Rubicon Research Shares list at 28% Premium on NSE, BSE

Rubicon Research IPO listed today on NSE and BSE.

Rubicon Research IPO listed at ₹620 per share on NSE and ₹620.1 per share on BSE. The ₹1,377.50-crore IPO comprising fresh equity and an OFS has attracted investor interest due to its pharma specialty theme and encouraging grey market indications. In the grey market, premium (GMP) had gone through the roof with unlisted shares at a ₹100 premium over the upper band (₹485).

The IPO price band was set at ₹461 to ₹485, and the issue includes a fresh equity component of ~₹500 crore, along with an Offer for Sale (OFS) of ~₹877.50 crore from existing shareholders.

Investor Class

Times Subscribed

Qualified Institutional Buyers (QIB): 2.11×

Non-Institutional Investors (NIIs): 1.82×

Retail Investors (RIIs): 3.94×

Overall / Total: 2.37×

About the Company

Rubicon Research is a formulation pharmaceutical firm whose product portfolio consists of generic drugs and drug-device combination/specialty products. The firm is concentrating more on regulated markets and spends significantly on R&D to increase its pipeline.

Competitor Analysis

Rubicon Research is a rapidly growing formulation driven pharma space and is actively competing with listed peers like Glenmark Life Sciences, Suven Pharmaceuticals, and Eris Lifesciences. While these players boast stable profitability and established export linkages, Rubicon is differentiated by a concentrated product mix across drug delivery systems and combination formulations. Its relatively small size provides scope for accelerated growth, though valuations and post-listing performance of peers guide caution on whether margin improvement and R&D execution over a sustained basis will be sufficient to win over investors.

What to Watch on Listing Day

Whether the stock opens near the grey market premium (~20%) or lags behind owing to market prudence

Early volume and institutional participation — whether buying pressure sustains beyond the early jump

How Rubicon trades compared to the pharma/healthcare index and peers

Its stability: whether it retains gains or loses them in early sessions

Sahi Research Review

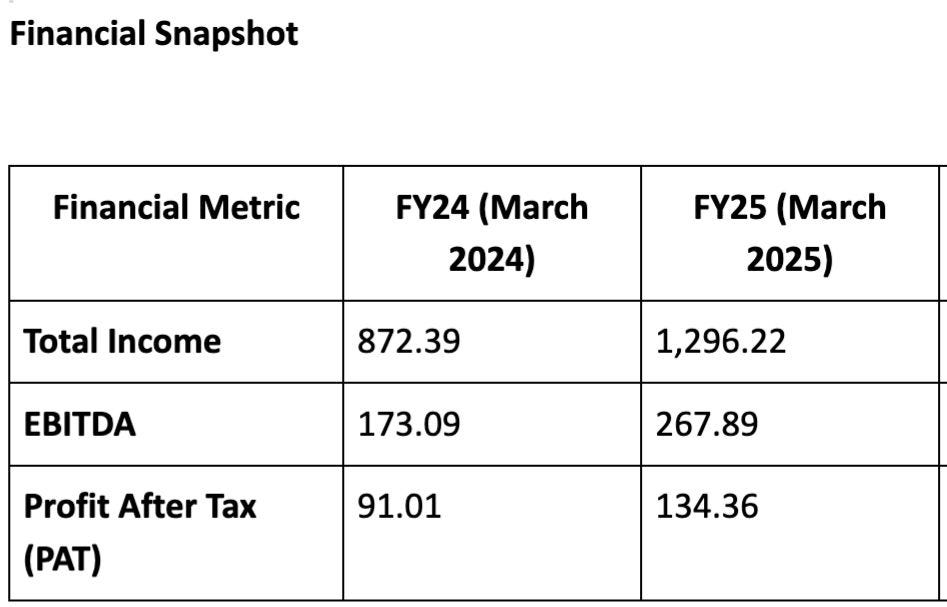

Rubicon Research has projected strong YoY growth, improving profitability, and focus in complex and specialty formulations. This has drawn attention from long-term investors. However, experts noted that valuation multiples appear on the higher side compared to peers. The analysts believe that the post listing performance will depend on management’s ability to strengthen export presence and maintain R&D-led differentiation.