Midwest Ltd opened at ₹1,165 on the NSE and BSE about 9% above its issue price of ₹1,065 marking a steady market debut for the granite exporter. The ₹451-crore IPO drew overwhelming investor interest, reflecting confidence in India’s expanding natural-stone export sector.

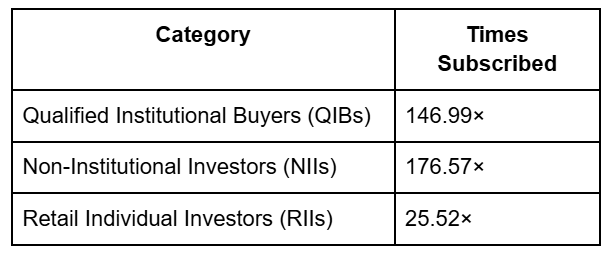

IPO Subscription Snapshot

About Midwest Ltd

Midwest Ltd is a leading exporter and processor of premium natural stones, notably Absolute Black and Black Galaxy Granite, supplying to clients across 17+ countries. The company operates an integrated value chain from captive mining and cutting to polishing and exports supported by a diamond-wire manufacturing facility and a quartz processing unit.

In recent years, Midwest has emphasized capacity expansion (Phase II of its quartz operations), technology adoption, and global distribution, reinforcing its position in the high-margin dimensional-stone segment.

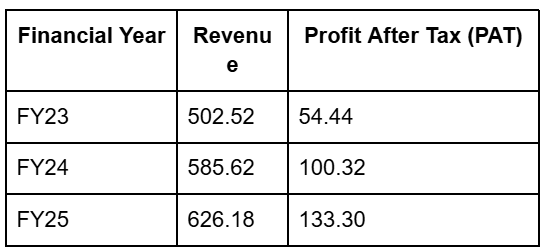

Financial Performance (₹ crore)

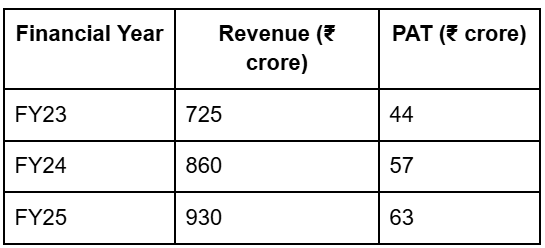

Competitor Analysis

Pokarna Ltd remains a key peer in the natural and engineered stone sector, with significant export exposure to the US and Europe. While Pokarna’s revenue growth has been steady, its profitability has been squeezed by rising energy and input costs. The company currently commands a market capitalization of approximately ₹27.7 billion, positioning it as one of the more established listed players in India’s stone and quartz export industry.

In contrast, Midwest’s integrated operations and stronger cost efficiency provide a more balanced growth outlook. Its diversified mix of domestic and international projects could help it sustain stable cash flows and reduce reliance on export-cycle swings.

Watch on Midwest IPO Listing Day

Whether the stock opens within or above the ₹965–₹970 range implied by the GMP.

Early volume trends and institutional activity, given the exceptional QIB subscription.

Comparison with recent mid-cap or mining-export listings, especially on valuation and day-one performance.

Sahi Review

Though listing gains were modest, Midwest’s debut signals sustained investor appetite for export-driven industrial plays that pair strong balance sheets with global demand visibility. The company’s fundamentals position it well amid renewed international interest in premium Indian stone.

Analysts will watch for institutional participation and sustained trading volumes post-listing to assess if the early stability can translate into longer-term investor confidence.