Rubicon Research IPO closed on October 13, 2025. The ₹1,377.50 crore public issue comprised a fresh issue of ₹500 crore and an offer for sale of ₹877.50 crore, with a price band of ₹461–₹485 per share and a lot size of 30 shares.

The IPO will be listed on both NSE and BSE, with the allotment finalisation on October 14, refunds & credit to Demat on October 15, and the listing date fixed for October 16, 2025.

The Rubicon Research IPO registrar is MUFG Intime India Private Ltd.

Rubicon Research, incorporated in 1999, is a pharmaceutical formulation and drug-development company providing R&D, contract manufacturing (CDMO), and specialty generic solutions for regulated markets such as the US and Canada.

How to Check Rubicon Research IPO Allotment Status Online

Option 1 – BSE Website

Visit https://www.bseindia.com/investors/appli_check.aspx

Select “Equity” under Issue Type

Choose “Rubicon Research Ltd” under Issue Name

Enter your Application Number or PAN

Click “Submit” to view your status

Option 2 – NSE Website

Go to https://www.nseindia.com/invest/check-ipo-allotment-status

Select “Equity” and choose Rubicon Research Ltd

Enter your PAN or Application Number

Click “Submit”

Option 3 – Registrar (MUFG Intime India Private Ltd)

Visit https://in.mpms.mufg.com/Initial_Offer/public-issues.html

Select “Rubicon Research IPO” under Select Company

Enter any of the following: PAN, Application No., or DP/Client ID

Click “Submit” to check status

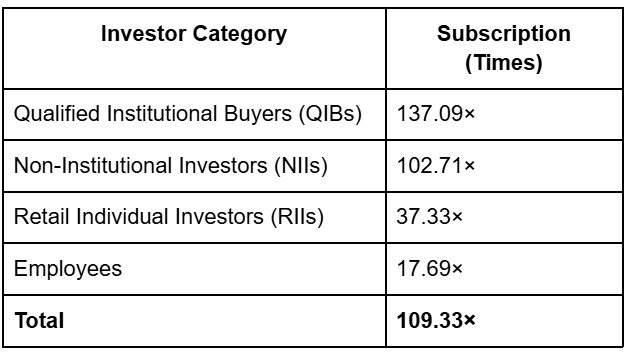

Rubicon Research IPO Subscription Status (Final Day – 13 Oct 2025)

Company Overview & Financials

Rubicon Research Ltd develops and manufactures specialty pharma and generic formulations, drug-device combinations, and controlled-release technologies. It operates R&D and manufacturing facilities in India and Canada, with about 99% of its revenue from the US market.

For FY 2024-25, the company reported:

Revenue: ~₹12,962

EBITDA Margin: ~21%

Revenue CAGR (FY23–FY25): ~80%