IPO Summary

Orkla India Limited (formerly MTR Foods Ltd) closed its IPO subscription window on October 31, 2025. The ₹1,667.54 crore issue was a pure Offer for Sale (OFS) of 2.28 crore shares, with no fresh issue component. The price band was set at ₹695–₹730 per share, and the minimum investment for retail investors was one lot of 20 shares (₹14,600).

The basis of allotment will be finalized on November 3, 2025, while refunds and share credits are scheduled for November 4, 2025. The stock will make its market debut on November 6, 2025, on both NSE and BSE.

Orkla India, backed by Norway’s Orkla ASA, is a leading player in India’s packaged food and spice segment, housing brands like MTR and Eastern. It caters to both domestic and export markets, distributing over 2.3 million units daily across 40+ countries.

How to Check Orkla India IPO Allotment Status

Option 1: On BSE Website

Visit the BSE IPO Allotment Page.

Select ‘Equity’ under Issue Type.

Choose ‘Orkla India Limited’ under Issue Name.

Enter your Application Number or PAN.

Click ‘Submit’ to view your allotment status.

Option 2: On NSE Website

Go to the NSE IPO Allotment Page.

Select ‘Equity’ and choose ‘Orkla India Limited’ from the list.

Enter your PAN or Application Number.

Click ‘Submit’ to check your status.

Option 3: On Registrar’s Website (KFin Technologies)

Visit the KFinTech IPO Allotment Page.

Select Orkla India Limited IPO from the dropdown list.

Enter your PAN, Application Number, or DP/Client ID.

Click ‘Submit’ to view your allotment details.

Allotment details will also be available on Sahi’s IPO section

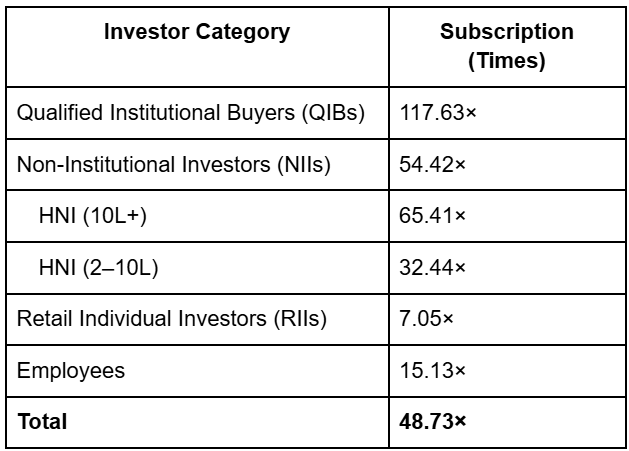

IPO Subscription Status (as on October 31, 2025)

The IPO saw overwhelming institutional participation, led by QIBs subscribing nearly 118 times, followed by strong demand from HNIs and retail investors.

Company Overview

Orkla India Limited is one of India’s leading packaged food companies, known for its MTR and Eastern brands. The company operates across ready-to-eat, spices, and convenience food categories and holds a dominant market share in South India.

Financially, Orkla India reported ₹2,370 crore in revenue and ₹253 crore in net profit for FY25. Backed by global parent Orkla ASA (Norway), the company has a stable business model, expanding export footprint, and consistent growth momentum.

What’s Next

With a strong subscription response and a grey market premium (GMP) hovering between ₹72–₹108, the stock is expected to list in the range of ₹805–₹838 per share, implying a 9–15% premium over the issue price.

The final listing performance on November 6 will depend on overall market sentiment and post-listing investor appetite for FMCG and consumer staple stocks.