Global markets are starting to position for rate cuts again — but this isn’t a 2020-style liquidity flood. It’s slower, more fragmented, and loaded with uncertainty.

The narrative sounds simple: inflation is moderating, growth is slowing, and central banks will cut. But if you look closer, you’ll see a more complex setup unfolding across the U.S., Europe, and emerging markets — with Indian markets caught right in the middle.

This week, we’re breaking down what’s actually happening across central banks, how the market’s reacting, and what this “rate cut trade” really means for Indian traders.

Where Central Banks Stand Right Now

The rate cut cycle has started — but it’s not global, and it’s definitely not aggressive.

Instead, what we’re seeing is a staggered, cautious easing trend that varies sharply by region. Here’s how the key players are positioned:

ECB: Actively Cutting

The European Central Bank is the most decisive so far. After multiple cuts since mid-2024, it just lowered rates again on April 17. Growth is slowing, inflation is cooling, and the ECB is now clearly in easing mode — with more cuts expected by September.

BoE: Under Pressure, Not Rushing

The Bank of England has cut rates three times since August 2024, but inflation in the UK remains above target. For now, it’s holding at 4.5% and keeping guidance vague — balancing between sticky prices and softening growth.

Chile: Eased, Now on Hold

Chile trimmed rates in late 2024 but has since paused. Inflation’s still above target, and the central bank is taking a wait-and-watch approach.

RBI: One Cut In, Playing it Safe

The RBI cut the repo rate by 25 bps in April, taking it to 6%. It’s the first move since 2023 — backed by softening food inflation and lower crude prices. But the tone remains cautious, with the central bank watching for global risks and supply shocks before taking the next step.

Brazil: Bucking the Trend

While others are easing, Brazil hiked rates by 100 bps in March, pushing its benchmark Selic rate to 14.25%. Inflation expectations have worsened, and the central bank isn’t backing off yet.

US Fed: Paused, But Eyes on June

The Fed has paused after a few earlier cuts. Markets are pricing in the possibility of more easing in the second half of 2025 — but only if growth stalls further and inflation stays in check.

What this tells us:

This isn’t a synchronized global easing cycle — it’s a fragmented, data-driven shift. Some banks are ahead. Some are waiting. A few are doing the opposite. For traders, that means: the “rate cut trade” is real — but it’s not risk-free.

How Markets Are Responding

Even though central banks are easing cautiously, markets are already positioning — and in some places, running ahead of policy.

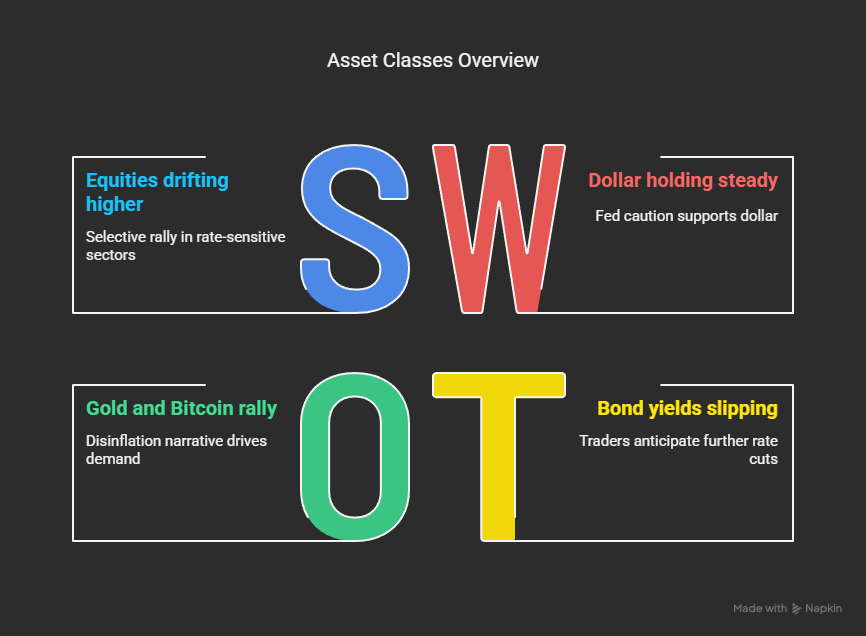

Here’s what we’re seeing across key asset classes:

Bond Yields Are Slipping

Global bond yields — including U.S. Treasuries and Eurozone bonds — have started easing as traders anticipate further rate cuts. Lower yields = lower discount rates, which supports equities and high-duration assets.

The Dollar Is Holding — But Not Leading

The dollar index (DXY) remains elevated, largely supported by Fed caution and safe-haven demand from geopolitical tensions. But with the Fed’s next move leaning dovish, currency volatility is picking up, especially across EM pairs.

Gold and Bitcoin Are Catching Flow

Gold is rallying on lower real yields and central bank demand. Bitcoin is riding the same disinflation narrative — with added liquidity-driven speculation. Both are acting like risk-tolerant inflation hedges.

Equities Are Drifting Higher

From the Nasdaq to Nifty, equities have responded positively — but not blindly. The rally is selective, with rate-sensitive sectors (tech, NBFCs, real estate) doing better than defensives. Still, breadth is mixed, and leadership is rotating fast.

What traders should take from this:

Markets are forward-looking — they’re trading the expectation of easing, not just the action. That means sentiment can flip fast if the data doesn’t play along.

What This Means for Indian Markets

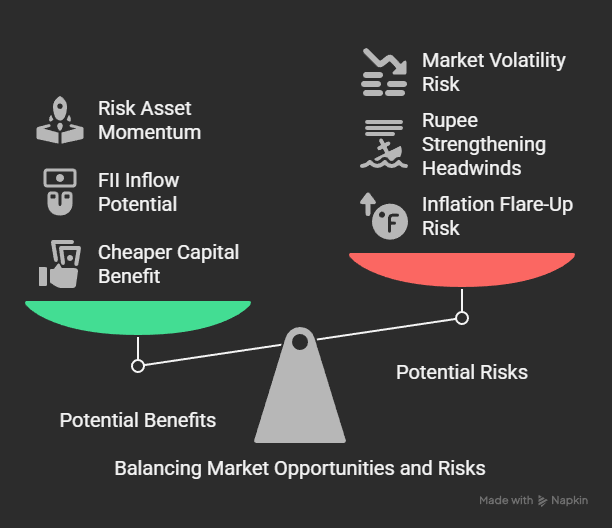

With the RBI easing cautiously and global central banks shifting their tone, Indian markets are now sitting in a sweet spot — but it’s fragile.

Here’s how that plays out across key sectors and setups:

NBFCs & Rate-Sensitive Stocks Could See More Flow

Lower rates = cheaper capital. Financials, autos, real estate, and housing finance companies tend to benefit first. If bond yields continue falling, expect these names to attract fresh positioning — especially from domestic institutions and swing traders.

FII Flows May Return If the Fed Softens

Historically, when the Fed cuts and the dollar weakens, EMs see stronger inflows. If this plays out, expect large caps — especially banks and diversified cyclicals — to benefit the most.

Crude Is Off Highs, Which Helps India’s Macro Case

Lower crude = better fiscal math, lower imported inflation, and more breathing room for the RBI. Keep an eye on OMCs and logistics plays if Brent stays soft.

Gold, Bitcoin & High-Beta Plays Are in Momentum Mode

With liquidity optimism rising, risk assets are seeing flows. Gold loan companies, jewellery stocks, and even fintech or smallcap proxies with crypto exposure could continue to outperform — but with high volatility.

But Not Everything Rallies on Rate Cuts

Exporters like IT and pharma might face headwinds if the rupee strengthens too much. Also, if inflation flares up again or the Fed delays cutting, the entire narrative can unwind fast. Be selective — and avoid trading the story without a setup.

Big picture for traders:

India may benefit from this shift — but it’s not immune to global whiplash. Structure matters more than headlines. Use macro for direction, but trade the price

Sahi’s Take: Read the Cycle, But Trade the Setup

Yes, the rate cut trade is on the table — but this isn’t a liquidity flood. It’s a slow shift, shaped by inflation data, oil prices, and policy risk. That means expectations will move faster than the central banks do.

So don’t trade the macro story. Trade the reaction to it.

Use the global easing cycle to frame your bias — then zoom into sectors, delivery spikes, OI shifts, and risk-reward setups that actually deserve your capital.

What to Watch in the Coming Weeks

U.S. PCE inflation data (Apr 26) → Could reset Fed cut expectations

Next RBI meeting (June 2025) → Will they follow through or hold?

Crude trend + monsoon outlook → Key for India’s inflation stability

FII flows + DXY moves → Keep an eye on currency cues and bond yields

That’s it for this week’s Global Economic Pulse.

The rate cut cycle has begun — but don’t front-run it blindly.

Let the narrative guide you.

Let price confirm it.

We'll see you next week with a closer look at how the U.S. dollar is shaping cross-market volatility — and what it means for Indian setups.