its volume growth outlook. Vodafone Idea fell 5.32% on profit booking post-AGR verdict. MCX also lost 2.03% as trading remained halted for over four hours due to a glitch.

NIFTY50: Top Gainers

JSW Steel ▲ +2.92%

Tata Steel ▲ +2.92%

SBI Life ▲ +1.77%

NIFTY50: Top Losers

Trent ▼ -1.53%

Bajaj Finserv ▼ -1.38%

Coal India ▼ -1.34%

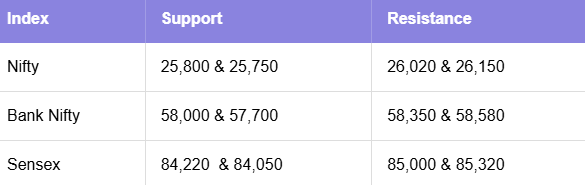

Key levels to watch for October 29, 2025

OI insights

Nifty50 witnessed a session of two halves, after an early rejection near the highs, the index swiftly recovered from the intraday lows to close almost unchanged. In the derivatives segment, significant put writing was observed at the 25,800 strike (16.9L), marking it as a crucial support zone. Meanwhile, heavy call writing at the 26,000 strike (43.39L) signals that the 26K level continues to act as a firm resistance barrier.

Takeaway:

The index remains range-bound between 25,800-26,000, with traders defending support while sellers cap the upside. A breakout on either side could dictate the next directional move.

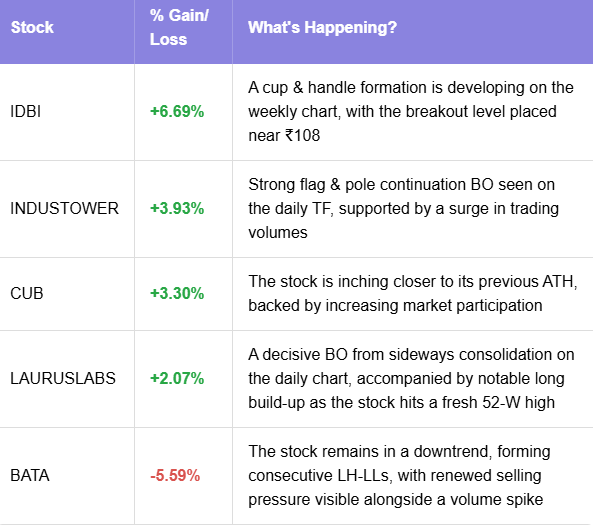

Today’s buzzing stocks at a glance

News you can use

HAL and UAC sign MoU in Moscow for production of the SJ-100.

BPCL and Oil India ink non-binding agreement for ₹1 lakh crore refinery project.

L&T Heavy Engineering secures orders worth ₹1,000–₹2,500 crore.

Premier Explosives wins ₹429.6 crore order from Defence Ministry.

CarTrade Tech Q2 results: Profit soars 109% YoY to ₹64 crore.

TVS Motor Q2 results: Net profit rises 37% YoY; revenue up 29%.

Newgen Software Q2 results: Revenue grows 11% YoY; profit up 16%.

Tata Capital Q2 results: Profit declines 6.5% YoY in first earnings post listing.

Chart of the day: LAURUSLABS

Spotted: Rectangle pattern

Structure: The rectangle pattern forms when the price moves between parallel support and resistance levels, indicating a phase of consolidation where buyers and sellers are in balance.

Validation: A BO above the resistance signals bullish continuation, while a breakdown below support indicates bearish continuation.

Trading Insight: Showcases a pause in trend, where smart money often accumulates or distributes positions. Traders typically wait for a decisive BO or BD with volume confirmation to enter trades.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 29, 2025, with more sharp insights, fresh trends, and signals from the markets.