Market Minute | Weekly Wrap-up

🚀Nifty50 recovers from Intraday lows: What’s next? Banks lead, BSE gains ~9%; Nykaa’s 243% profit surge & more inside!

Nifty 25,492.30 ▼ -0.07%

Sensex 83,216.28 ▼ -0.11%

Bank Nifty 57,876.80 ▲ +0.56%

Bulls stage a comeback: Nifty & Sensex recover from day’s low!

It was a volatile yet rewarding Friday for the Markets. After a weak start, both Sensex and Nifty staged a sharp intraday rebound, ending the session ~1% higher from their lows. The Sensex slipped just 95 points to close at 83,216, while the Nifty ended 17 points lower at 25,491, a recovery that underscored strong buying interest in financials and midcaps.

The Broader Market showed even more resilience, with the Nifty Midcap index surging ~2% from the day’s low. Sectors like Financials, Autos, and PSU banks led the charge, suggesting that investors were quick to buy into the dip after recent weakness. The Nifty 50, which had opened near 25,300, found support around 25,318 before reversing sharply higher to close near the 25,500 mark, a strong sign of intraday demand emerging at lower levels.

The question now is whether this momentum can sustain into next week, with 25,318 now acting as an important short-term support. On the flip side, the index will need to cross above the 25,700–25,750 zone for the bulls to regain full control.

Banking stocks take the lead: Nifty Bank sparks the recovery!

If there was one clear driver of today’s bounce, it was the Banking pack. The Nifty Bank index climbed 323 points to 57,877, rebounding ~1.3% from the day’s low as financials turned the tide for the broader market.

Within the space, Bajaj Finance was among the star performers, rising 2.37% ahead of its Q2 results on Monday. Shriram Finance also stole the spotlight, rallying sharply after reports suggested a possible deal with MUFG. Meanwhile, SBI Life and LIC gained too, riding on strong Q2 showings that boosted sentiment for insurance names.

Technically, Bank Nifty’s close above its 20- and 50-EMAs on the one-hour chart indicates improving strength. The immediate resistance now stands near the 58,000 mark, a zone the index must clear decisively to extend this uptrend. On the downside, 57,650 remains the trailing support to watch.

Broader Markets shine bright: Midcaps & Metals outperform!

Beyond the Benchmark indices, it was the broader markets that truly outshined today. The Nifty Midcap 100 rose 0.63%, while the Nifty Smallcap 100 held flat with with a marginal 0.16% loss.

Among individual names, Mahindra & Mahindra advanced 1.98% after brokerages turned upbeat post its Q2 results, while L&T Finance rallied a solid 10.32% after management outlined plans for higher AUM growth over the next 12–18 months. On the flip side, Amber Enterprises slumped 7.73% on weak earnings, ABB India fell 4.05% on soft order inflows, and Divi’s Labs declined 3.30% despite in-line results.

For the week, the Sensex and Nifty ended slightly lower but managed to recoup most of their losses by Friday’s close. The market breadth remained neutral with the NSE advance-decline ratio at 1:1, signaling that while the rebound was encouraging, sustained follow-through will be key in the sessions ahead.

NIFTY50: Top Gainers

Shriram Finance ▲ +3.01%

Adani Enterprises ▲ +2.38%

Bajaj Finance ▲ +2.37%

NIFTY50: Top Losers

Bharti Airtel ▼ -4.47%

Tata Consumer ▼ -1.95%

InterGlobe Aviation ▼ -1.92%

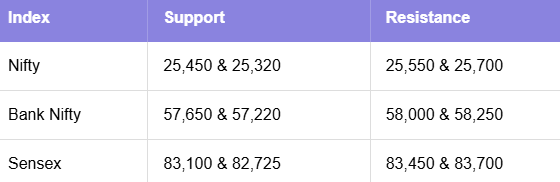

Key levels to watch for November 10, 2025

OI Insights

Despite opening with a sharp gap-down, Nifty50 showed resilience, holding firm near the day’s low before staging a steady recovery. The index managed to erase most of its early losses and ended close to the 25,500 mark. On the derivatives front, strong put writing at 25,400PE (55.32L) and 25,300PE (69.57L) signals firm support for the index, while limited call additions, with only a moderate buildup of 11.53L at 25,600CE, indicate restrained bearish sentiment.

Takeaway: The index appears to be finding its footing near 25,400, with the downside seemingly well-protected. A sustained move above 25,500 could invite further momentum towards 25,575–25,600.

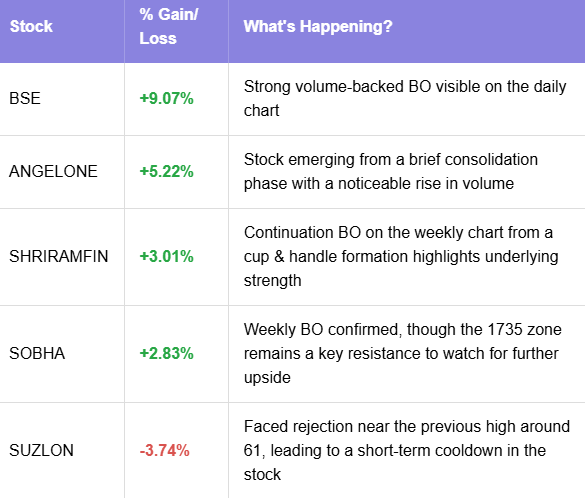

Today’s buzzing stocks at a glance

News you can use

BHEL bags ₹6,650 crore order from NTPC.

Hindalco Q2 results: Consolidated PAT rises 21% YoY to ₹4,741 crore.

Bajaj Auto Q2 profit jumps 24% YoY to ₹2,479.74 crore; revenue grows 14% to ₹14,922 crore.

Trent Q2 results: Net profit rises 11% YoY to ₹373 crore.

Nykaa Q2 results: Net profit surges 243% YoY to ₹34.43 crore.

Ola Electric Q2 results: Net loss narrows to ₹418 crore as revenue declines 43% YoY.

NBCC bags ₹350 crore order from Heavy Vehicles Factory.

RailTel secures ₹66 crore order from Sarva Shiksha Abhiyan, Gujarat.

Studds Accessories lists at ₹565 per share versus issue price of ₹585 on NSE.

Chart of the day: SOBHA

Spotted: Flag & pole

Structure: The “pole” forms after a sharp, nearly vertical price move followed by a brief, downward- or sideways-sloping consolidation i.e. “the flag”.

Validation: A BO above the flag’s upper boundary, ideally supported by strong volume, confirms the continuation of the prior trend and signals that the next leg of the rally is underway.

Trading Insight: Indicates strong underlying momentum with only a brief consolidation phase. Traders typically enter on a decisive BO from the flag with volume confirmation, placing stops just below the flag’s lower boundary.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on November 10, 2025, with more sharp insights, fresh trends, and signals from the markets. Until then, have a great weekend!