In a market obsessed with speed, scale, and splashy IPO buzz, Ather Energy is choosing something far less fashionable — patience.

Over the last decade, while competitors raced to flood the roads, Ather has been steadily crafting its identity: premium scooters built with precision, an expanding fast-charging network, and a loyal, engineering-first customer base that values reliability over rebates.

Now, with the EV two-wheeler market at an inflection point, Ather is stepping into the public markets. There’s no grey market frenzy. No overnight hype. Just a company asking investors to bet on vision, not valuation multiples.

It’s a bold move — and the timing couldn’t be more telling.

India’s E2W sector is growing fast. Electric scooters made up nearly 6% of all two-wheeler sales in FY24, up from about 4% the year before. The market is shifting from early adopters to the everyday commuter — and with that, expectations around product quality, after-sales service, and ecosystem reliability are also rising.

So while Ola Electric has sprinted ahead in volumes, Ather has been playing a different game. One that values engineering, infrastructure, and brand equity over pure scale.

And that brings us to the real question this IPO asks:

Is India’s EV race about scaling fast like Ola or building strong like Ather?

Let’s dive in.

Current Financial Snapshot: The Reality Check

Before we get caught up in the EV buzzwords, let’s look at the numbers because numbers don’t lie.

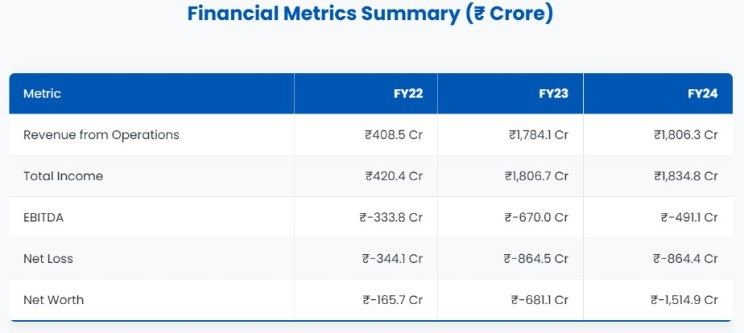

From FY22 to FY24, Ather’s revenue from operations grew sharply from ₹408 crore to ₹1,890 crore, a ~4.6x jump. Production and deliveries ramped up significantly too.

However, despite the surge in revenue and volumes, losses have ballooned instead of narrowing.

What should you, as a reader, infer from this?

When a company’s top-line growth doesn’t translate into profits, it usually points to high operational expenses absorbing the gains.

In Ather’s case, major cost heads such as R&D spending, manufacturing expansion, service network buildout, and customer acquisition costs are pulling down profitability.

In short: Revenue is rising, but the cost of scaling the ecosystem is rising even faster.

Sales Units vs Production Units

Units Produced in FY24: 1,31,491

Units Sold (Retail Deliveries) in FY24: 1,08,889

While production volumes have increased strongly, retail sales have lagged behind production, leading to some inventory build-up. This gap between production and actual deliveries shows that while demand is growing, it’s not perfectly matching supply yet, which impacts working capital and cash flows.

As a customer of this report, you should infer:

Growing revenue is being partly supported by production ramp-up but customer deliveries still need to catch up to fully absorb inventory and turn production efficiency into real cash flows.

According to Ather’s Draft Red Herring Prospectus (DRHP):

Key Financial Observations:

Gross Margin Pressure: Subsidy cuts (FAME-II) are squeezing margins; raw material costs remain a key risk.

High Fixed Costs: Heavy R&D, network expansion, and brand investments continue to weigh on near-term profitability.

Promoter Strength: Hero MotoCorp’s ~37% stake provides strategic backing and market credibility.

No Immediate Profitability: Despite scaling, Ather is unlikely to turn profitable before FY26 without major cost or subsidy tailwinds.

Ather today is a high-growth, high-cashburn company ,not a cash cow. Investors need to understand that this IPO is about buying into a story and vision, not a quarterly earnings machine.

The Road Ahead

While Ather's financials today look heavy on losses, the real question is:

Growth Drivers in Ather’s Plan

1. New Product Launches

Ather has expanded beyond premium scooters (450X, 450S) with the Rizta, targeting mass-premium families — while carefully protecting its brand positioning.

2. Charging Infrastructure Scale-up

Ather Grid 2.0 doubled from 1,973 chargers (March 2024) to 4,100+ chargers (April 2025), strengthening its EV ecosystem lock-in.

3. Software and Connected Tech

Ather’s Atherstack platform powers OTA updates, remote diagnostics, and ride analytics — reinforcing customer engagement and potential subscription revenues.

4. Battery R&D and Local Manufacturing

Ather is investing in local battery production to cut import dependency and control ~40% of EV costs — a long-term margin lever.

Who’s better positioned for the EV marathon?

Ather is clearly prioritizing deep customer trust, strong infrastructure, and product quality over immediate volume grabs. Ola is betting on speed, mass expansion, and rapid mindshare capture.

Ather vs Ola: The EV Rivalry

Both companies are fighting for leadership in India's electric two-wheeler space. But the way they fight and what they prioritize couldn't be more different.

Ather scooters consistently command a higher average selling price (ASP) compared to Ola, reflecting their premium brand positioning.

Ola’s lineup is priced aggressively lower to target mass adoption and volume sales.

Customer Viewpoint: If you're looking for performance, reliability, and finish, Ather targets you. If you're looking for affordability and latest features, Ola tries to attract you.

Strategic Differences

Ather plays the long game: Building an experience-driven, loyalty-based, premium ecosystem slower to scale, but stronger brand equity.

Ola plays the blitzkrieg: Flood the market, capture maximum mindshare, expand across segments fast, even if some quality issues surface early.

Both approaches have merit but they attract very different types of customers and investors.

Ather Energy IPO: Is It Worth the Bet?

Ather isn’t pitching profits. It’s pitching patience.

FY24 Revenue: ₹1,806 crore

Operating losses: Continuing

Borrowings: ₹1,121 crore

Fresh Capital Raise: ₹2,626 crore (for growth, not exits)

You’re backing a brand still building its moat — not booking profits yet.

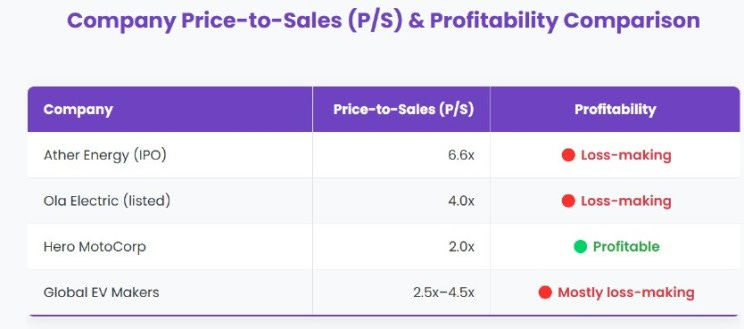

Valuation Reality Check

The multiple is rich — the highest among its peers. You're not paying for today’s comfort. You’re paying ahead, betting that Ather will convert engineering discipline and brand loyalty into pricing power over time.

Grey Market Sentiment

The GMP stands at ₹0.

Should You Place Your Bid?

This IPO is a binary call:

If you believe India's EV story will tilt toward quality, and Ather can stay premium despite scaling pressures — this IPO fits you.

If you need fast validation, quarterly wins, or quick liquidity — stay away.

There’s no middle ground. You either bet on craftsmanship surviving the speed race, or you don’t.

Good information