Studds Accessories IPO Lists at ₹575 | GMP Misses Mark, Stock Opens Weak

Studds Accessories lists at 3-4% discount

Studds Accessories IPO , the country’s largest manufacturer of two-wheeler helmets, lists at 575 on the NSE and BSE - a 3-4% discount from its issue price.

The ₹455.49 crore IPO, comprising a complete Offer for Sale (OFS), received a very strong institutional response but did not have a fresh issue component. On the eve of listing, Studds Accessories IPO GMP was at ₹55–₹63, which hinted at a 9–11% expected listing gain over the upper price band of ₹585 per share. According to analysts, muted yet positive GMP indicates “measured optimism” in view of overall market consolidation and modest sector valuation.

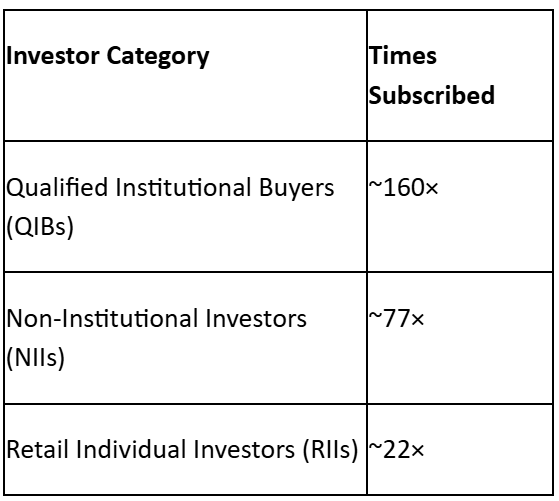

Snapshot of Subscription for Studds Accessories

About the Company

Studds Accessories Ltd. was founded in 1972 and has its headquarters in Faridabad. It manufactures and markets safety accessories and two-wheeler helmets under the well-known brands SMK and Studds. The company exports to over 70 countries worldwide and supplies the domestic aftermarket.

One of the biggest helmet manufacturers in the world by volume, Studds runs four production plants with an installed capacity of over 9 million helmets annually. It gains from its robust dealer network, integrated production setup, and growing demand for high-end helmets in India due to safety consciousness and regulatory enforcement.

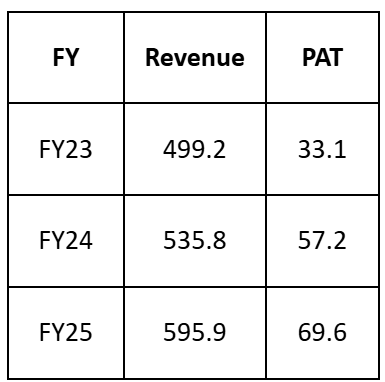

Financial Snapshot (₹ crore)

Competitor Analysis

In the organized helmet market in India, the key competitors for Studds are Steelbird Helmets, VEGA Helmets, and its own premium sub-brand, SMK. Fragmentation still characterizes this industry; however, Studds leads by volume while having an international presence that is unmatched by mostly domestically oriented competition.

While both Steelbird and VEGA are private and unlisted, their much smaller scale and restricted export exposure ensure that Studds maintains an edge in cost efficiency and brand recall. The diversified product portfolio also gives it a cushion against the cyclicality in domestic demand for commuter, premium, and export models.

What to Watch on Listing Day of Studds Accessories IPO

Opening Price & Volume - Whether the stock will trade flat or open near the ~10% GMP amidst mixed sentiments among small and midcap counters.

Institutional Activity: The post-listing activities of anchor and QIB investors can influence early price stability.

Sectoral Trends: Discretionary spending and fuel prices remain key influencers in demand in both the two-wheeler and accessory markets.

Valuation Lens: The listing is purely a market-driven price discovery without any new issue component; the post-listing rating potential will be dictated by continued growth. Analyst Review: The IPO of Students Accessories has been considered a sector leader with stable fundamentals and modest listing gains.

Studds Accessories IPO Review

It is a genuine long-term consumer engineering play on the back of its profitability, export reach, and strong brand. However, since the Studds Accessories IPO is a pure OFS, there is not enough money available upfront for expansion, and thus, post-listing performance and operational execution become vital for supporting valuation. The consensus estimate points to a steady start, leaving scope for upside, given sustained institutional participation and favorable market conditions.