IPO Summary

PhysicsWallah IPO subscription window closed on November 13, 2025, amid mixed but improving sentiment for new-age tech listings. The ₹3,480 crore IPO, comprising a ₹3,100 crore fresh issue and a ₹380 crore OFS, was priced in the ₹103–₹109 per share range.

A strong surge in QIB participation on the final day helped the issue sail through, even as retail and NII interest remained moderate. The allotment finalisation date is November 14, 2025, and the stock is scheduled to list on November 18, 2025 on both NSE and BSE.

Investors are watching this listing closely, as PhysicsWallah’s FY25 numbers suggest improving fundamentals and a more sustainable hybrid (online + offline) model.

How to Check PhysicsWallah IPO Allotment Status

Option 1: Check on BSE

Visit the BSE IPO Allotment Status page

Select ‘Equity’ under Issue Type

Select ‘PhysicsWallah Ltd’ in Issue Name

Enter Application Number or PAN

Click ‘Submit’

Option 2: Check on NSE

Visit the NSE IPO Allotment page

Choose ‘Equity’ and then ‘PhysicsWallah Ltd’

Enter PAN or Application Number

Click ‘Submit’

Option 3: Check on Registrar’s Website (MUFG Intime India Pvt. Ltd.)

Visit the MUFG Intime India website

Select ‘PhysicsWallah Ltd’ from the IPO dropdown

Enter PAN, Application Number, or DP/Client ID

Click ‘Submit’

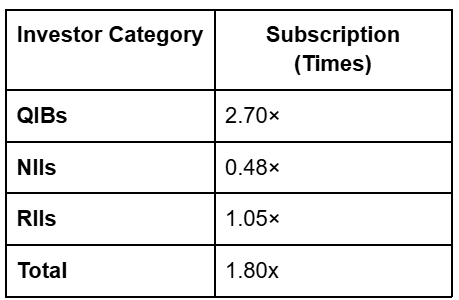

IPO Subscription Status (Final Day)

The issue saw subdued demand from retail and HNIs, with QIBs accounting for most of the overall subscription.

Company Overview

PhysicsWallah is an edtech unicorn providing affordable learning across JEE, NEET, UPSC, and K–12, supported by a powerful hybrid strategy combining digital content, YouTube reach, and a rapidly scaling network of offline Vidyapeeth centres.

In FY25, the company reported revenues of ~₹3,039 crore, marking 49% YoY growth, while losses narrowed sharply through offline scale and tighter cost control. Offline centres now contribute nearly half of total revenue, improving stability and unit economics. The company also secured ₹1,562.85 crore from anchor investors, reflecting selective but notable institutional conviction.