IPO Summary

Studds Accessories Ltd closed its IPO subscription window on November 3, 2025.

The IPO comprised a total issue size of ₹455.49 crore (7,786,120 shares), which was entirely an Offer for Sale (OFS) by existing shareholders, with no fresh issue component.

The price band was fixed at ₹557–₹585 per share, with a face value of ₹5 per equity share and a lot size of 25 shares.

The basis of allotment is expected to be finalized on November 4, 2025, while refunds and Demat credits will begin on November 6, 2025. The listing is scheduled for November 7, 2025, on both the NSE and BSE.

Studds Accessories Ltd is India’s leading two-wheeler helmet and riding gear manufacturer, exporting to over 70 countries under its brands Studds and SMK.

How to Check IPO Allotment Status

Option 1: On BSE Website

Visit the BSE IPO Application Status Page

Select ‘Equity’ under Issue Type

Choose ‘Studds Accessories Ltd’ under Issue Name

Enter your Application Number or PAN

Click ‘Submit’ to view your allotment status

Option 2: On NSE Website

Visit the NSE IPO Allotment Page

Select ‘Equity’ and choose ‘Studds Accessories Ltd’

Enter your PAN or Application Number

Click ‘Submit’

Option 3: On Registrar’s Website (MUFG Intime India)

Visit the MUFG Intime India IPO portal

Select ‘Studds Accessories Ltd’ from the dropdown

Enter any of the following:

PAN

Application Number

DP/Client ID

Click ‘Submit’ to check your allotment

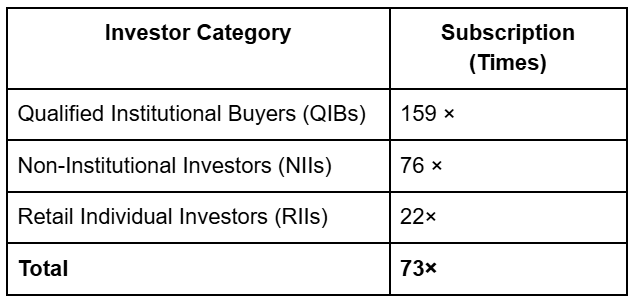

IPO Subscription Status (As on November 3,2025)

Company Overview

Studds Accessories Ltd is a leading manufacturer of two-wheeler helmets and riding gear in India, operating under the Studds and SMK brands.

The company designs, manufactures, and markets helmets and accessories, and also acts as an OEM supplier to global brands.

It exports to over 70 countries, including the US, Europe, and Australia, and has an annual manufacturing capacity of 9.04 million units, making it the world’s largest helmet manufacturer by volume (2024) and India’s largest by revenue (FY23).

Its clients include global partners like Jay Squared LLC (Daytona) and O’Neal USA. The IPO was managed by IIFL Capital Services.

What’s Next

The issue saw strong investor participation, supported by an anchor book worth ₹136.65 crore (23.36 lakh shares), with anchor lock-ins ending on December 3, 2025 (50%), and February 1, 2026 (remaining 50%).

The Grey Market Premium (GMP) for Studds Accessories IPO stood around ₹65–₹67 near the allotment date, reflecting an upside of approximately +(11–12%) over the upper price band of ₹585 per share. Based on this premium, the estimated listing price is expected to be in the range of ₹650–₹652 per share, suggesting a likely positive debut if market sentiment remains supportive.

MUFG Intime has quietly become one of the most reliable registrars in the Indian IPO space. The fact that they're handling such high profile offerings shows the trust issurs have in their infrastructure. Their portal integration makes allotment checking seamless compared to some of the clunkier alternatives out there.