The best tools are the ones that help you stay in that rhythm by giving you clearer signals, smoother workflows, and controls that stay firm even when the market doesn’t.

This week’s update brings exactly that: sharper trend reading, expiry-aware strategy analysis, portfolio-linked baskets, and stronger exit automation.

Guppy Moving Averages

Most moving averages tell you where price has been. Guppy helps you understand how the trend is building. It does this using a simple 6+6 structure: six fast EMAs that react quickly to short-term moves, and six slow EMAs that move steadily with long-term sentiment.

When the fast and slow groups pull apart, the trend is gaining strength. When they start coming closer, momentum is easing. And when price begins pushing through the structure, it often signals a shift. You don’t look for crossovers or hunt for signals; the trend’s rhythm becomes easy to read.

That’s the difference from regular moving averages. Instead of giving you one line or one crossover, Guppy shows how short-term traders and long-term money are behaving together. It’s a clearer picture of strength, weakness, and transition in a single glance.

On Sahi, we keep Guppy in its classic 6+6 form because it’s the cleanest and most reliable way to read this indicator. Customisation may come later, but only in a way that keeps this clarity intact.

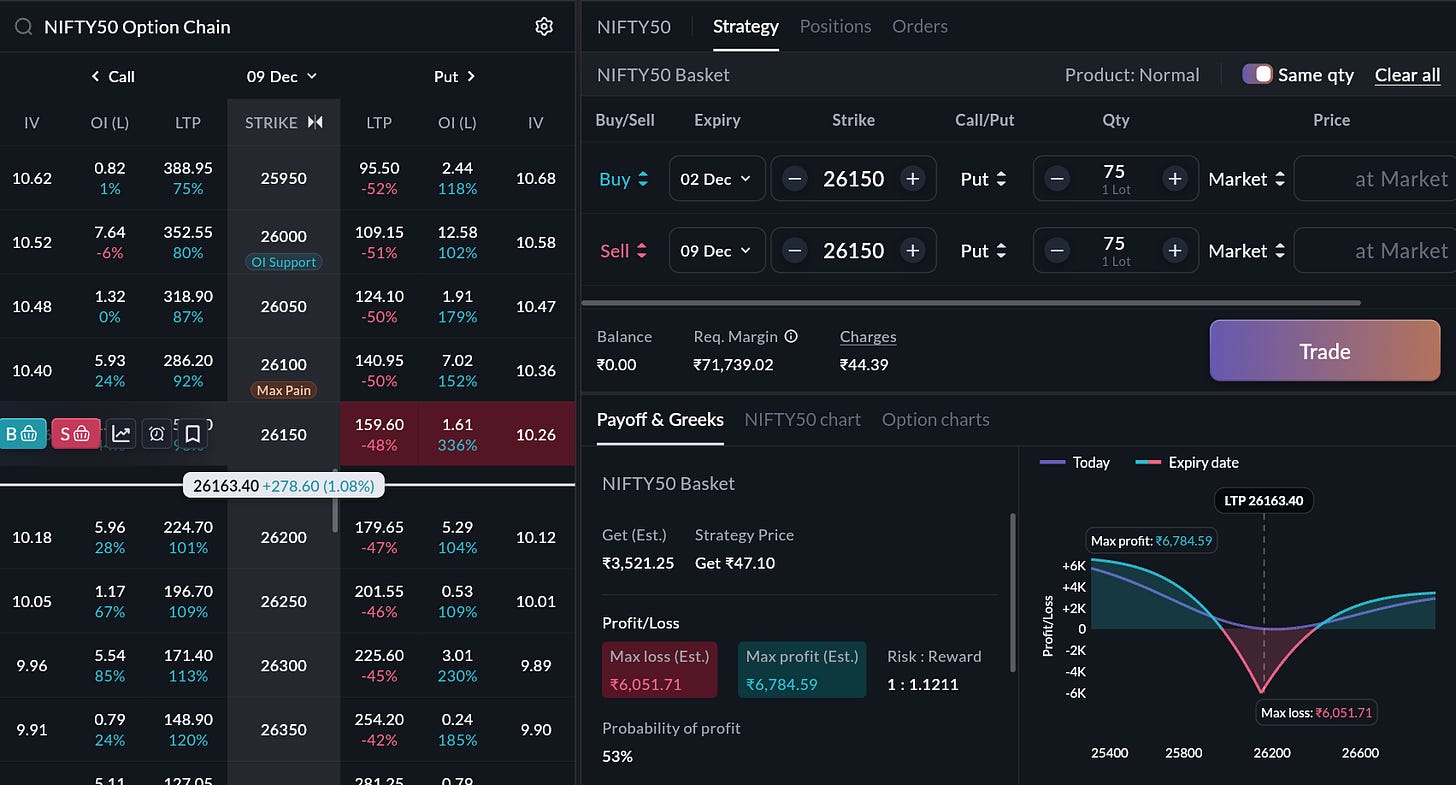

Analyse: Multi-Expiry Strategies

Trading across expiries shouldn’t feel like stitching together separate strategies.

Now it doesn’t.

You can now analyse baskets that span weekly, monthly, and far-month expiries in a single, continuous view.

The entire strategy sits together with Greeks, payoff, breakevens, and risk without jumping between tabs or keeping mental track of which leg belongs where.

This is especially powerful for calendar spreads, rollovers, and diagonal setups where the relationship between expiries matters more than the individual legs.

You can compare impact across time, test scenarios, adjust exposure, and make expiry-driven decisions with far more clarity and far less clutter.

Analyse: Build New Baskets With Your Existing Positions

Add your open or closed positions directly into a newly created basket and instantly see how the combined structure behaves.

The system recalculates payoffs, Greeks, breakevens, and risk zones automatically giving you the complete picture before you commit to a change.

This unlocks a practical workflow traders have been asking for:

1.Add hedges on the fly.

2.Test adjustments without touching your live position.

3.Visualize rollovers before executing them.

4.Understand how today’s moves impact both intraday payoff and expiry payoff.

By showing both “today” and “expiry” outcomes together, the basket becomes a real-time risk companion especially helpful when theta decay and intraday volatility can shift your risk zones within minutes.

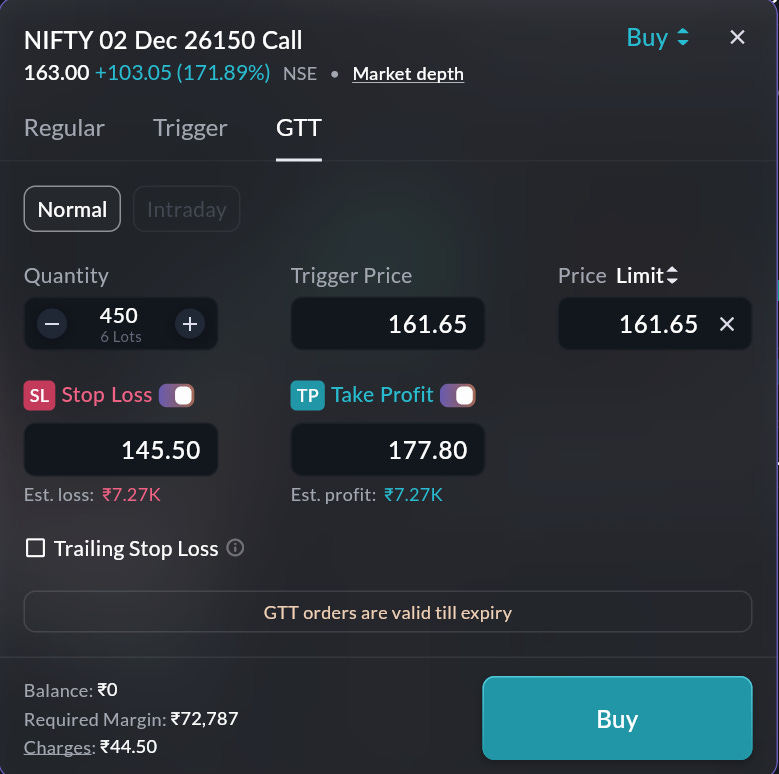

SL/TP for GTT Orders

Good exits are planned, not improvised.

You can now attach Stop-Loss and Take-Profit conditions when placing a GTT order bringing more structure and discipline to long-duration trades.

It’s particularly useful for swing traders, position builders, and anyone holding options or equities over multiple sessions where screen-time is limited.

Your exits now follow your rules, not your availability.

Set it once, and your conditions stand even on days when you aren’t checking the market.

This adds reliability to setups that depend on time, patience, and controlled risk.

Also, pl see if you can give option of GTT similar buy in intraday as i would like to buy after crossing a particular level on chart

Pl make TP conditional - I meant there should be option of partial exit so that partial can be trailed.