Orkla India IPO made it’s market debut on November 6, 2025, with a listing price of 740 per share .

Investors responded favorably to the ₹1,667.54 crore IPO, which was essentially an Offer for Sale (OFS) of 2.28 crore equity shares, especially from institutional buyers.

According to analysts, the company’s growth potential and brand equity are more important to investors than speculative listing gains, and the moderate GMP reflects “healthy but realistic” expectations.

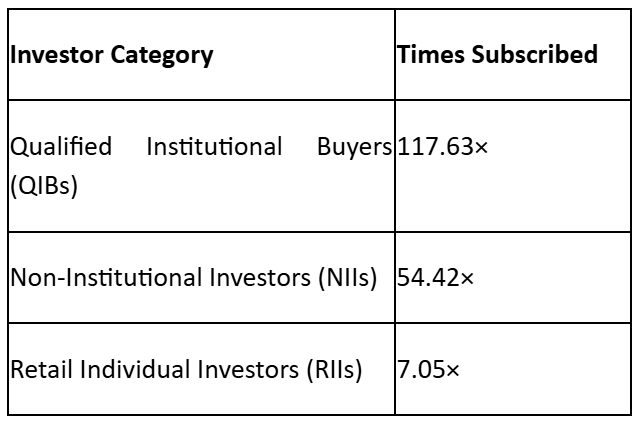

Subscription Snapshot for Orkla India

About the Company

Norway’s Orkla ASA, a well-known European consumer goods company, supports Orkla India Ltd, a multi-category food products company. The company operates in the ready-to-eat (RTE), ready-to-cook (RTC), spices, and instant foods categories with its flagship brands, MTR, Eastern, and Rasoi Magic.

Particularly in South India and export markets like the Middle East, the company enjoys strong brand loyalty and operates on an asset-light, debt-free model. In order to capitalize on India’s growing demand for branded and high-end food products, it has also diversified its product line to include high-margin convenience and packaged food categories.

Orkla India IPO had a lot size of 20 shares and was priced between ₹695 and ₹730 per share. Since this is a 100% offer for sale, there will be no new issue component and all proceeds will go to the selling shareholders, which includes Orkla ASA and its subsidiaries.

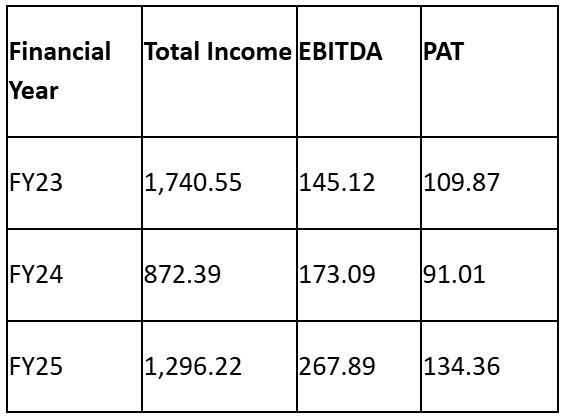

Financial Snapshot (₹ crore)

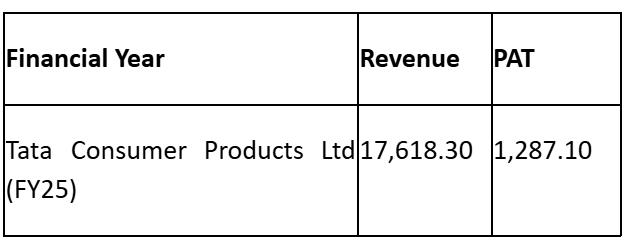

Competitor Analysis

Tata Consumer Products Ltd. (TCPL) is Orkla India’s nearest publicly traded rival in the packaged food and FMCG sectors. Tata Consumer’s significantly higher revenue and brand diversification stand in stark contrast to Orkla’s superior operating margins, which are a reflection of its efficient cost structure and targeted category presence.

Despite having a much lower topline, Orkla’s PAT margin (~10.7%) is higher than Tata Consumer’s (~7.3%). Whether Orkla can maintain this margin advantage while growing its revenue base and geographic reach will be the main focus after listing.

What to Watch on Orkla India IPO

• Opening Price & Early Trade Volume: Orkla India’s listing price may be in line with the approximately 2-3% GMP, or it may trade flat due to market volatility.

• Institutional Activity: Anchor and QIB investors’ extensive purchasing or profit-booking may dictate the initial stability of the price.

• Sectoral Sentiment: The attitude of the market toward FMCG and packaged food companies, especially in view of inflation data and trends in input costs.

• Valuation Focus: Unless growth surpasses projections, Orkla’s estimated valuation (~31–39× FY26 earnings) at the upper band leaves little opportunity for a short-term re-rating.

Sahi Review

Orkla India’s initial public offering (IPO) is characterized as a “quality consumer play with moderate listing gains and long-term potential.” The robust institutional subscription demonstrates faith in its category leadership and brand power. However, its capacity to grow revenues while preserving high margins will determine how well it performs after listing.

Orkla’s stock trajectory in the near future will depend on its ability to maintain volume growth and margin expansion through FY26, given that the FMCG industry as a whole is trading at premium valuations.