Market Minute | October 7, 2025

🚀Nifty at 25,100: Off Day’s high, RIL & ICICI Bank lead; Top stocks in action & full wrap inside!

Nifty 25,108.30 ▲ +0.12%

Sensex 81,926.75 ▲ +0.17%

Bank Nifty 56,239.35 ▲ +0.24%

Nifty holds above 25,100, but upside remains challenged

The Nifty50 rose 31 points (+0.12%) to 25,108 and the Sensex added 137 points (+0.17%) to close at 81,927, marking the 4th straight session of gains. Even as the benchmarks ended in the green, market breadth leaned negative, with a 3:4 advance-decline ratio, reflecting more weakness beneath the surface.

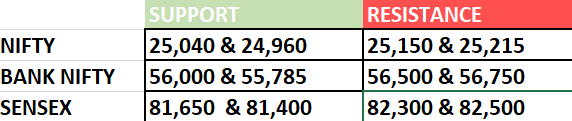

The session began flat to positive, and the bulls pushed Nifty toward 25,200, but the region acted as resistance, triggering selling. On charts, support is now pegged at 25,040 and 24,960, holding these will be crucial to maintaining the positive momentum. Meanwhile, Sensex showed rejection near 82,300, putting 81,700 in focus as its key base. Bank Nifty also showed resilience, briefly pushing toward 56,500 before cooling off, with 55,600 acting as critical intraday support.

Financials, IT & Reliance power the move!

Big names in Financials, IT and Reliance were among the key drivers behind today’s rally. The Nifty Bank index jumped 135 points to 56,239, led by gains in ICICI Bank, despite some profit booking in SBIN, Axis and Kotak Bank. Reliance Industries added 0.71%, continuing its strong contribution to the benchmark’s gains.

In sectoral action, Telecom and Rail stocks outperformed significantly. Vodafone Idea jumped 8.38% following positive developments in its AGR case, while Bharti Airtel gained 1.36% on signs of improved subscriber additions. Utilities and Energy names also saw interest, and Railway names soared after the government cleared ₹24,000 crore in new projects: IRCON rallied 5.84%, Titagarh Rail Systems gained 3.16%.

Stock-specific movers!

The Nifty Midcap 100 advanced 0.47% and the Nifty Smallcap 100 gained 0.31%, reflecting selective strength in the broader market. Sectorally, Realty emerged as the top gainer (+1.09%), followed by Pharma, Energy, Auto, and Financial Services. FMCG, Media, PSU Banks, and Metals ended lower.

In stock-specific action, Tata Motors fell 2.05% despite JLR resuming production at one of its units. Trent also slipped around 1.91% on subdued Q2 revenue growth.

Among insurance names, SBI Life rose, while HDFC Life and Max Financial edged lower. IGL jumped 5.80% amid reports of a possible tax implication change for gas sourcing.

In the Midcap Space, Divi’s Labs, Titagarh Rail, Torrent Power, Amber Enterprises, and Federal Bank stood out among top gainers, while CESC, JSPL, Britannia, HDFC AMC, BoB, and Hind Copper saw profit-taking.

Key levels to watch for October 08, 2025

OI Insights

As Nifty50 tested the 25,200 mark and ended nearly flat after a volatile session, the derivatives data offered key insights into trader sentiment. On the put side, strong writing at 25,000PE (39.26L) highlighted that participants are firmly defending this zone as support. On the other hand, fresh call writing at 25,200CE (34.71L) and 25,300CE (31.44L) indicates that upside is likely to face resistance in the near term.

Takeaway:

The 25,000 level is emerging as a crucial base for bulls, while supply pressure near 25,200-25,300 could keep the index in a tight range until a decisive breakout unfolds.

News you can use

World Bank lifts India’s FY26 GDP forecast to 6.5%, trims FY27 estimate to 6.3%.

The Finance Minister launches Foreign Currency Settlement System (FCSS) at GIFT City.

WeWork India IPO fully subscribed on final day; QIBs 1.67x, retail 0.53x (as of 2:30 PM).

AIA Engineering’s subsidiary wins $32.9 million order in Chile.

Allcargo Terminals board approves ₹80 crore fundraise via rights issue.

JLR to resume phased manufacturing restart from October 8.

September general insurance data shows mixed premium trends:

Go Digit General Insurance premiums up 3% MoM.

ICICI Lombard General Insurance premiums down 12% MoM.

New India Assurance premiums up 48% MoM.

Niva Bupa Health Insurance premiums down 3% MoM.

Star Health premiums up 7% MoM.

Chart of the day: CANBK

Spotted: Flag & pole pattern

Structure: Begins with a sharp, almost vertical price move: the pole, followed by a brief, downward or sideways consolidation that forms the flag.

Validation: A breakout from the flag in the direction of the prior move, ideally supported by strong volumes, confirms the pattern.

Trading insight: Typically viewed as a continuation pattern, the flag & pole suggests that after the short consolidation, the market is preparing for another strong leg in the direction of the initial move.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on October 08, 2025, with more sharp insights, fresh trends, and signals from the markets.