Market Minute | September 25, 2025

Losing streak: Nifty below 24,900! Huge CE writing; Defence stocks witness gains & more inside!

Nifty 24,890.85 ▼ -0.66%

Sensex 81,159.68 ▼ -0.68%

Bank Nifty 54,976.20 ▼ -0.26%

Markets crack again, are supports now in play?

Indian Markets extended their losing streak to the 5th straight session, ending at the day’s lows as selling pressure showed no signs of easing. The Sensex dropped 556 points to 81,160 while the Nifty shed 166 points, slipping below the crucial 24,900 mark to close at 24,891. Bank Nifty fared slightly better but still ended down 145 points at 54,976.

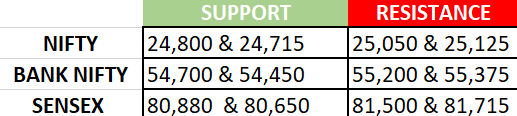

The slide came after an early flat opening and intraday consolidation, before sharp selling dragged benchmarks lower. With Nifty and Sensex now hovering close to their key supports at 24,800 and 81,050 respectively, the next few sessions will be crucial in deciding if buyers step in to defend these zones. Bank Nifty’s supports lie at 54,700 and 54,450.

Sectoral churn: IT and Autos drag, Defence and Metals shine!

Weakness in IT and Auto stocks was the biggest drag on the market. IT stocks continued their 5-day slide, with TCS hitting a 52-week low, while Tata Motors fell 2.73% on concerns around the Jaguar Land Rover cyberattack. Realty counters also remained under pressure, with Prestige Estates and Godrej Properties leading losses.

On the flip side, Defence and Shipbuilding stocks outperformed after the Cabinet approved new maritime and shipbuilding development schemes. HAL rose 1.09% on the back of the Defence Ministry’s ₹62,370 crore order for Tejas Mk-1A fighter jets. Hindustan Copper gained 6.33% as copper prices rallied to multi-month highs, and select Shipbuilding names also drew strong buying interest.

Broader markets and stock-specific moves!

The pain was evident across the Broader Markets, with the Nifty Midcap 100 down 0.64% and Smallcap 100 lower by 0.57%. Market breadth clearly favored declines, with the NSE advance-decline ratio at 2:5.

Among notable movers, Adani group shares saw profit booking, Polycab slipped 1.66% after a block deal involving promoter stake sale, while Muthoot Finance and Minda Corp stood out in earlier sessions with resilience. India VIX climbed 2.57%, reflecting heightened nervousness.

Except Metals (+0.22%), all other sectoral indices ended deep in the red: Nifty Realty was the top laggard, down 1.65%, followed by IT (-1.27%), Pharma (-0.92%), and Auto (-0.92%). The picture remains tilted towards caution, but the supports just below current levels could hold the key to the next directional move.

Key levels to watch (September 26,2025)

OI Insights

As Nifty slipped below the 25,000 mark and selling pressure intensified, the derivatives setup reflected the same bearish tone. Heavy call writing is visible at 25,000CE (1.22 cr) and 25,100CE (83.92L), effectively creating a ceiling for any near-term recovery. On the downside, limited put additions were seen, with 24,800PE adding 27.11L OI, highlighting it as the key support to watch.

Takeaway: The OI setup suggests a capped upside near 25,000-25,100, while 24,800 emerges as the crucial support. A break below could accelerate the fall.

News you can use

Defence Ministry signs ₹62,370 crore contract with HAL for 97 LCA Mk1A aircraft.

Dilip Buildcon and Ramky Infrastructure win ₹2,905 crore order under Rajasthan Water Grid Project.

ABB India to invest over ₹140 crore in expanding low-voltage motors manufacturing unit.

Natco Pharma board approves demerger of agro business into a separate entity.

Maharashtra Seamless secures ₹256 crore order to supply seamless pipes for oil and gas sector.

Polycab India sees ₹1,695 crore equity traded in block deal.

Chart of the day: HINDZINC

Spotted: Rectangle pattern

Structure: The rectangle pattern forms when price oscillates between parallel support and resistance levels, creating a sideways trading range. This reflects a balance of power.

Validation: A breakout beyond either boundary confirms the pattern. Typically, the move aligns with the prior trend.

Trading insight: As a continuation pattern, the rectangle often represents consolidation before the next leg of the trend. Once the breakout is validated, it can trigger a sharp directional move with strong follow-through.

That’s a wrap for today’s action-packed session!

We’ll be back in your inbox on September 26, 2025, with more sharp insights, fresh trends, and signals from the markets.