Mazagon Dock Q1 FY26 Results: Net Profit Falls 35% YoY, Margins Under Pressure Despite Revenue Growth

Mazagon Dock Shipbuilders Ltd (MDL) reported its Q1 FY26 results after market hours on July 28, revealing a sharp decline in profitability despite a double-digit growth in revenue. The company’s net profit came in below expectations, largely due to a significant drop in operating margins.

Net Profit Drops Below Street Expectations

Net profit fell 35% YoY to ₹452 crore for the quarter ended June 30, 2025, down from ₹696 crore in Q1 FY25.

The decline was steeper than what most analysts had anticipated, suggesting cost pressures or execution delays in key shipbuilding contracts.

Revenue Rises, But Operating Leverage Falters

Revenue from operations rose 11.4% YoY to ₹2,626 crore compared to ₹2,357 crore in the same quarter last year.

The top-line growth indicates continued traction in the company’s shipbuilding order book, particularly from defence and government-led contracts.

However, that growth did not translate into operating performance.

EBITDA plunged 53% YoY to ₹302 crore versus ₹642 crore in Q1 FY25.

EBITDA margin halved, falling from 27.2% to 11.5%, reflecting either rising input costs, project timing mismatches, or unabsorbed fixed costs due to under-utilisation.

Stock Reaction & Market Implications

Shares of Mazagon Dock ended 3.35% lower today, but this move occurred prior to the earnings announcement.

The actual market reaction will be seen in tomorrow’s session, where the sharp miss on profitability could weigh on sentiment.

Despite robust order inflows and steady revenue growth, the Q1 numbers signal growing margin volatility a key concern for investors in capital-intensive defence and infrastructure businesses where cost overruns are not easily passed on.

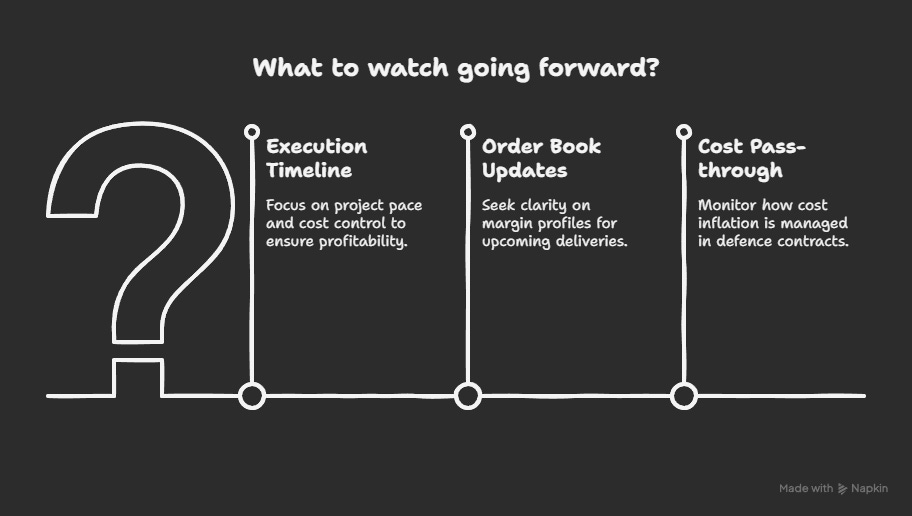

What to Watch Going Forward

Execution Timeline: With profitability under strain, the pace and cost control of ongoing projects will be closely scrutinized.

Order Book Updates: While the company has a healthy order backlog, investors will seek clarity on margin profiles of upcoming deliveries.

Cost Pass-through Mechanisms: Any management commentary on how cost inflation is being managed across defence contracts will be key.

Mazagon Dock’s Q1 FY26 results underline a worrying trend top-line growth without margin support. The defence shipbuilder continues to benefit from strong institutional demand, but cost pressures and operational inefficiencies could weigh on earnings quality unless addressed swiftly.