This Diwali, the stock market isn’t just opening, its rewriting tradition.

For the first time ever, Muhurat Trading will take place in the afternoon (1:45 PM – 2:45 PM), giving traders a chance to celebrate the festival of lights with both their portfolios and their families.

Muhurat Trading has always been more than just a trading session; it’s a cultural and financial ritual that marks the start of the new Samvat year with optimism.

What is Samvat?

Samvat is the Hindu calendar year used by many traders and investors in India to track financial performance. The new year, Samvat 2082, begins on Diwali day (October 21, 2025), which is why Muhurat Trading is considered the symbolic start of the financial year for many participants.

What is Muhurat Trading?

Muhurat Trading is a special one-hour trading session conducted by NSE and BSE on Diwali day. The word “Muhurat” means auspicious time making this session a symbolic way to kick off the Hindu New Year.

Tradition Meets Market: Investors make token purchases, often in blue-chip stocks, to mark good fortune.

Full Market Functionality: Equity, F&O, intraday, and block deals are available though volumes are lighter than usual.

Symbolic, Not Predictive: While the session often ends on a positive note, it doesn’t guarantee full-year trends.

Did You Know?

This tradition aligns with Lakshmi Puja, a ritual invoking prosperity and wealth. Many traders see their Muhurat buy as a good luck charm for the year ahead.

New for 2025: Afternoon Slot for the First Time

Muhurat Trading 2025 will run from 1:45 PM – 2:45 PM , a historic shift from the traditional evening slot.

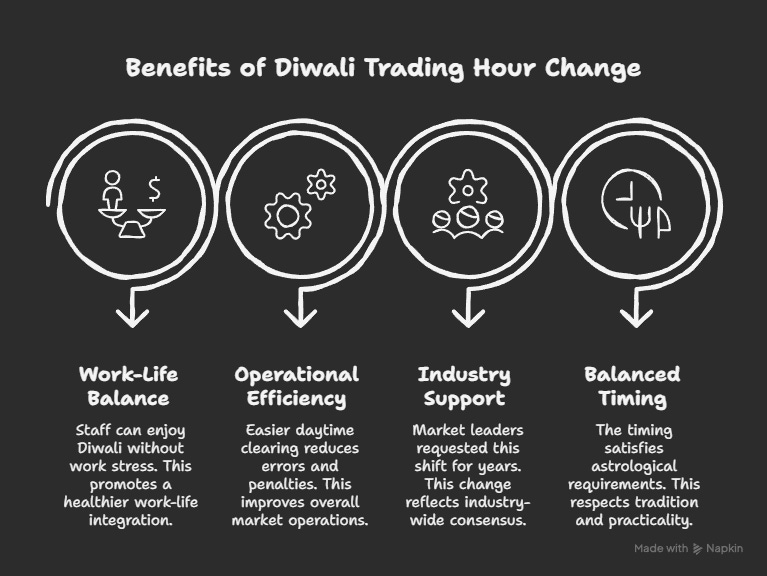

Why the Change Matters

Better Work-Life Balance: Brokers and exchange staff can finish clearing and compliance work early and join Diwali festivities stress-free.

Operational Efficiency: Daytime slot allows easier clearing, settlement, and reporting reducing last-minute errors and penalties.

Industry Consensus: The Brokers’ Industry Standards Forum (ISF) and market leaders had requested this shift for years.

Ritual & Practicality Balanced: The timing still satisfies the astrological muhurat for Diwali.

Looking Ahead: Many expect this afternoon slot to become a permanent feature.

This is the biggest timing change since Muhurat Trading began and most stakeholders are celebrating the move.

Muhurat Trading 2025: Full Schedule

Normal Market: 1:45 PM – 2:45 PM

Pre-Open: 1:30 PM – 1:45 PM

Block Deal Window: 1:15 PM – 1:30 PM

Call Auction Illiquid Session: 1:50 PM – 2:35 PM

Closing Session: 2:55 PM – 3:05 PM

Segments Open for Trading:

Equity (Cash Market) – All NSE & BSE listed stocks

Equity Derivatives (F&O) – Index and stock futures & options

Currency Derivatives – USD/INR, EUR/INR, GBP/INR, JPY/INR

Commodity Derivatives (MCX) – Gold, Silver, Crude, etc.

All trades will result in regular settlement obligations, just like a normal market day

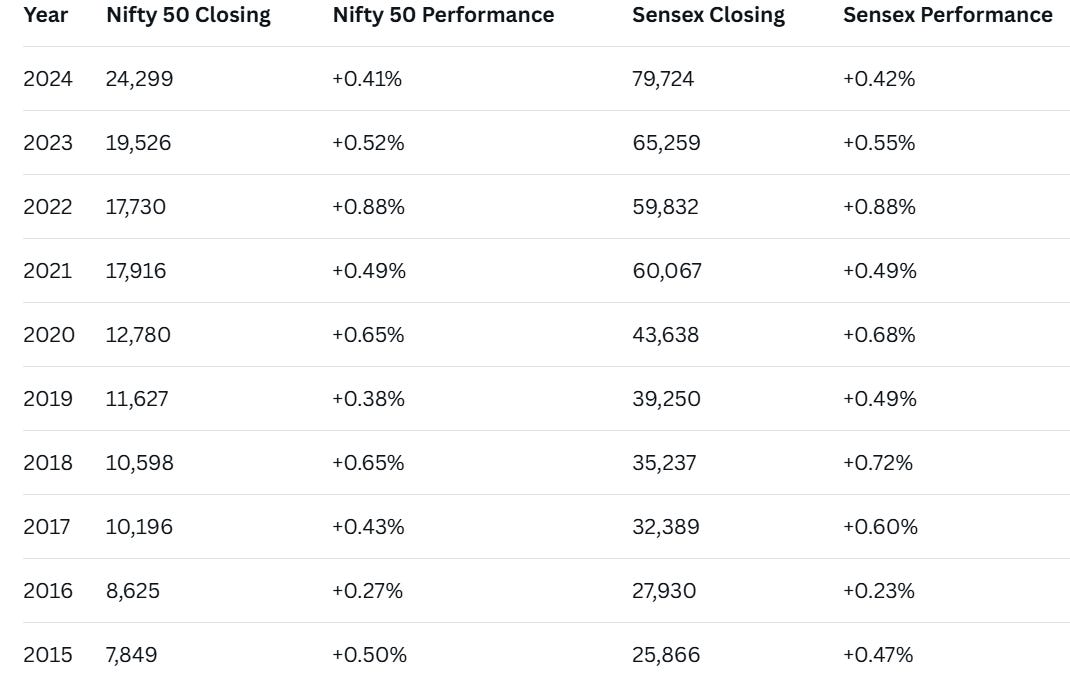

Muhurat Trading Performance: Last 10 Years (2015–2024)

Muhurat Trading has delivered consistent positivity over the last decade with both Sensex and Nifty closing in the green in 10 of the last 10 sessions, reflecting festive optimism and strong market sentiment year after year.

Insights & Sentiment

Sector Performance & Index Gains

2024 (Samvat 2081):

Gains were broad-based with auto, energy, and infrastructure leading the rally.

All sectoral indices closed in the green, signaling strong festive optimism and healthy market breadth.

2023 (Samvat 2080):

Banking and financial stocks were the key drivers as festive credit demand boosted sentiment.

Sensex and Nifty both posted 0.5%+ gains in the session, continuing the multi-year positive streak.

2022 (Samvat 2079):

IT and PSU banks outperformed, with PSU Bank index seeing strong momentum.

Sensex and Nifty gained nearly 0.9% each, making it one of the strongest Muhurat sessions of the decade.

2021 (Samvat 2078):

Pharma, IT, and metals were the biggest contributors to gains.

Mid- and small-caps were more volatile but offered selective opportunities for outperformance.

Key Trends

Sector Leaders: IT, banking, and large-cap heavyweights like Reliance and HDFC Bank consistently dominate Muhurat winners.

Mid & Small Caps: These indices tend to be more volatile but have delivered outsized returns in some Samvat years.

Rising Participation: Muhurat sessions continue to see record turnover and growing retail involvement, making them both a ritual and a market event.

Quick Tips for Traders

Long-Term Investors: Use this session to buy quality stocks and set the tone for Samvat 2082.

Active Traders: Stay mindful of wider spreads and low liquidity trade light.

First-Timers: Make your first symbolic investment and join the tradition.

Diwali Gift from Sahi

To make this Muhurat Trading even more special, Sahi is offering zero brokerage for all trades during the Muhurat session.

No charges, no fine print just pure festive trading.

So whether you’re making your first symbolic buy or adding to your favourite stock, this Diwali, trade freely and start your Samvat 2082 journey on a profitable note.

Closing Thoughts

Muhurat Trading 2025 is historic not only because it ushers in Samvat 2082, but because it moves to an afternoon slot for the first time ever.

Plan your trades, make your first investment count, and welcome the New Year with confidence.

After all, Diwali is about new beginnings why not let your portfolio join the celebration?

Happy Diwali and Happy Trading!