WeWork India, the Indian subsidiary of the global coworking giant (controlled by Embassy Group), is preparing for one of the most anticipated listings in the shared workspace sector this year. The IPO has been designed as a pure offer for sale (OFS), suggesting that existing shareholders desire liquidity and not raising new money. As demand is strong for coworking in today’s post-pandemic hybrid work environment, there are high hopes, but so is scrutiny.

IPO Details

Price Band: ₹615 to ₹648 per share

Issue Type: Offer for Sale only (no fresh shares)

Total Shares Offered: ~4.63 crore shares (35.4 million from Embassy Group and about 10.9 million from WeWork affiliate)

Maximum IPO Size (at upper band): ~₹3,000 crore

Opening / Closing Dates:

• Opens for retail investors: October 3, 2025

• Closes: October 7, 2025Allotment / Refund / Listing:

• Basis of allotment: October 8, 2025

• Refunds & credit of shares: October 9, 2025

• Tentative listing date: October 10, 2025 (on BSE & NSE)Lot Size: 23 equity shares (so minimum investment ~₹14,904 at band)

Promoter Stake:

• Embassy Group (major promoter) will sell ~3.5 crore shares

• WeWork’s affiliate (1 Ariel Way Tenant) will offload ~1.03 crore sharesBusiness:

• As of Sept 2024, WeWork India operates 59 coworking centres and offers 94,440 desks across 8 cities

• Promoter shareholding prior: Embassy ~76.21%, WeWork Global ~23.45%

Key Risks & Triggers

•Tone-deafening gap between grey market and listing: As there is good brand recall, grey market hopes may lead to a premium. But with it being an OFS with no new money, price discipline will come under the spotlight.

•Tussle between Institutional and Retail appetite: Large part of allocation is expected towards QIBs. To what extent does interest percolate down to retail investors will be an indicator of faith in the sector.

• Sustainability & profitability: Flexible workspaces are cost-intensive (leases, maintenance, fit-outs). Despite the business scaling up, profitability metrics (EBITDA margins, occupancy rates, lease obligations) will be monitored in detail.

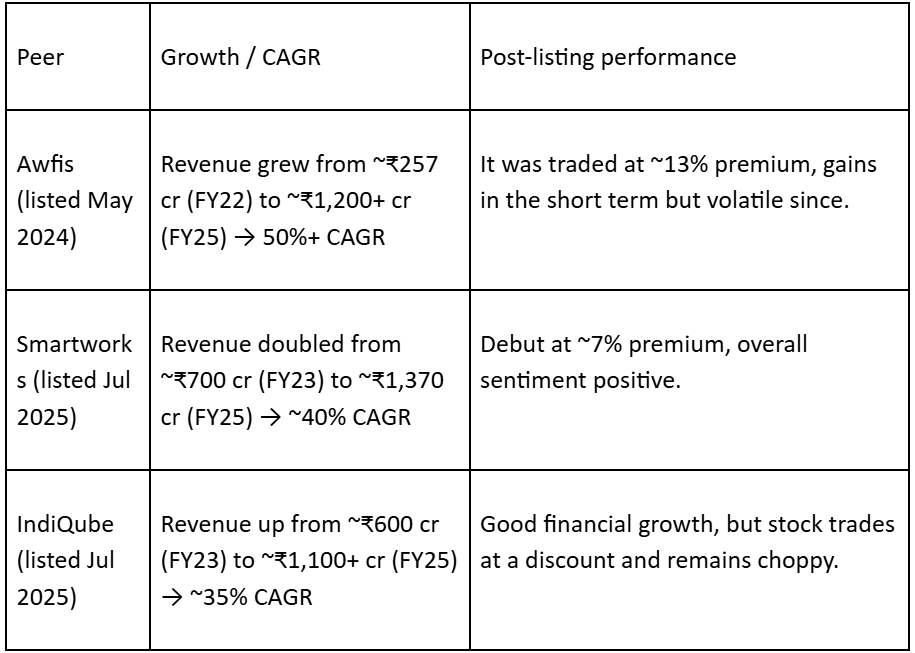

•Peer / sector comparisons: After listing, peers will be Awfis, Smartworks, IndiQube. How WeWork valuations compare to these will be a key reference point. Among listed peers, IndiQube, Smartworks, and Awfis have collectively observed robust revenue growth over the past few years as demand for flexible workspaces increased. Post listing, however, the stock market reaction has been varied: Awfis listed at a premium but has remained volatile, Smartworks observed a smooth debut with good investor demand, while IndiQube listed at a discount despite robust top-line growth. The trend indicates that, whereas the fundamentals of the industry are growing strongly, market valuations are still sensitive to profitability and execution risks.

• Macro Real estate headwinds: Trends in commercial real estate cycles, lease rates, interest rates, and real estate regulatory norms will dictate investor perception.

• Post-listing liquidity / share performance: Since original shareholders are selling out, there may be downward pressure unless there is strong demand. The initial trading patterns of the stock (first few sessions) will determine the tone.