The Midwest India Industries Ltd IPO closed for subscription on October 17, 2025. The ₹451 crore issue comprised a fresh issue of ₹250 crore and an offer for sale of ₹201 crore, with a price band of ₹1,014–₹1,065 per share.

The basis of allotment is expected to be finalized on October 20, 2025, while the listing is tentatively scheduled for October 24, 2025.

Midwest is a leading natural stone and quartz processor engaged in the extraction, processing, and export of natural stones. The company is India’s largest producer and exporter of Black Galaxy Granite and Absolute Black Granite, operating across mining, processing, and global distribution.

How to Check IPO Allotment Status

Option 1: On BSE Website

Visit the BSE IPO Application Status Page

Select ‘Equity’ under Issue Type

Choose “Midwest India Industries Ltd” under Issue Name

Enter your Application Number or PAN

Click ‘Submit’ to view your allotment status

Option 2: On NSE Website

Visit the NSE IPO Allotment Page

Select ‘Equity’ and choose your IPO name

Enter your PAN or Application Number

Click ‘Submit’

Option 3: On Registrar’s Website (KFin Technologies Ltd)

Visit KFintech IPO Allotment Page

Select “Midwest India Industries Ltd” from the dropdown

Enter any of the following:

PAN

Application Number

DP/Client ID

Click ‘Submit’ to check your allotment status

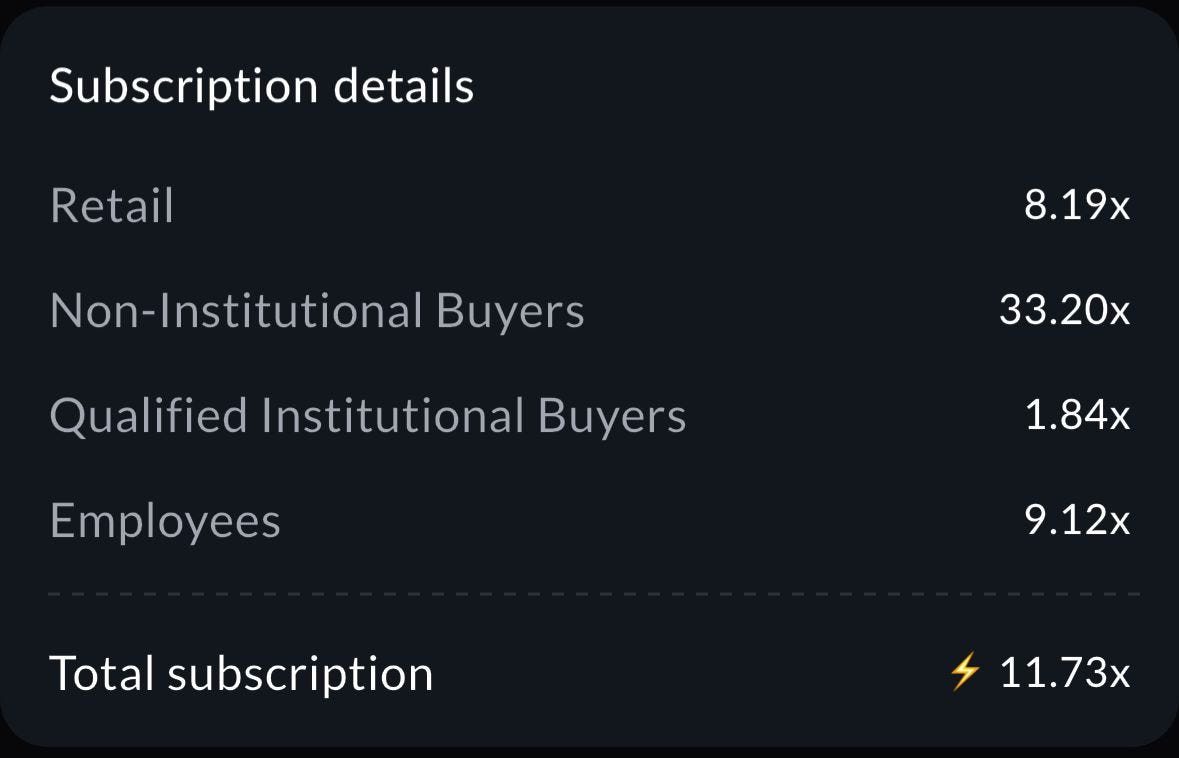

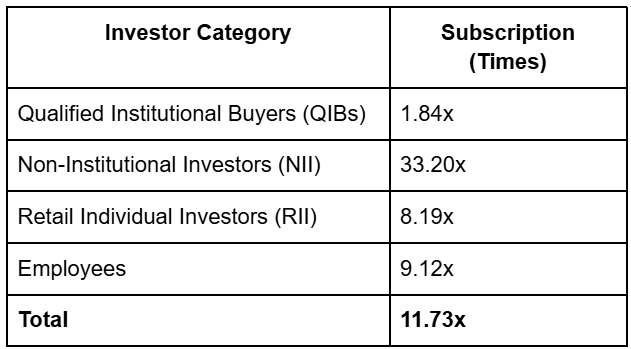

IPO Subscription Status (as on October 17, 2025)

Company Overview

Midwest India Industries Ltd is a fully integrated natural stone and quartz processor specializing in high-quality granite extraction and export. The company operates 16 granite mines and two large-scale processing facilities, catering to clients across 17 countries on five continents.

It holds approximately 64% of India’s Black Galaxy Granite export market and 15.7% of Absolute Black Granite production, making it a dominant player in its segment. Midwest also runs a diamond wire manufacturing facility, serving both mining and construction industries.

Recent Financials (FY25):

Operating Revenue: ₹626 crore

EBITDA: ₹172 crore (27.4% margin)

Net Profit: ₹133 crore

Net Worth: ₹632 crore

ROE: 21%

Historical Financials (₹ crore):

Midwest’s consistent profitability, strong export base, and healthy return ratios underline its operational efficiency and leadership in the natural stone export sector.

Key Takeaway:

The Midwest IPO allotment will be finalized on October 20, 2025, with the listing scheduled for October 24, 2025. Investors can check their allotment on the KFintech portal once activated.