NSE Cuts Lot Sizes in Nifty, Bank Nifty & More | What Traders Should Know Before Dec 2025

If you trade Nifty or Bank Nifty options, mark this date –October 28, 2025.

The National Stock Exchange (NSE) has announced a revision in market lot sizes for key index derivatives, a move that could reshape position sizing, margins, and liquidity in India’s F&O market.

This revision follows SEBI’s periodic review framework to align contract values with market realities, ensuring each lot continues to represent roughly the same notional value as index levels rise.

Quick Summary

Effective: October 28, 2025 (EOD)

Applies to: Nifty, Bank Nifty, FinNifty, MidCap Nifty

No change: Nifty Next 50

Transition ends: December 30, 2025

Purpose: Maintain uniform notional contract values under SEBI guidelines

Why Lot Sizes Change

SEBI mandates exchanges to periodically review lot sizes so that each contract’s notional value stays within ₹5–10 lakh.

As index prices climb, the number of units per contract is reduced helping maintain consistent exposure and making derivatives more accessible to smaller traders.

This prevents high index levels from inflating position sizes and keeps the F&O ecosystem balanced for both retail and institutional participants.

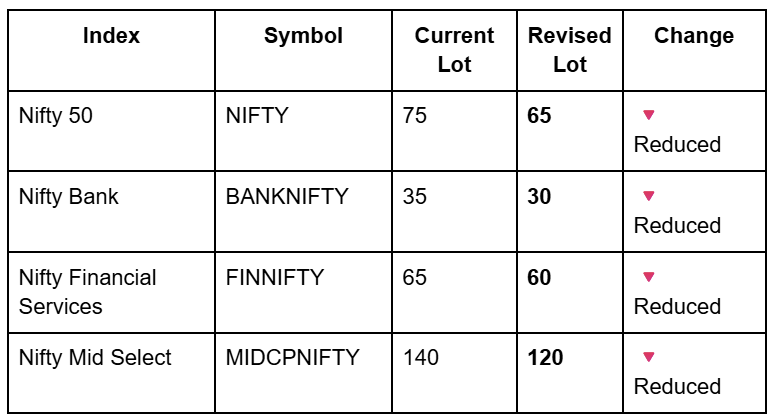

The New Lot Sizes

Here’s what’s changing from October 28, 2025:

With these reductions, the contract value per lot comes down slightly, easing margin requirements and enabling finer risk control.

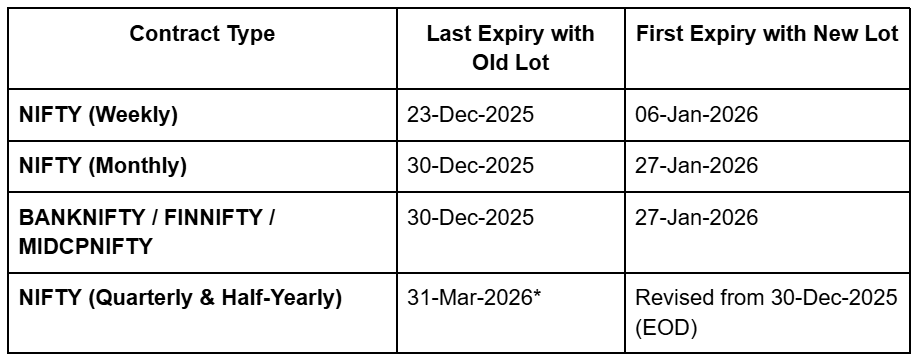

Implementation Timeline

NSE will roll out the new lot sizes in a staggered manner to ensure a smooth transition.

Note: The March 2026 contract will become a far-month contract after the December 2025 expiry.

What Traders Should Do

Recalculate position sizing — the reduced lots change notional exposure.

Review margin requirements post-revision; they’ll adjust slightly.

Check brokerage system updates before trading the new contracts.

Adjust hedging ratios — smaller lots allow finer control.

Monitor liquidity — especially around December 2025 transition expiries.

For retail traders, these changes may lower capital barriers, making it easier to trade index options responsibly.

The Big Picture

This update signals a maturing derivatives market that adapts dynamically to price levels.

As Nifty and Bank Nifty hover near record highs, smaller lot sizes keep participation inclusive and risk exposure balanced.

In essence, NSE’s move aligns with global best practices maintaining contract uniformity while fostering liquidity and healthy participation.