Listing Overview

Physics Wallah (PW) made its market debut with a strong start, listing at a solid 33% gain on the NSE and BSE on November 18, 2025. The IPO had been one of the most closely watched in the education sector, priced in the ₹103–₹109 band. PW’s listing performance reflects the market’s confidence in its positioning affordable learning, disciplined growth, and a rare streak of profitability in India’s evolving edtech landscape.

Physics Wallah IPO Summary

PW’s large fresh issue signals its focus on strengthening offline presence and operational expansion.

Subscription Snapshot

About Physics Wallah

Founded in 2020 by Alakh Pandey and Prateek Maheshwari, PW has grown into one of India’s most trusted education brands.

What started as a YouTube-led learning channel is now a full ecosystem of online courses, test series, hybrid batches, educational books, and a rapidly expanding offline network of 60+ Pathshala centres.

PW now serves over 1 crore students, with a model built around accessible pricing and strong educator-led trust. The hybrid approach digital content for scale and offline centres for structure has helped PW reach deeper into Tier-II, Tier-III, and aspirational markets across India.

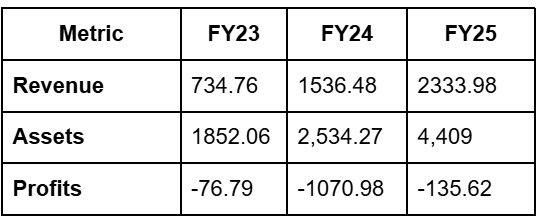

Financial Highlights (₹ crore)

PW’s performance has stood out in the edtech landscape thanks to its rapid scale-up, strong student acquisition, and disciplined cost structure. Its ability to grow while keeping operations efficient continues to shape positive investor interest.

Valuation and Listing Outlook

At the upper band of ₹109, PW’s valuation exceeds ₹11,000 crore.

The company enters the public market with a profitability track record, strong digital distribution, and a fast-growing offline footprint all factors that justify a valuation premium compared to other education players.

The GMP around ₹8 supports expectations of a moderate premium listing, driven by PW’s brand, scale, and trusted teaching base.

Post-listing performance will depend on how effectively PW manages its offline expansion while protecting margins and faculty depth.

Key Risks

PW’s offline rollout requires operational discipline and consistent educator quality.

Competition remains intense, with Unacademy, Aakash, BYJU’S, and various regional institutes fighting for the same student cohorts.

Test-prep demand cycles can create seasonal revenue patterns, and education policy changes may also influence future growth.

Sahi’s Take

Physics Wallah’s listing marks a defining moment for India’s edtech sector. It enters the market with strong brand recall, profitable operations, and a hybrid model that has resonated across student communities.

A steady premium listing appears likely, and long-term investor confidence will hinge on PW’s ability to scale offline classrooms without compromising what made it successful in the first place affordable, trusted, high-quality education.